Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

"Ready for an end-of-year rally?" asks The Sunday Times. Key indices in America, Europe and Britain had gained 20% from their late October lows by last week before falling back. Bulls note that US stocks, which set the tone for world markets, often bounce after an election. The S&P has gained an average of 7% in the three months after a Democrat wins and almost 14% a year later, notes The Sunday Times's Jennifer Hill. Meanwhile, Morgan Stanley's European strategist Teun Draaisma, who rightly warned investors to sell in June last year, reckons that while there are short-term risks ahead, "the severe part of the bear market is over".

It's hard to share this confidence. Even after last week's surge, major indices remained in a downtrend, as John Authers points out in the FT. They hadn't risen above their 50-day moving average, a key indicator of the longer-term trend. And when US elections take place in bear markets, as Alan Abelson points out in Barron's, the S&P slides by an average of 6% by the end of the year.

But the overriding issue at present is that investors are still getting to grips with the rapidly deteriorating global economic outlook. The IMF is now forecasting that the developed world faces its first annual contraction since 1945. This is hardly a typical recession that may be over within a year, but a case of huge credit and housing bubbles bursting. "The unwinding of the massive economic and financial imbalances built up over the past decade requires a long and painful hangover," says Capital Economics.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Interest-rate cuts have had scant impact on the economy or the markets this time as the money markets are gummed up, rattled banks are shrinking their balance sheets and savings-short consumers are in no mood to take on more debt. So statistics that say stocks should soon embark on a bull trend because they tend to bottom out months ahead of the end of a recession are of no help partly because we don't know how long the recession will last. So beware of "geeks bearing recovery data", says John Mauldin on Investorsinsight.com.

No wonder global market confidence has been dented over the past few days by corporate news showing that the recession is deepening and the impact of tighter credit on the world economy "will continue to reverberate", says UBS. American electronics retailer Circuit City has filed for bankruptcy after a clampdown on credit-card lending dented sales and its suppliers had withdrawn credit lines and insisted they be paid upfront. Weaker British retailers are also being squeezed by suppliers, says David Wighton in The Times. American mortgage giant Fannie Mae has posted a $29bn third-quarter loss as the housing downturn continues; the Fed extended its rescue package for insurance giant AIG; while in Britain, Intercontinental Hotels' poor earnings outlook rattled investors.

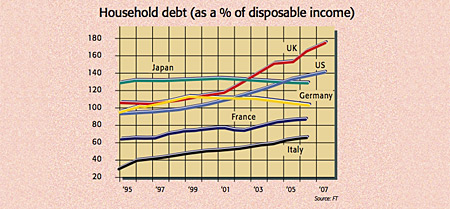

So bad news is still unnerving the markets, casting doubt on whether the worst has really been factored in. With earnings estimates for next year still high and the economic downturn in its early stages, there are plenty more profit downgrades to come and stocks don't do well in times of slowing earnings momentum, says Peter Jarvis of F&C Asset Management. An improving American housing market and a return to normality in the credit market would be needed for a sustained rebound, he reckons. These are some way off: in October, US credit-card issuers were unable to sell a single bond (backed by credit-card debt). The damage caused by the unwinding "supercycle of debt", as Albert Edwards of Socit Gnrale puts it, is far from over, and cheap stocks thus look set to get even cheaper. In the words of Michael Pento of Delta Global Advisors, "these are not normal times".

The big picture

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.