The market reaction to the French riots goes a long way to explaining them

The “yellow vests” riots in France have met with a typically Gallic shrug from the country’s stockmarket. That’s very telling indeed, says Dominic Frisby.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

With everything that's been going in France these past few days, I thought it would be interesting to check in on its stockmarket, the CAC 40, to see how it has reacted.

How seriously is it taking the "yellow vests" riots?

A very peculiar general election

The CAC 40 is France's benchmark index, equivalent to the Dow Jones in the US. It is made up of 40 of the largest public companies in France by market capitalisation, including the likes of cosmetics giant L'Oreal, car manufacturer Renault, oil major Total, banking group BNP Paribas, luxury goods manufacturer Hermes and tyre company Michelin.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Although almost all of the companies in the index are domiciled in France, about 45% of the shares are foreign owned a higher proportion than in any other main European index. Big investors in the French market include German, Japanese, American and British shareholders.

So the riots.

Tension in France (as in many other parts of the world) has been growing for some time. That something was wrong was apparent in France's general election of 2017. It was highly unusual for a number of reasons.

First, for the fact that the previous president, Franois Hollande, was so unpopular that he became the first president of the Fifth Republic ever not to seek re-election.

Second, for the fact that the National Front candidate, Marine Le Pen, was so popular at one stage she was the most popular candidate.

Third, for the fact that the final run-off again for the first time in the history of the Fifth Republic did not include a nominee from either the traditional left-wing or right-wing parties.

And fourth, for the fact that Emmanuel Macron and Le Pen's combined share of the vote was just 26% of eligible voters a historic low.

In the end, I'd say, Macron got elected not so much because of who he was, but because of who he wasn't which is not a good recipe for political success. The centre may have breathed a sigh of relief at his election, but that does not mean the underlying discontent had gone away. It merely lacked an outlet.

Unreasonable taxation often leads to revolution

As you may know, I am currently writing a book about taxation. One of the arguments I make in the book is that every great rebellion, revolution or revolt has some kind of perceived injustice perpetrated by taxation at its core. In France's yellow vests we have another example.

I have observed that rulers have a long history of justifying new taxes on moral grounds. Mediaeval knights, for example, who did not want to follow their king to war had to pay a tax instead. This became known as the Cowardice Tax. Ex-chancellor George Osborne's sugar taxes exist, not for the good of government coffers, but for the good of your health.

President Macron imposed several fuel taxes, justifying them on climate change grounds: they were meant to encourage people to exchange their diesel-fuelled vehicles for more environmentally-friendly models.

The current riots began in reaction to these fuel taxes. The protestors wore yellow vests the hi-vis safety jackets that French motorists have to carry in their cars in case they break down by the side of the road.

The uprising has clearly caught a nerve, and has now morphed into an expression of general anger at the high cost of living. The protestors, at least at first, were not necessarily of the left or the right. The main thing they had in common is that they were blue-collar workers living outside big cities.

The cost of diesel has risen by about 20% this year, but France has an extraordinarily high tax burden anyway, one of the highest in the developed world. Government spending stands at around 57% of GDP, according to Ryan Bourne and Philip Booth of the Institute of Economic Affairs.

Many of those taxes are not directly felt income taxes are deducted at source, for example so the "pain" of paying is concealed. But the recent rises in diesel will have been palpable.

You'd have thought, after the French Revolution, the dangers of excess taxation would be embedded in the French psyche but clearly not. The result is these riots which have seen at least four people killed, many hundreds injured, and many thousands taking part.

