The pound is very, very cheap – but it’ll stay that way until Brexit is sorted

The pound could rocket once we have a satisfactory resolution to Brexit, says Dominic Frisby. But we have to clear that hurdle first.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In a world where the forex markets are as jittery as they are now, it seems that a mere thumbs up from a mid-ranking politician can send the pound soaring.

Today we consider what's going on with sterling, the euro, the US dollar and we look at the elephant in the currency room, Brexit.

Forex markets are even more hair-trigger than usual

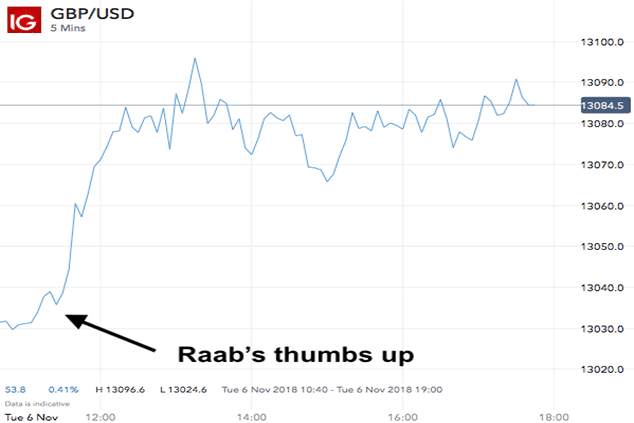

Just after 11.30am yesterday, Dominic Raab, the Brexit secretary, left the cabinet meeting, where he had been briefed by the prime minister, Theresa May, on the latest developments in the Brexit negotiations.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The BBC's political editor, Laura Kuenssberg, asked him how it had gone. Without breaking step, he replied with a cheery thumbs up.

The pound reacted like this.

It's quite something when, with a mere hand gesture, you can move an entire national currency some 40 or 50 basis points.

The episode shows just how sensitive the forex markets are at the moment. Like the rest of us, they want Brexit resolved. It has been too long.

What's more, the direction of least resistance for the pound would appear to be up, which is no surprise. It is undervalued; very much so.

It won't, however, enjoy a sustained rally, until a satisfactory resolution to Brexit is, to use May's fall-back word, "clear".

If, whatever these latest developments are and, to be frank, what they are is not "clear" is not passable, then the pound will come back down again with a plod.

The surprise of the Brexit referendum and its implications meant the pound was always going to sell off. But there was no need for it to be so weak for so long. This weakness has been a reflection of the collective failure of Britain's politicians and civil service to negotiate Brexit, to be "clear" about what they wanted and to negotiate it in a satisfactory manner.

Instead, Brexit has been, in the admirably straight-talking words of the Conservative MP, Johnny Mercer, a "shit show". It has been leadership without direction, set on middle ways and compromise, on not showing its hand for fear of being bitten leadership without leadership, in other words.

Different bodies have their own views of how to define "fair value" for a currency. I like purchasing power parity (PPP) how many goods and services the same amount of money buys you in different countries.

The Big Mac Index is perhaps the most famous measure of PPP it simply looks at how much a Big Mac costs in different countries worldwide, measured in the same US dollars. Switzerland is the most expensive country on this front, at $6.54 per Big Mac.

No surprise there, it's Switzerland. Its currency is strong and its people are rich. The US is third at $5.51, while the eurozone average is $4.74. Britain comes in at $4.24, marginally ahead of Colombia.

There have been plenty of occasions in recent history where the UK has been more expensive than our continental neighbours or our American cousins. But to take us to parity with them today, you would have to revalue sterling up by around 30% against the dollar and by about 10% against the euro.

