Alumasc: a cheap stock in a tough market

Alumasc should profit in both sunshine and storms thanks to its balance of different businesses, says Richard Beddard.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Judging by Alumasc's sales over the last decade, this building-products supplier hasn't been a particularly impressive performer. They've fluctuated, but essentially the firm earned no more revenue in the year to June 2017 than it did ten years earlier.

And just in case you're thinking I'm going to suggest that's all about to change, I'm not. In March, Alumasc released a trading statement blaming economic and political uncertainty, the collapse of Carillion, delays to public-service housing refurbishment projects in Scotland and severe winter weather for falling demand for building products.

Earlier expectations of growth have been dashed. Brokers forecast marginal reductions in sales and profit for the year to June 2018, despite Alumasc's acquisition of Wade International, a profitable drain manufacturer.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Trading on a low valuation

Things aren't always as bad as they seem, yet in the eyes of the market, Alumasc's prospects are not good. Following the trading statement, the share price fell more than 25% and, although it's since recovered a little, the current price of around 140p values the firm at just ten times profit in 2017, on a debt-adjusted basis.

While the trading statement reads like a list of excuses, they're probably genuine. Businesses are nervous about taking on large commercial building projects due to economic uncertainties including Brexit; councils are cash-strapped; and bad weather has delayed building projects. The weather should improve, but it's naive to expect Alumasc to grow every year. The question now is whether economic ill winds will demonstrate Alumasc's weaknesses or its strengths.

The company's sales record isn't as bad as it looks. Until it disposed of two unrelated engineering businesses, one in 2015 and one in 2016, its results were marred by these units contracting. If we take those two businesses out of the equation, Alumasc has grown revenue from building products, which is all it sells now, by 20%. That may not seem impressive, particularly as it made a couple of small acquisitions in the period, but 2008 was a high watermark for the construction industry so the starting point makes for a tough comparison.

Rising return on capital

Over the last decade, Alumasc has repaid most of its debt and focused on premium building products required to meet building or environmental standards. Most of these products such as solar shading systems, drains, gutters, roofing and walling go on the outside of buildings and need to look good too. Often, Alumasc doesn't bear the capital cost of factories because it outsources manufacturing, so return on capital has improved dramatically since it offloaded its ailing capital-intensive engineering businesses. In 2017, Alumasc earned a pre-tax return on capital of over 30%.

One of the winning characteristics of the business model is some bits of it zig when other bits zag. While Levolux, a manufacturer of the giant fins you see shading skyscrapers, is experiencing lower demand in the UK, it's growing in the US. While Gatic, which supplies surface drainage for car parks, shopping centres and airports, is struggling, drainage and other products for the residential housing market are selling well.

Alumasc is well balanced between different sectors, earning significant revenues and profits in public and private housing, commercial property, infrastructure, new build and repair, and maintenance markets. Most reassuringly for a company in a cyclical business Alumasc should prosper in good times, and still profit in bad times, judging by its profit margins.

Kicking the tyres... noodle through the notes

In the fast-paced world of today's stockmarket, investors rarely read annual reports, let alone the notes to the accounts. But it's these notes that break down and explain the headline figures reported on websites and in the media. To understand where the profit is coming from, it often pays to noodle through the notes.

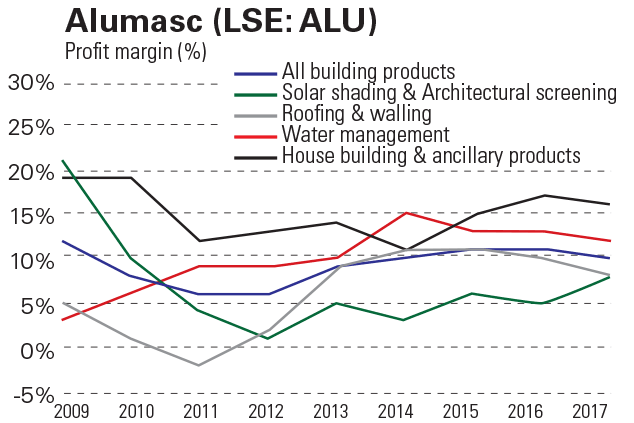

Note four in Alumasc's 2017 annual report is a segmental analysis. This shows us how much revenue and profit different parts of the business generate. From these numbers, we can calculate the most profitable segments. The chart on the right shows profit margins plucked from segmental reports in the last nine annual reports. Before 2009, Alumasc reported in different segments: at the peak for construction in 2008, the combined profit margin for all building products was 13%.

Profit margins tell us the proportion of revenue a business or segment converts into profit. If the proportion is high, revenue can fall a long way or costs can increase markedly before a company will get into difficulty. If profit margins are thin, a company could easily make a loss. Alumasc's combined profit margin of 10% in most years (the blue line) compares favourably to the thin margins normally experienced in the construction industry.

Profit margins also look pretty solid. Although the profitability of the individual segments varies wildly and roofing & walling made a loss in 2011 Alumasc has generally prospered as a whole. This is because different parts of buildings are built at different times. Different markets residential, commercial, public and private are also subject to different business cycles.

Alumasc needs stability though. The notes also reveal a large defined benefit pension obligation, biggerthan the assets the company has put aside to pay pensions. Companies can get into difficulty if they don't generate enough cash to plug their pension deficits, so Alumasc must keep performing.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Richard Beddard founded an investment club before joining Interactive Investor as an editor at the height of the dotcom boom in 1999. in 2007 he started the Share Sleuth column for Money Observer magazine, which tracks a virtual portfolio of shares selected for the long-term by Richard. His career highlights include interviewing Nobel prize winners, private investors and many, many company executives.

Richard is freelance writer who invests in company shares and funds through his self-invested personal pension. He has worked as a teacher and in educational publishing, and is a governor at University Technology College, Cambridge. He supports the Livingstone Tanzania Trust, a charity supporting education and enterprise in Tanzania.

Richard studied International History and Politics at the University of Leeds, winning the Drummond-Wolff Prize for "distinguished work in the field of international relations".

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how