What’s next for US stockmarkets?

US stockmarkets are hugely volatile right now. It’s a shake-up that’s been a long-time coming. Dominic Frisby looks at the state of the markets, and where they might go next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today we turn our attention to the US stockmarkets.

It feels like a long time since they were as volatile as they were last week. In fact, it was only last February.

But nevertheless, you can't help feeling that a shake-up has been a long-time coming.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The Dow Jones was the last man standing.

The creeping malaise in markets started back in January

Market weakness set in back in January, and I think it's fair to say that the rot started in the emerging markets.

Although eurozone stocks have been weak, the Euronext 100 peaked in May (and has been making lower highs ever since). But there was weakness evident on the continent long before that.

Two countries you might associate with constant economic strength are Germany and Switzerland. Germany's DAX peaked in January; it's now down by around 15%. Switzerland has gone in a similar direction, though it's only down by around 10% from its January peak.

China has been horrible. The Shanghai Composite peaked at the same time as Germany's DAX (they sell each other a lot of stuff) and is now down almost 30%. Hong Kong's Hang Seng has gone the same way.

Emerging markets have been dancing to precisely the same tune, with the odd exception. Brazil, for example, has recovered with the election of its new president. Russia and India, however (to complete the BRIC acronym remember that one?) have both been poor.

This led to that peak in the eurozone in May, and with that May peak came a sell-off in the materials sector. Copper often seen as a barometer for the economy went into freefall in June (zinc, interestingly, peaked much sooner). Fewer and fewer markets were dancing.

In the US, the semiconductors and then the small caps rolled over, followed by the tech stocks. It seemed that all that was left making new highs was the Dow.

The Dow takes a tumble

"From false moves come fast moves in the opposite direction" is an expression you have heard me use on these pages before. It's an expression I first heard from US technical analyst JC Parets.

We got a case of it with the Dow over the past month. In late September and then again in early October it broke out to new highs, before capitulating along with everything else last week.

I understand that Wednesday was the third biggest down day in Dow history in terms of points lost. But that statistic, good copy though it might make for, is a dud. You need to measure these things on a percentage, not a numerical basis. Last Wednesday was no 29 October 1929 or 19 October 1987 (why is it always October?)

There always seem to be more reasons to be bearish than bullish. Maybe it is my or the human brain's bias towards preparing for the worst. But here are some of those reasons they are good ones too.

An abnormally hawkish Fed seems intent on raising rates, until something breaks. The bond market looks jittery. Earnings expectations look a little ambitious. Markets are already stretched. There are the escalating trade tensions and even, as some have declared it, the possibility of a new Cold War.

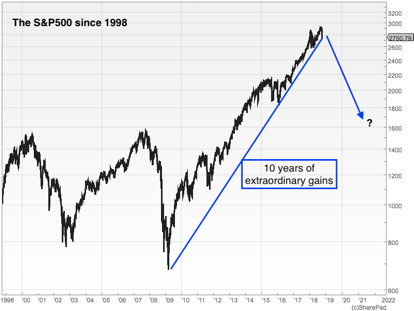

It's easy particularly if you have very little investment in this market to look at a long-term chart of the S&P 500, and in particular at the run it has had over the last ten years from 666 in 2009 to almost 3,000 today, and say that a large chunk of that should be retraced.

To go back 1,100 points to the break-out area at 1,600 does not look so impossible from a pattern point of view. As the chart below shows, it would be little more than a 50% retracement of the entire run.

I would have thought that such a pullback is unlikely. You never know, of course, but things don't "feel" bad enough to me.

There are too many bearish commentators calling for the end of the world. Stockmarkets don't crash until such commentators are long. When the bears are in there are no more buyers, and no more money to come into the markets.

In the short term, we might expect something akin to the action that we saw in the February correction.

Below is a chart of the Dow over the last 18 months. There is support (a level at which the market has tended to bounce) and resistance (a level which the market has banged its head on a few times) where I have drawn the dashed red lines.

The fact that the Dow came down so sharply from its false breakout (the red circle, which indicates where the Dow briefly broke above resistance) is a worrying sign and it now looks like a fairly resounding double top. That is food for the bears.

However, this could just as easily resolve to the upside, as it did in February as loosely illustrated by the green lines below.

I do not think this is the time to be buying aggressively. If you use leverage (borrowed money), then I would recommend scaling down the size of your positions there is likely to be a lot of volatility as this market determines which direction it wants to go in. Risk is high.

I can envisage scenarios in which this market whipsaws and then breaks out to new highs. I can just as easily see a scenario in which we go down and retest the spring lows.

If these then do not hold, then much more bearish scenarios come into play.

But, in the short term, expect volatility and whipsawing.

I can, as much as a lowly bod from Brockley is able to do, almost guarantee that the Dow will come back and at least re-test its lows of last week. But I expect to see 26,000 first.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how