Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

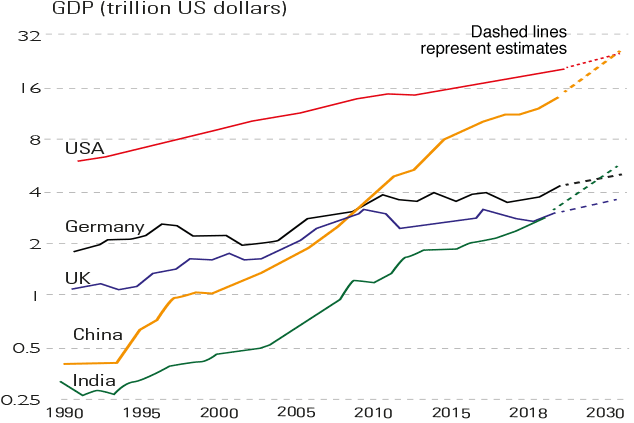

From 1990 to 2018, China managed to grow its GDP 35 times, while American GDP merely tripled and Germany's doubled. And this steep trajectory is expected to endure. By 2030, the US will increase the value of its goods and services by another 25% or so, and Germany is likely to be 17% bigger.

China's economy may balloon by 85% as increasingly widespread automation in factories gives productivity a big fillip, says Sebastian Kirsch in WirtschaftsWoche. China could therefore be the single biggest driver of global growth over the next decade.

But it's hardly guaranteed, says The New York Times. An economic slump, lack of innovation or high corporate debt levels could get in the way.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Viewpoint

"Frankly I don't know what's more frightening that the FAANG stocks lost more than $1trn in just a few months or that investors drove them higher by more than $1trn in just a few months without any material change in circumstances. Now investors are wrestling with the fact that Facebook is a fundamentally dishonest company that steals its customers' data and privacy for a living, Apple is a victim of its own success and faces the law of large numbers, Amazon cannot trade at infinity-times earnings forever, Netflix can't simply spend endless amounts of money forever, and Google earns virtually all its money from annoying ads that nobody wants to see none of the FAANGs contributes meaningfully to the productive capacity of the economy but... feed solipsistic activities like social media and shopping [this] is not the sign of a healthy society or economy."

The Credit Strategist

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how