Philippines ready to rise again

Investors enjoyed a 25% increase in the Philippines’ benchmark index in 2017. This year, however, has been a disappointment.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Investors enjoyed a 25% increase in the Philippines' benchmark index in 2017. This year, however, has been a disappointment. Soaring consumer prices, a tumbling peso and slowing economic growth have prompted an exodus, says Ian C Sayson on Bloomberg.

The index has plunged by 17% this year, losing almost $47 billion of value as foreigners withdrew more than $1.6 billion from the nation's stocks. Now some investors "are finally starting to see the light at the end of the tunnel", at least in the short term. Stockmarket valuations are at the same levels that preceded the end of a bear market in the Philippines in 2016. Value might be re-emerging.

The Philippines' economy "is ready to rise again", says Panos Mourdoukoutas on Forbes. According to a recent McKinsey Global Institute study, the Philippines is among the few emerging market economies set to achieve sustained growth over the next decade, provided corruption, inflation and revolution don't get in the way.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That's never guaranteed in emerging markets and, in any case, there's the short term to get through. Given the headwinds facing the economy in terms of elevated inflation, rising interest rates, weaker global demand and political uncertainty, Gareth Leather of Capital Economics is forecasting growth to slow to 6% in 2019, from 6.3% this year. But things are looking up. Recent inflation data suggests the surge in consumer prices could be peaking, Robert Ramos, chief investment officer at East West Banking Corp, says on Bloomberg.

Meanwhile, the economy has been helped by a number of pro-growth policies under the populist president Rodrigo Duterte's administration. He has lowered income taxes and raised levies on sugary drinks and oil products. This boosted government revenue by 19% in the first five months of this year. He also poured 9 trillion peso ($170 billion) into an infrastructure programme dubbed "build, build, build" to construct roads and railways, and upgrade Manila's airport and rail links to its provinces, creating more jobs.

Debt is a danger

Investors will be keeping a close eye on the country, however. In order to fund this ambitious infrastructure plan, the government is targeting a budget deficit of 3% of GDP next year. But if economic growth comes in below target, the shortfall could widen. Government debt is currently just above 40% of GDP, which is low for the region. A fiscal crisis "is not imminent" but if the deficit widens, the government will have to show it can commit "to a responsible fiscal policy". Given Duterte's populist tendencies, that's hardly a given.

Ten years on, the bubble returns

When the Bank of England hears "echoes of the subprime crisis", says Nils Pratley in The Guardian, it's time to worry. The Bank says the growth of today's leveraged loans market in the US is reminiscent of the surge in the US subprime mortgage market before the 2008 crisis.

It's not just America. Ten years after a financial crisis caused by too much debt, the world has an even higher debt load. The International Monetary Fund calculates global borrowings (public and private) are worth 225% of GDP, up 12% in the past ten years. China's credit bubble is responsible for 43% of the total rise in worldwide borrowings since 2007.

In the UK the market "looks alarming", says Pratley. UK companies issued a record £38bn of leveraged loans in 2017 and an additional £30bn this year. These companies' debt is four times their top-line earnings before interest and tax. They are "higher-risk borrowers" and they account for 20% of the UK corporate bond sector. What's more, some four-fifths of leveraged loans are "covenant-lite".

In other words they don't require borrowers to pass stringent financial tests. In the aftermath of the 2008 crisis, lenders ensured they had covenants to protect themselves, but now standards have loosened again. "It's as if the financial crisis never happened and the lessons from it are ancient history," Jonathan Rochford of Narrow Road Capital told The Daily Telegraph.

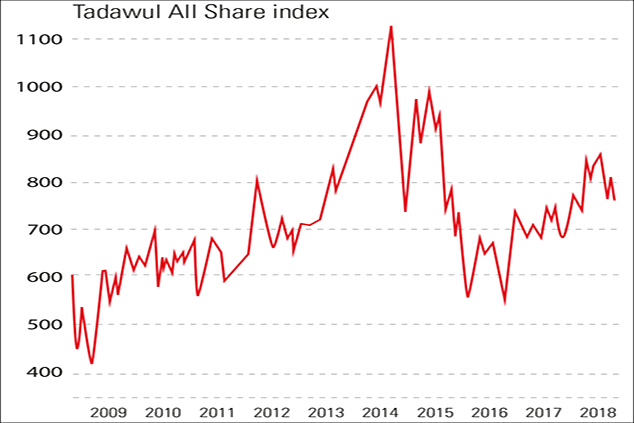

Chart of the week:The stampede out of Saudi Arabia

Investors "are dumping Saudi stocks like never before", says Filipe Pacheco on Bloomberg. They sold $1.1 bn of local equities last week, the most since records began in 2015, as the killing of journalist Jamal Khashoggi continued to dominate the headlines and undermine confidence in the regime. Most of the sales came from qualified foreign institutional investors, who were first authorised to trade in the market three years ago, but local retail investors joined the stampede.

Only Saudi institutional investors kept buying, tempering the stock market's decline. Traders have speculated that funds with links to the regime were doing the same. The benchmark Tadawul All Share index has slipped to a seven-month low.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Marina Gerner is an award-winning journalist and columnist who has written for the Financial Times, the Times Literary Supplement, the Economist, The Guardian and Standpoint magazine in the UK; the New York Observer in the US; and die Bild and Frankfurter Rundschau in Germany.

Marina is also an adjunct professor at the NYU Stern School of Business at their London campus, and has a PhD from the London School of Economics.

Her first book, The Vagina Business, deals with the potential of “femtech” to transform women’s lives, and will be published by Icon Books in September 2024.

Marina is trilingual and lives in London.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.