The charts that matter: the Fed hints at a more relaxed pace of rate hikes

John Stepek looks at how the US Federal Reserve's more dovish stance as affected the global economy's most important charts.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

If you missed any of this week's Money Mornings, here are the links you need.

Monday:One area of financial markets where ETFs could prove very disruptive

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday:Italy is testing Mario Draghi to step in and do "whatever it takes"

Wednesday:Gold looks a better bet than UK property here's why

Thursday:A simple lesson from Turkey for investors: rising authoritarianism is bearish

Friday:The new Federal Reserve isn't as tough on inflation as it looks

And in this week's podcast, Merryn and I talk about Italy and the headache it poses for the EU; and about how we think democracy is working just fine, but we may be in the minority. Oh and we have a quick chat about the oil price too.

Now over to this week's charts.

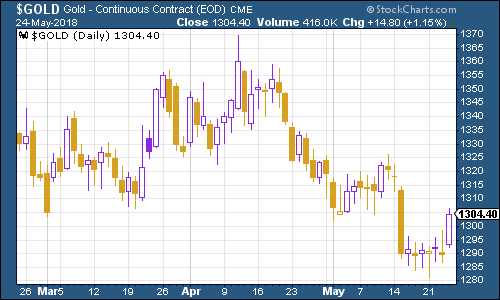

Gold had an interesting turnaround this week. It rallied back above the $1,300 mark. What made the difference? I suspect it was the Federal Reserve turning a little more dovish than markets had expected (I wrote about that yesterday).

As I've said before, gold responds to changes in real interest rates (interest rates after inflation is taken into account). If the Fed slows the pace of raising interest rates, then that should mean assuming rising inflation that real interest rates rise more slowly or even fall. That's good for gold.

(Gold: three months)

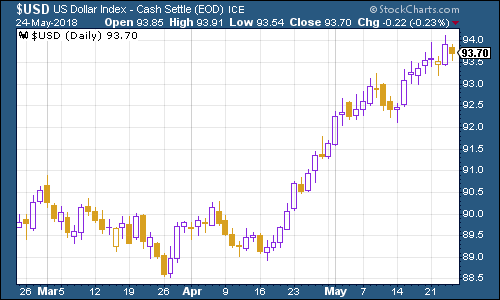

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners was higher compared to last week, but it took a hit from the aforementioned Fed minutes.

(DXY: three months)

The yield on the ten-year US Treasury bond slipped sharply this week. That's partly safe haven demand (what with the summit between the US and North Korea falling apart, for now) and partly due to the Fed standing down on interest rates somewhat (although if that means inflation takes off more rapidly, then that won't last).

(Ten-year US Treasury: three months)

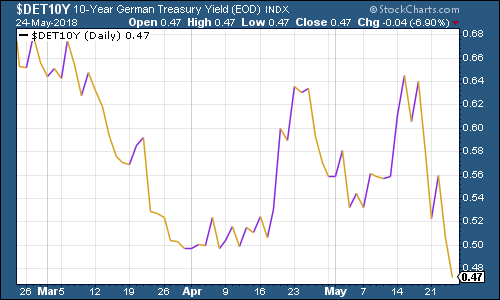

The yield on the ten-year German bund the borrowing cost of Germany's government, which is Europe's "risk-free" rate fell sharply too. A slowdown in the eurozone economy alongside Italy stirring up new "break-up" fear were the main drivers behind that.

(Ten-year bund yield: three months)

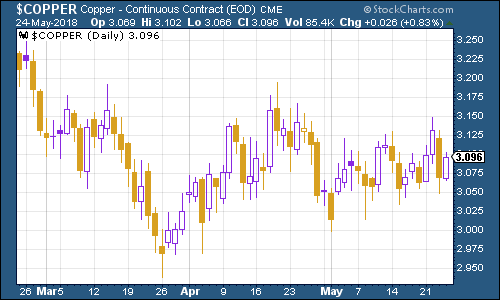

Copper continued to trade in a pretty tight range.

(Copper: three months)

Bitcoin continues to head lower. Sentiment was hit by the US justice department opening a criminal probe into whether traders are manipulating the bitcoin price.

(Bitcoin: ten days)

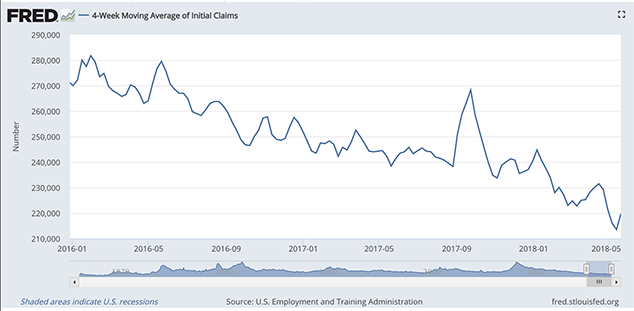

On US employment, the four-week moving average of weekly US jobless claims rose a little to 219,750 this week, while weekly claims came in at 234,000, the highest reading in seven weeks.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later.

We hit a new trough last week, so if there's anything to Rosenberg's observations (and of course, they are drawn from a limited pool of past cycles), then we should see the stockmarket hit new highs before this cycle is out. That would mean the S&P 500 returning to close to 2,900. Given that the Fed is starting to look a little more relaxed about inflation, it's by no means impossible although it would mean looking beyond the whole mess in Italy for now.

(US jobless claims, four-week moving average: since January 2016)

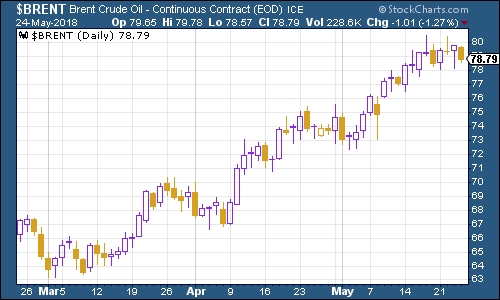

The oil price (as measured by Brent crude, the international/European benchmark) appears to have bashed its head on the $80 a barrel mark for now.

(Brent crude oil: three months)

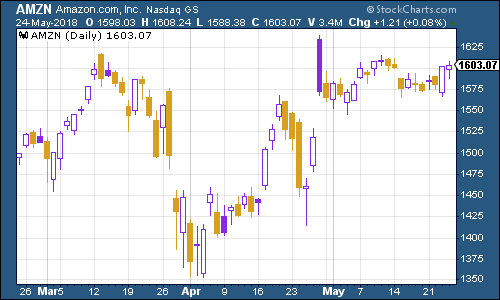

Internet giant Amazon continued to make gains, helped by a modest market rally on the Fed minutes.

(Amazon: three months)

Tesla saw its share price continue to slide this week. Elon Musk spent a lot of time on Twitter, getting annoyed with the press, and generally being attention seeking. That time might be better spent building more cars.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how