Bitcoin’s big bounceback - can it continue?

Bitcoin has risen by 40% in the last two weeks to over $8,000. Dominic Frisby looks at what's behind the spectacular rally, and where the price might go next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Bitcoin is the subject of today's missive.

It's enjoyed a 40% surge over the last fortnight. Has this rally got legs?

And what has China got to do with it all?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

What's driving bitcoin's spectacular rally?

After a fairly abysmal May and June which saw bitcoin fall by more than 40% as it slid from $10,000 to $5,700 things have rather perked up for cryptocurrencies over the last few weeks.

Yesterday, bitcoin made its way through the $8,000 barrier. This morning it sits at $8,350. Its next technical hurdle is its 200-day-moving average at $8,600.

"Why is it going up?" my editor, John Stepek, asked me yesterday. "It always seems to do well when China is panicking."

John's comments got me thinking and researching.

There's no doubt that China influences the bitcoin price. Chinese mining pools control more than 70% of bitcoin's collective hashrate. Effectively, that means the speed and power of the network is determined in China, and the larger part of the maintenance of the system occurs there.

Once upon a time, China accounted for something like 90% of global bitcoin trading. But that number has fallen quite dramatically. According to China's state-run Xinhua News Agency (which cited the country's central bank), yuan-denominated trading in bitcoin has dropped below 1% of global volume.

Japan has overtaken China as the global trading hub and the yen now accounts for about 44% of global volume, compared to 11% in US dollars.

The explanation for this is that Chinese authorities banned trading in cryptocurrencies. But not only are the Chinese notoriously a nation of speculators, there are plenty of them trying to find ways around the increased capital controls that are being imposed, so as to get their money out of the country.

So there is a great deal of cryptocurrency speculation still going on, much of it via tether (a cryptocurrency pegged to the dollar), which accounts for almost 40% of global volume.

As the yuan has been falling in recent months, Chinese authorities have been taking steps to limit selling and money escaping the country. The latest wheeze to get your money out, I read, is real estate speculation in Hong Kong, as the disclosure demands are not as onerous as for overseas wealth elsewhere.

Again, cryptocurrencies play a role in this movement of money as they were specifically designed to do.

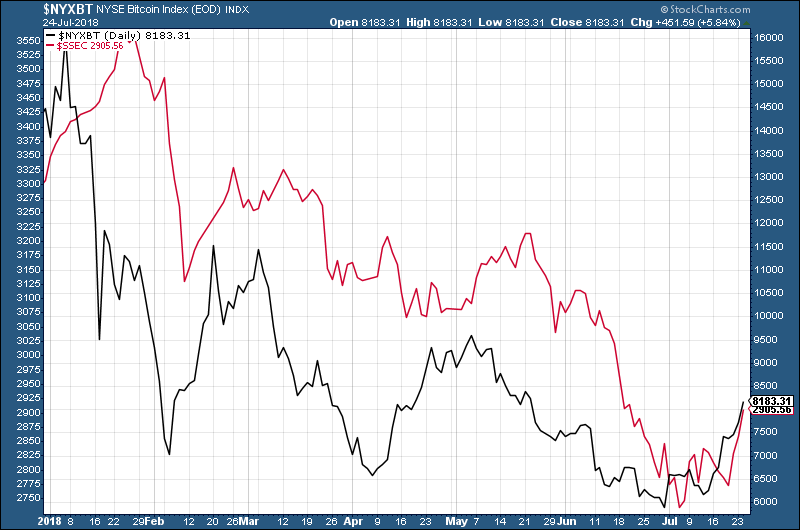

Meanwhile, I've noticed some correlation between the bitcoin price and the Chinese stockmarket. This might be coincidental, but I rather suspect it isn't. John's right about Chinese panicking: its stockmarket has absolutely stunk the room out this year, down, at one stage, over 25% from its February high.

But in the last fortnight or so, it's enjoyed something of a surge and that has coincided with bitcoin's 40% gain.

In other words, if it is the Chinese who are moving the price, it isn't because they are panic-selling stocks and moving their money into coins; it's because stocks are rising in value.

In the chart below we see the bitcoin price in black and the Shanghai Composite index in red over the course of this year. You can see the two have traded almost in lockstep, with bitcoin leading slightly.

The relationship is not unlike that of emerging markets and commodities, or the commodity currencies (the Australian dollar, the Canadian dollar, the Norwegian krone etc) and gold.

I won't go as far as to say the Chinese are determining the price, but I will broaden that net out to East Asia. The short and rather facile answer to John's question of "why is the bitcoin price going up", is "more Asian buyers than sellers".

But what we really want to know is where next? Does the surge continue?

We could find out if the bitcoin rally will be sustained today

From a technical point of view, the bull case is quite strong in that, first, bitcoin has put in what looks like a strong bottom just below the $6,000 mark. It first went there in February, then re-tested the area in April, and again in June-July. So we have a nice solid floor at around $5,800.

Coming off those lows we now have a nice solid short-term trend. The short and medium-term moving averages are all sloping up, and the bitcoin price is above them. This is good.

On the downside, bitcoin is a little overbought in the short term according to some measures although bitcoin being overbought has rarely bothered it in the past, so I would not be too concerned about that.

There are two things that temper my bullishness. The first is the 200-day moving average (200DMA). I'm not usually a fan of the 200DMA in most markets beyond its use as a general indicator of trend I prefer numbers that are a little more esoteric but with bitcoin, for some reason, it has been working well.

The chart below shows the bitcoin price this year. I have marked the floor in the price in red. The 200DMA is in black. You can see that it has capped every attempt bitcoin has made to rally since March.

The question we must ask is, will it cap this rally? We should know soon enough, the first test looks as though it's coming as soon as today.

Then, leaving technical analysis aside, there is the matter of miners selling. Below $7,000, many miners had to sell all newly-mined coins to cover expenses. Some shut down altogether. However, with the recent rally there have been some interesting changes in behaviour.

MoneyWeek buddy Charlie Morris has put together a new bitcoin analytics provider called cryptocomposite.com and it observed that miners had begun holding back inventory as prices appreciated. However, in the last 24 hours miners sold $17.3m of coins, while they earned around $14.4m.

In other words, close to the bottom they were selling to survive. As the price appreciated, they held back. This week they appear to have started taking profits. If that accelerates, it could put a cap on the rally.

It'll be interesting to see what happens.

If you don't have any crypto in your portfolio, you really should, even if it's only a tiny amount. There's a chance the whole thing amounts to nothing, but there's also a chance it becomes the dominant money system of the internet, in which case the potential for gain is too great to ignore.

My guide to getting started is here.

The other way you can get started is by coming to see my Financial Gameshow at the Edinburgh Festival, starting next week. What a shameless plug!

As well as being sponsored by MoneyWeek, it's also being sponsored by bitcoin cash, so there are MoneyWeek subscriptions and bitcoin cash to be won in every show. You could also win the small matter of five hundred quid. Hopefully, I'll see you there. I set off next week and I can't wait. Tickets can be bought here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how