The charts that matter: a short-lived panic – or something deeper?

John Stepek looks at whether the charts that matter most to the global economy point to the market fall being just a blip, or if this is something more serious.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back. Once again, we have a new podcast for you, in which Merryn and I discuss what Larry Summers did on his holidays (found out that not everyone in America owns or even wants an iPhone, it seems); what the increasing risk of a stand-off between Italy and the European Union means for markets; and we also look at the predictive powers of mania in the art market.

And if you missed any of this week's Money Mornings, here are the links you need.

Monday: Why rising US bond yields really matter for markets

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday: Italy's debt crisis could be far messier than the Greek drama ever was

Wednesday: In the future, no one will own a car. Here's why and what it means for investors

Thursday: Is this another buying opportunity? Or is it the start of something bigger?

Friday: Why it's worth holding a bit of gold in your portfolio

Also, this week Merryn has been on a roll writing about the confused world of ethical business; the risks of owning shares in your employer (written before the Patisserie Valerie scandal broke this week, but that's a good case in point); and a little-commented on but extremely important point about shareholder democracy the type that the likes of you and I can get involved in and Unilever's failed plan to move its headquarters to Rotterdam.

Lastly, don't miss this week's issue of MoneyWeek magazine if you're not already a subscriber, sign up here now.

And now over to the charts. This week, the context is a sharp slide in global stockmarkets. You can put this down to all sorts of things, but the most obvious factor unnerving markets is that interest rates are rising more rapidly and with more determination than investors had really believed, at a time when politics is as messy as ever and most assets are moderately-to-wildly overvalued.

Will the sell-off endure, or is it a passing blip? I talked about this in Money Morning a fair bit already this week, but my short answer is that I don't think this is "the big one", but I do think it's a significant wobble a warning that markets can't support the weight of their own contradictions (rising rates plus valuations based on permanently low rates) for very much longer.

We'll see.

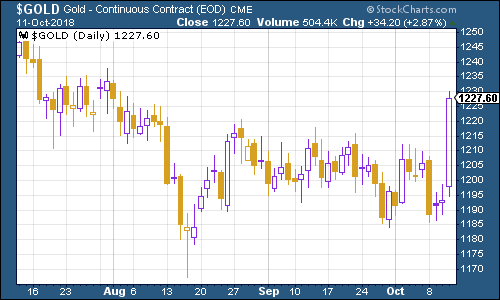

Gold (measured in dollar terms) rebounded as investors suddenly felt the need to run for a "safe haven" rather than take on as much risk as they possibly could. It may not last but I'd be surprised if investors now forget this lesson in a hurry.

(Gold: three months)

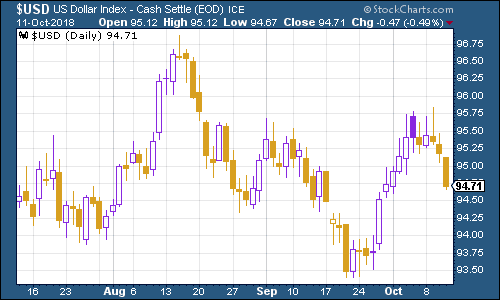

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners slipped back this week (another reason for gold bouncing back).

The currency fell as US inflation (as measured by the consumer price index) missed expectations, raising hopes that interest rates won't have to rise as quickly. The euro also strengthened as the European Central Bank continued to make noises about ending quantitative easing later this year.

(DXY: three months)

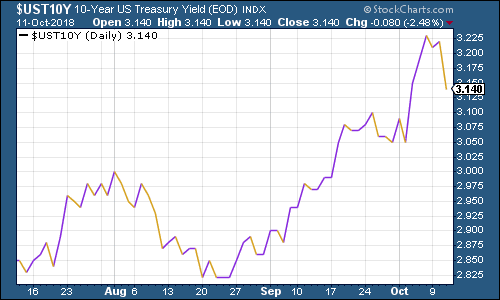

The yield on the ten-year US Treasury bond fell back but remained above the 3% mark. If yields consolidate for a bit, then markets can probably recover. If not, it'll be a lot trickier.

(Ten-year US Treasury yield: three months)

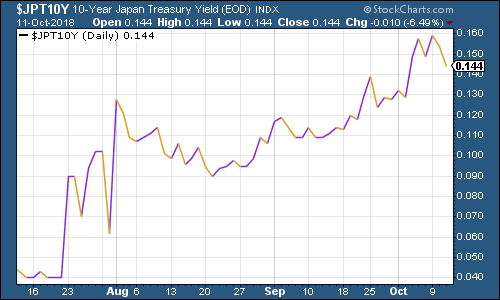

The Japanese government bond (JGB) yield slipped back but is still higher than we've seen it in a very long time.

(Ten-year Japanese government bond yield: three months)

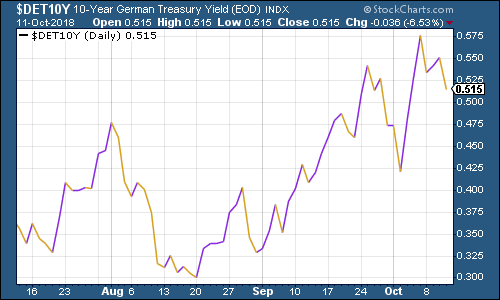

The yield on the ten-year German bund (the borrowing cost of Germany's government, Europe's "risk-free" rate) slipped alongside with US yields. The gap between German and Italian bond yields which is the thing we need to watch just now widened to above 3% this week. This simply shows how much more worried investors are about lending to Italy rather than Germany.