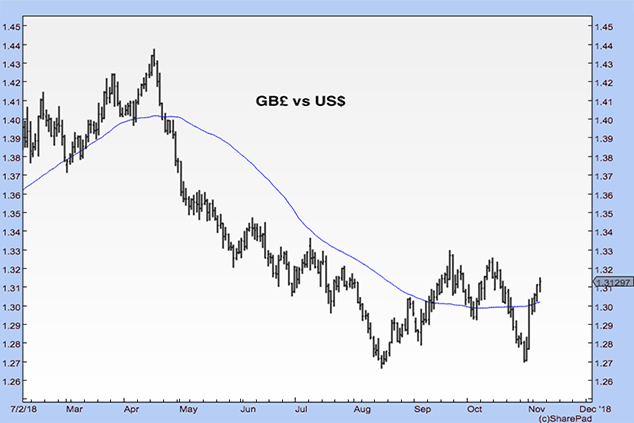

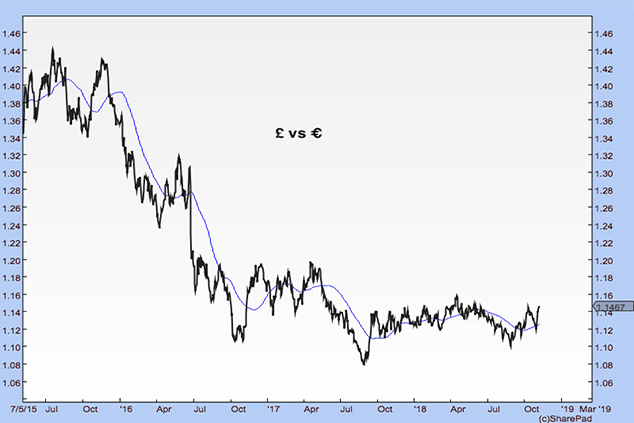

According to the Big Mac Index (which was last compiled in July of this year), sterling should be, then, almost $1.70 and €1.25, as opposed to today's price of $1.31 and €1.14.

Of course, measures of PPP vary it depends what goods and services you put in the basket (a Big Mac is a good choice because it's homogenous and available around the world, but obviously it's still just one product). Some have US$1.50 as fair value for a pound. Others have it above US$1.60.

But however you measure it, the consensus is that the pound is cheap. You can feel it when you travel to the continent or the US. Both, especially the latter, "feel" expensive. Those who come to the UK comment on how much cheaper it is than it used to be.

So I have $1.60 and €1.25 as eventual targets. If leaving the EU proves a success, then the pound will exceed those targets. But between now and then we have Brexit to get through. The deal is by no means done. Given the proven record so far, there is plenty yet to go wrong. As they no doubt say in Portcullis House, "the shit show must go on".

The pound could rocket once Brexit is sorted but it needs to be sorted first

We cannot think about $1.60 and €1.25 until business has some idea what is going on. Will Britain retain control of its trade agreements, for example (which I thought was kind of the whole point of Brexit)? Leaving without this is like resigning from a job but leaving all your future employment to be negotiated by your former boss, who has got the hump that you left.

In any case, while all this speculation is going on, the charts are looking good for the pound. "Cable" (the pound vs the dollar) has put in a textbook double bottom. Here's a chart of nine months of the pound vs the US dollar.

For this to be so textbook that the Society of Technical Analysts will start using it as this year's Christmas card, you'd probably want to see it come back to the $1.28-$1.29 area before launching off. But a rally to the $1.37-$1.38 area looks quite possible.

The price is also sitting above the 55-day simple moving average (the curving blue line), which is sloping up a sign of a positive intermediate term trend.

Here's three-and-a-half years of the pound versus the euro. I've included a longer-term chart, to remind you of not so long ago, when the pound was above €1.40 and the continent felt cheap.

Again there is a nice intermediate-term upward trend in place since the late-August low. The 55-day simple moving average is sloping up and the price is above. €1.16 beckons.

€1.20 was where we were at before May's disastrous general election took place last year. From an academic point of view, it will be interesting to see if we can get there before Brexit.

Against the euro, there is a lot of "room" to go higher.

The charts look good to me. But first we have got Brexit to get through. Where anything and nothing is possible.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how