This was the most important event for markets in 2018

Forget the year’s political shenanigans. They’ve been largely irrelevant to the markets. The one thing driving the markets this year was Jerome Powell’s appointment as chair of the Fed. Here’s why.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

What was the most important event for markets this year?

Jerome Powell took charge of the Federal Reserve on 5 February this year.

That day, the S&P 500 fell by 4% the worst one-day hit the US market had taken since 2011.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It's like they knew what was coming next.

Forget politics I'm sure you'd love to

A lot has happened this year. It's one of those years where it feels as if there's been a lot of news.

A permanent pall of Brexit sniping has hung over every front page in the UK. Donald Trump has hogged a lot of limelight from trade wars to oil wars, he likes to cause a ruckus. And then there's Europe Angela Merkel stepping down (or starting a lengthy notice period), Italy's coalition picking fights over budgets, and Emmanuel Macron becoming even less popular than the comedy philanderer on a scooter who was the last French president.

But all of that pales into insignificance for markets compared to one important, but entirely expected, change of personnel.

This year, Janet Yellen handed her chairmanship of the Federal Reserve over to Jerome Powell. And whether you like to admit it or not, the direction of our purportedly free markets over the past year, has been influenced more by the tone and attitude of this one man than by any other event this year.

You can see why we wonder if there isn't a better alternative to central banks, can't you? When one man can send global markets into a tizzy with a raised eyebrow or an added coma in a press release, then what is the true value of the wisdom of crowds?

Anyway. Powell took over at a tough time. Quantitative easing (printing money to buy government bonds) in the US stopped under Janet Yellen back in 2014. From then, the Fed kept its balance sheet broadly stable. It wasn't printing money to buy more bonds. But every time a bond matured, it would reinvest the money into a fresh bond.

As a result, it never took money out of the market. It just recycled the holdings it had. And the balance sheet stayed the same size, even although interest rates started to rise from December 2016.

But that couldn't stay the case for good. And it fell to Powell to oversee the start of the reversal of QE. Or as it's become known, quantitative tightening (QT).

From money printing to money burning

What happens when you do QT?

QE adds money to the market. There are lots of technicalities but let's keep it simple and broad brush. The Fed prints the cash. It buys bonds. When the Fed buys bonds, the people who would have bought bonds, or who owned those bonds, buy other stuff instead.

QT is the opposite. The Fed takes cash out of the market. Here's how it works.

The Fed has a load of bonds on its balance sheet. They represent money that the US government (mostly) owes to it. Until this year, when the US government repaid those IOUs, the Fed used that money to buy another debt from the US government. So nothing changed.

Now, when the US government repays the Fed, the Fed simply burns the money (that's the simplest way to look at it). It doesn't buy the other IOU that the US government had to issue in order to repay the one that the Fed was holding.

In this way, the Fed burns a targeted amount of money each month. It started the year at about $10bn a month and now it's up to $50bn.

If the Fed is burning $50bn a month, then that's $50bn that's not going into the US government bond market. In effect, that's $50bn of demand that the US government needs to find from somewhere else.

It doesn't help that the US government is also now borrowing an awful lot more money than anyone had expected at the start of this year, what with Donald Trump's tax cuts.

So you have a big rise in supply. And you also have a big buyer the Fed deciding to quit the market.

Supply goes up, demand goes down you'd expect bond prices to rise, wouldn't you? (which means bond yields which are the main way we look at bonds will go up).

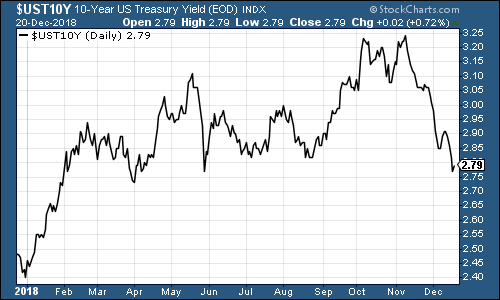

And the government bond market stuck to that script for a while this year. But in the last few months, it has gone right off the boil, as the chart below shows.

(Ten-year US Treasury yield over the past year source: StockCharts.com)

You can see that yields are still a lot higher than they were at the turn of the year. And in April, they finally managed to burst above the 3% mark, which had been seen as a bit of a line in the sand, earlier this year.

But in the last six weeks or so, even as the pace of QT has picked up to that $50bn we mentioned, ten-year yields have dropped sharply.

What does this suggest? Long story short, when investors are freaking out, they don't care how many bonds the US government is going to issue. The US Treasury is seen as the safest asset in the world. If you are worried about losing money, that's where you go.

The big question for next year, I think, is this: are markets right to be worried? Are we heading for another deflationary turn of events? Or is this a false alarm?

Taking the longer-term perspective

I have to be honest with you I don't know. But it looks finely balanced right now.

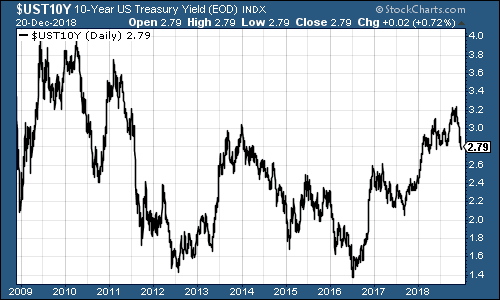

Take a look at the ten-year chart below. You can see that in the longer-term context, the recent retreat in yields could easily be a case of the market falling back from a recent surge higher. But you can also probably see that if it falls much further, then maybe we're looking at something chunkier.

(Ten-year US Treasury over the past decade source: StockCharts.com)

The question for me this year is not really whether the US will have a recession or not. A recession does not have to be a disaster. The banking sector can survive a recession which means that while it's unpleasant, it's not existential.

I think the place we have to watch in 2019 for systemic issues is China. China has been stuck between the rock of rampant misallocation of capital and the hard place of having to avoid an economic slowdown at all costs for at least a decade now.

That tension is coming to a head. The trade war hasn't helped, but nor has Xi Jinping's more authoritarian bent.

China could punch a hole in global growth which would be deflationary. The reaction of global central banks to that could dwarf anything we saw during the financial crisis.

It's one scenario. As long as you have reasonably diversified asset allocation, some gold for emergencies and some cash for opportunities, you can afford to sit back and monitor things. But if you're not on top of your finances, I would strongly suggest you make the effort over the Christmas period to try to understand where everything is, and where you want it to be.

Taking out a subscription to MoneyWeek (if you haven't already) would be a good start, by the way. Just a suggestion and you can get your first six issues for free if you buy now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?