Italian deputy prime minister Matteo Salvini has said that it won't get above 4%, which does rather sound like walking into a firing range and painting a bullseye on your forehead.

(Ten-year bund yield: three months)

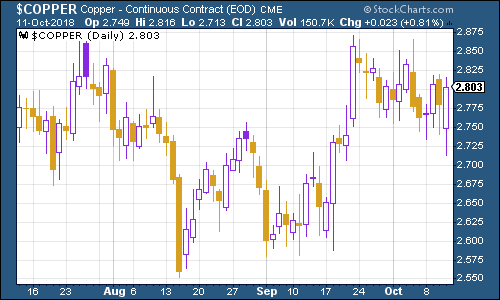

Copper rallied a little this week in reaction to the weaker US dollar, but is still ranging around the $2.80 per pound mark.

(Copper: three months)

Cryptocurrency bitcoin didn't enjoy the market crash. It fell hard in a very short space of time earlier this week, but since then, has been pretty stable.

(Bitcoin: three months)

On US employment, the four-week moving average of weekly US jobless claims stayed close to its cycle low this week, coming in at 209,500. Meanwhile weekly claims rose a bit to 214,000.

As David Rosenberg of Gluskin Sheff has noted in the past, the stockmarket usually does not hit its peak until after we've seen jobless claims (as measured by the 14-week moving average) hit rock bottom for a cycle.

In other words, jobless claims hitting a cyclical trough and then starting to turn up is a lead indicator for a stockmarket peak. Based on a very small number of widely varied observations, the stockmarket peak usually follows about 14 weeks from when jobless claims hit the bottom, and a recession follows about a year later.

In other words, we should be a few months at least away from a peak, and at least a year away from recession as yet. But remember that is based on a small number of occurrences. Just watch out for any sustained rise in the number of jobless claims.

(US jobless claims, four-week moving average: since January 2016)

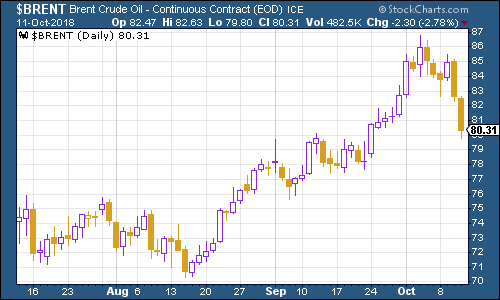

The oil price (as measured by Brent crude, the international/European benchmark) fell hard, along with stockmarkets. This was partly because US crude inventories rose by six million barrels last week, a lot higher than the 2.6 million expected. But in all honesty, it was mostly to do with oil crashing in sympathy with the wider market. Fundamentals do matter to oil but only eventually, not from day to day.

(Brent crude oil: three months)

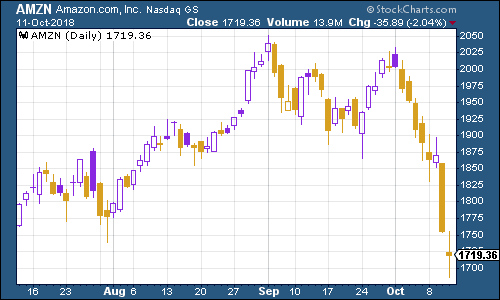

Internet giant Amazon had a tough week along with the rest of the tech sector. Tech has benefited greatly from low interest rates. As the FT notes, one Morgan Stanley analyst argued that tech stocks are arguably the longest-duration asset in the world. So "it's perfectly reasonable that they would eventually succumb to rising rates."

What does that mean? This is an oversimplification but it does explain everything you need to know to understand this point: a long-duration asset is one in which your payoff is far out into the future rather than very near by (it's usually used when talking about bonds). That makes these assets very sensitive to changes in interest rates because the higher that rates rise, the less attractive that distant pay-off becomes in comparison to the ones that are coming up more quickly.

As I said earlier this week, tech stocks tend to be "jam tomorrow" stocks today is all about building an audience, and tomorrow is about monetising it (indeed, Jeff Bezos always talks about how it's permanently Day One at Amazon). As interest rates rise, jam tomorrow is less attractive. Hence the tech sell-off.

(Amazon: three months)

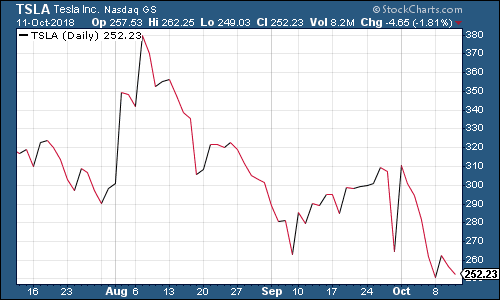

Electric car group Tesla is also a "(traffic) jam tomorrow" stock, but in this case, the reasons for its share price woes are much more specific to Tesla than the "big picture" environment.

The company is looking for a new chairman to take Elon Musk in hand. There are rumours it might be James Murdoch, currently a non-exec. That would be an interesting mixture of egos to watch.

(Tesla: three months)

Have a great weekend. And don't forget to listen to the podcast.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how