Is the yield curve about to flip?

If the yield curve reverses and investors are willing to accept lower rates on long-term debt than short-term, it bodes ill for the economy, says John Stepek.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

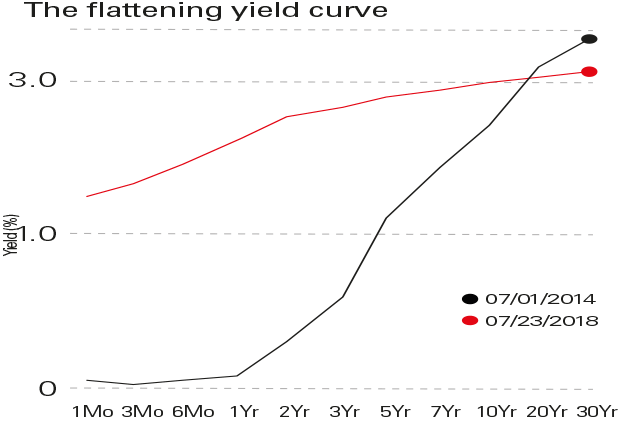

In December I highlighted an unusual and worrying phenomenon in the bond market the threat of an "inverted yield curve". This relatively rare event has a remarkably good track record of predicting recessions. In the seven months since I wrote that piece, the yield curve has only flattened still further, growing ever closer to the dreaded inversion point.

A quick recap: the yield curve refers to the shape you get if you plot the yields on bonds (IOUs issued by companies and governments) of ever-increasing maturities on a graph. Usually, short-term bonds pay a lower yield than longer-term bonds. So a two-year US government bond will pay less than a ten-year one. That's because investors will usually demand a better return for locking their money up over a longer period of time, because there's a higher risk of inflation or default denting their wealth.

When the yield curve flattens, it means the gap (or "spread" see below) between short-term debt and long-term is narrowing. As the chart shows, the yield curve is far flatter today than it was five years ago, for example. And it's only getting flatter. In December the spread between the two and the ten-year US Treasury was above 0.5% now it's below 0.35%. And if it inverts, it shows that long-term debt is actually yielding less than short-term debt. Typically, that's because investors are worried that a recession is around the corner, which will stifle inflation, and force central banks to reduce interest rates.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Former Federal Reserve chairman Ben Bernanke said this week that we should be wary of reading too much into the flattening yield curve. That may be a fair point with quantitative easing elsewhere in the world (Japan and Europe), plenty of money is still flowing into longer-term Treasuries, which may be suppressing rates. But Bernanke has form here. He dismissed the significance of the inverting yield curve in 2006, when he became Fed chair. As the ensuing crisis demonstrated, he was wrong to do so. It would be foolhardy to make the same mistake again.

Of course, the yield curve hasn't turned down yet. In fact, on Friday last week, as John Authers notes in the Financial Times, the curve actually steepened at its fastest rate (in percentage terms) since the financial crisis. Now, given its current flatness, that doesn't mean a lot in absolute terms. But it does suggest that inversion may still be avoided for now. And that would make sense as Authers notes, the curve has "looked out of place with other measures suggesting that the prime danger is overheating". That said, while an escape from our "deflationary torpor" is to be welcomed, higher rates would bring their own problems. But that's a discussion for another day.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge