Passive investing would have confounded Adam Smith

If Adam Smith were alive today, the great economist would be left utterly perplexed by the rise and popularity of passive investing, says Merryn Somerset Webb.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

This week, I did something rather exciting. I hosted the first conversation about politics and economics at Adam Smith's only surviving home Panmure House in Edinburgh since 1790, which was the year Smith died.

Panmure House has been restored by Heriot-Watt University and one thing you can't help but notice is that while it is smaller than in Smith's day (a wing has gone), it is really very grand. This leads me on to the question of how Smith financed himself.

His books were wildly successful and he had well-paid positions at universities and as the commissioner of customs and the salt duties in Edinburgh. But another part of the answer is in good pension planning.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In 1763, four years after publishing The Theory of Moral Sentiments (which is worth skimming he wasn't all about the invisible hand), Smith received the kind of offer for which most modern writers would bite off their arm: a job accompanying and teaching the young Duke of Buccleuch on a European tour.

Having never been abroad, Smith probably fancied the travel and the chance to meet Europe's other great thinkers, but the job also came with a pension of £300 a year for life, the equivalent of not far off £60,000 a year today. By the time he returned to London in 1773, Smith had bagged himself one of the best defined-benefit pensions in history, gained from a mere ten years' work pleasant work at that and with no pesky "work to 55" conditions attached. How's that for a financial triumph?

Some of my audience at Panmure had the relaxed look of people financing their festival trip on a final-salary scheme. For most of us, though, the Adam Smith route to pension financing no longer exists. Nor, for that matter, do many of the others that have worked so well in the past.

The phasing out of mortgage interest tax relief and the sharp rise in stamp duty on buy-to-let property has made the idea of "property is my pension" less attractive than it once was. Landlords took out 19% fewer mortgages in June this year than June last year, for example. As for the bond and equity markets, my panellists didn't have much joy to offer there.

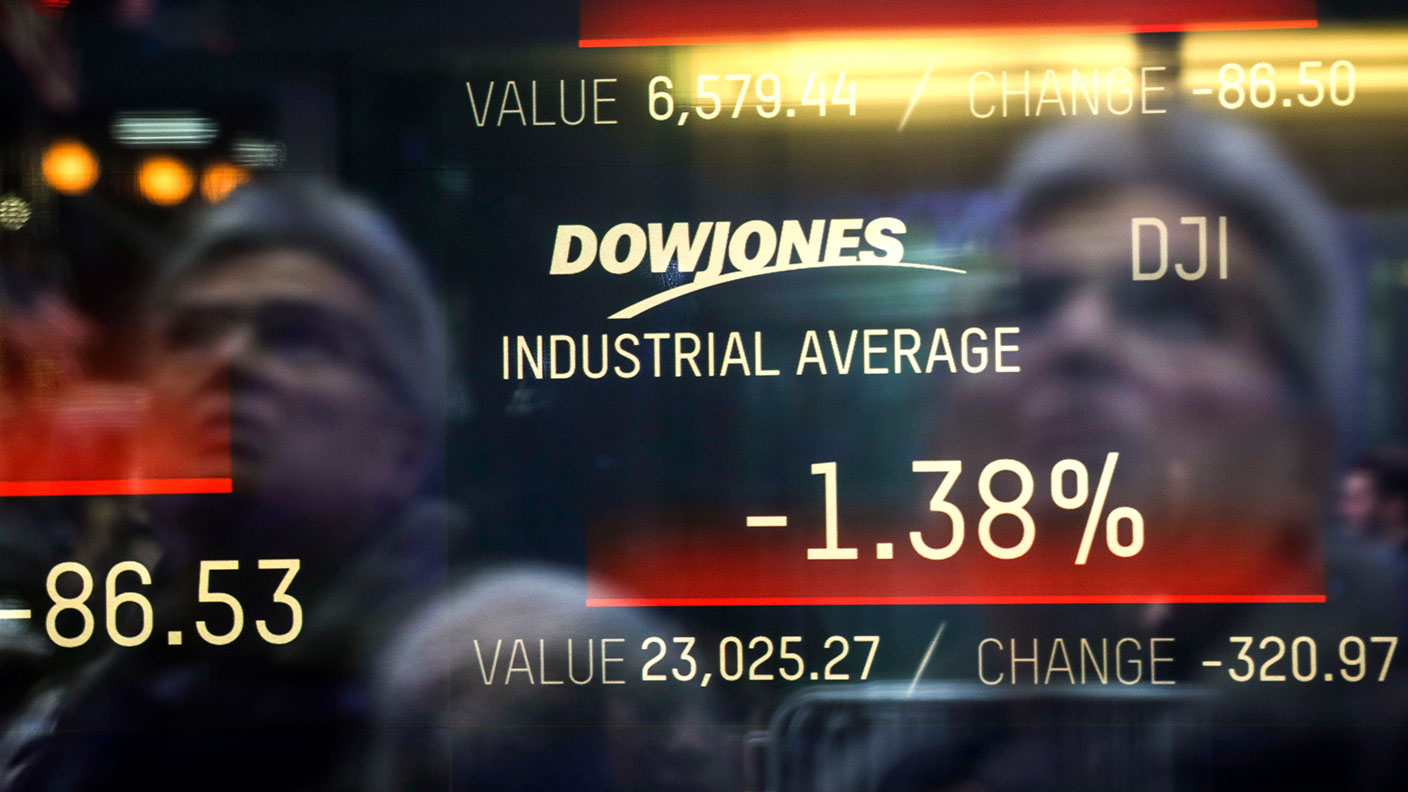

What, asked author Russell Napier, would Smith have thought of today's markets? Answer: not much. A lot of his thinking circled around the idea that to "increase the industry of a country", capital must be well allocated, "active and productive". So seeing us all investing passively which in the end just means investing by size, since the bigger a company is, the more an index investor invests in it would have left him confused and possibly unimpressed.