The market reaction to the French riots goes a long way to explaining them

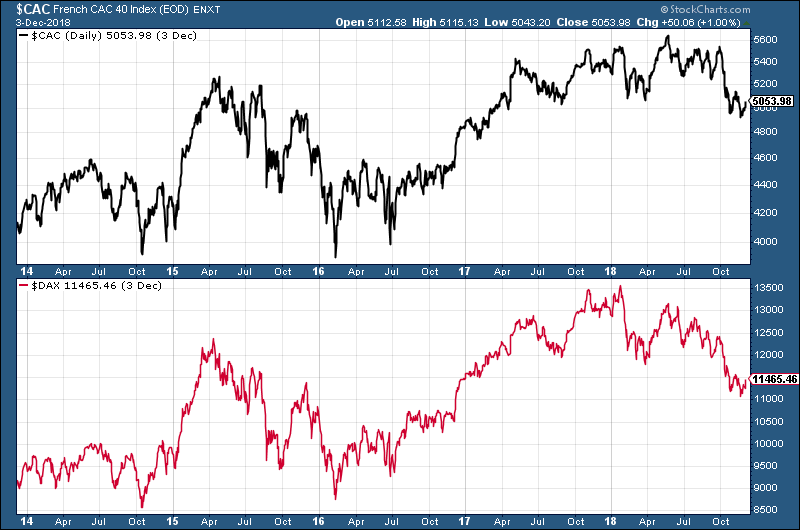

Here's France's CAC over the last five years, with Germany's DAX beneath.

You can see that the performance of the two has been virtually identical, until this year when the DAX not the CAC has been a little weaker (arguably because the DAX is viewed as being more exposed to global trade wobbles than the CAC 40).

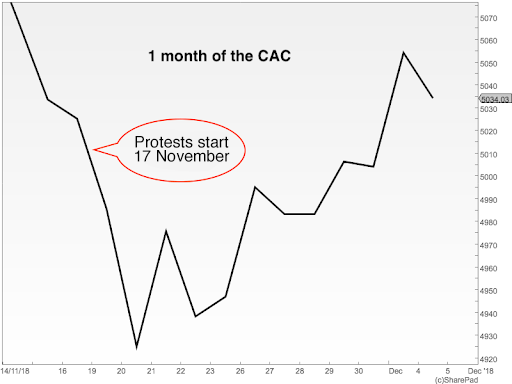

Now here's the CAC over the past three weeks.

The protests began on 17 November, which I've marked in the chart below. The CAC fell for three days until 20 November, since when it has been steadily rising.

Even if these protests began on 17 November, they were fairly small scale at that point, so it is rather stretched to use the early protests to explain the falls of 17-20 November. The fact that France's stockmarket has been rising, just as the protests have been getting more intense, I do, however, find rather telling.

The markets could be forecasting that these protests will lead to tax cuts (and indeed Macron has backed down to an extent), but I think that argument is also rather stretched. My inference is that the markets are simply discounting the significance of these riots as far as the investment case for the companies listed on the CAC is concerned.

In fact, that the CAC has been rising in the face of these riots is in itself an illustration of the disconnect between stockmarkets and the real economy which is one of the many things, I dare say, that those protestors are angry about.

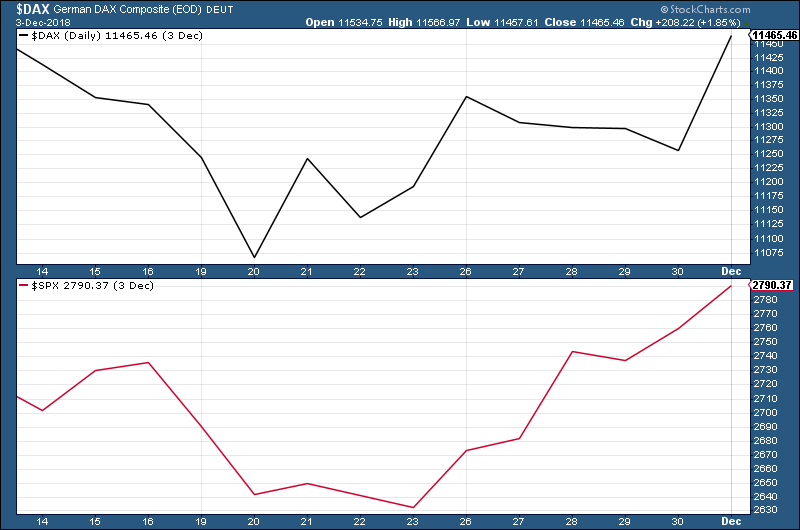

Here meanwhile are the DAX and the S&P 500 over the last three weeks.

They've been pretty much the same as the CAC.

In other words, markets have met these riots which seem pretty significant to an outsider, and certainly are in the minds of the protestors with a great big shrug.

In the face of such social unrest, you might expect some volatility in the currency markets, but given that France is just one part of the euro, there is not much to be seen there either.

It's an illustration of the powerlessness many must feel in the face of 21st century, globalised, financialised economies.

For how much longer? The times, they are a-changing.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?