After all, long-term capital misallocation can only lead to lower productivity and lower long-term returns for everyone. Add to that the cyclical threats in the market and it is hard to be positive about finding a way to recreate Smith's financial world over the next decade.

These threats include the risk that Turkey sparks a genuine emerging-markets crisis by defaulting on its debt markets should pay more attention to whether the country under President Erdogan is willing to pay its debts than whether it is capable of paying them, says Napier. We are also seeing extreme valuations in more stable parts of the world: asset manager GMO forecasts negative real returns of nearly 5% in large-cap US stocks for the next seven years.

James Ferguson of MacroStrategy, one of this week's guests, had a happier take. Sure, he said, Smith would have been horrified by the rise and rise of passive investing. Yet it does make investing easy and cheap for the new wave of investors and it also comes with a silver lining for experienced and active investors.

The efficient market hypothesis suggests that prices always accurately reflect the level of information in the market. We can argue about that forever (everyone else does) but the nitty-gritty of it is how quickly that information is reflected. The rise of passive, in forcing funds to buy more shares that have gone up and fewer of those that have gone down in adding unthinking investors to the market surely makes the process take rather longer than in the past. Markets, in other words, are becoming increasingly inefficient.

The downside to that is if you find cheap assets, they will stay cheap for longer than they might have done. The upside is that this gives you more time to do the hard work of finding them which you probably should with at least part of your portfolio. For help with this, try the Scottish Investment Trust (I am a client) or Kennox.

There is, however, one other thing you must do if you want to have any chance of retiring in Smith style. You must never take a cold call from, talk to anyone or even begin to dream of giving your money to anyone who offers a free pension review or to help "release cash" from your pension early, however authorised they claim to be. Those that did and fell victim to pension fraud lost an average of £91,000 last year.

I don't think this is too big a risk for many Financial Times readers. The headlines on the matter tell us that losses have doubled in the past year and that is, of course, a worry which is why the Pensions Regulator and the Financial Conduct Authority have launched a public awareness campaign. That said, the total stolen remains a mere £23m, a drop in the ocean of pension assets, and only 253 people have reported being taken in. More of a risk to most of us are the corrosive effects of high charges and iffy asset allocation.

Either way, remember that while Smith died at 67, you are unlikely to do the same. Official statistics show that a man aged 65 today has an average life expectancy of just over 85. You don't want to hit your 80s £90,000 down. Doing so might be something that would stop you aiming, as Smith thought one should, for "habitual cheerfulness, which is always founded upon a peculiar relish for all the little pleasures which common occurrences afford".

I'll be hosting conversations at Panmure House at 2pm daily until 25 August in my Edinburgh Fringe show, "The Butcher, the Brewer, the Baker and Merryn Somerset Webb". Tickets available at edfringe.com.

This article was first published in the Financial Times.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Low-cost index funds for simple investing

Low-cost index funds for simple investingTips Index funds are an easy, low-cost way for investors to invest in a sector or asset class. Here’s a selection of the cheapest passive tracker funds on the market right now

-

Looking for a hedge against inflation? The FTSE 100 might be a good bet

Looking for a hedge against inflation? The FTSE 100 might be a good betAnalysis There are no assets that will protect investors' wealth entirely against inflation. But the FTSE 100 – a global stockmarket index with a sterling hedge – could be the best of a bad bunch says Rupert Hargreaves.

-

The power of passive investing – for good and bad

The power of passive investing – for good and badOpinion The rise of passive funds has made investing simple and cheap for millions of people. But it comes with huge consequences for markets, the economy and your wealth, says Merryn Somerset Webb.

-

Index tracker funds won't shield your wealth from inflation – here's why

Index tracker funds won't shield your wealth from inflation – here's whyAnalysis If you want your portfolio to survive in an inflationary world, a broad index-tracker fund won’t cut it. You need to be a lot more selective than that. John Stepek explains why.

-

Has passive investing created a stockmarket bubble?

Has passive investing created a stockmarket bubble?Sponsored Over the past two decades, investors have been switching from buying actively managed investment funds to buying passive funds that simply track a market. And that’s affected how the markets work. John Stepek explains why.

-

What is passive investing?

What is passive investing?Videos Passive investing is when you buy a fund that aims to track the performance of a particular index. Here's how it works.

-

The triumph of the blob: how passive investing could devour markets

The triumph of the blob: how passive investing could devour marketsCover Story We’re fans of passive investing at MoneyWeek. But is the rapid growth in passive ownership having a detrimental effect on the way that markets work? It might just be, reports John Stepek

-

How the boom in passive investing could create better-run companies

How the boom in passive investing could create better-run companiesOpinion ESG investing, or "ethical investing" as it used to be called, is mostly about the marketing, says John Stepek. But it's not all bad.