The charts that matter: the cracks start to show as the dollar squeeze continues

As the US dollar continues its rise, gold has been struggling. John Stepek looks over the charts that matter most to the global economy to find out what's changed over the last week.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

If you missed any of this week's Money Mornings, here are the links you need.

Monday:What the merger between Sainsbury's and Asda means for you

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday:M&A deals are being done faster than ever that's not a good sign

Wednesday:Sterling has taken a pounding but I'm looking to buy back in

Thursday:Has the Fed really turned hawkish? Or is it just an act?

Friday:Argentina's woes show that faith alone will no longer prop up markets

Other articles you shouldn't miss on the website this week include Merryn's view on inheritance tax scrap it, but replace it with a gift tax (Tax the living, not the dead); and her piece on the history of fund management and the unintended consequences of benchmarking (The modern-day perils of fund management).

The podcast will be back next week (no, really).

Now over to this week's charts.

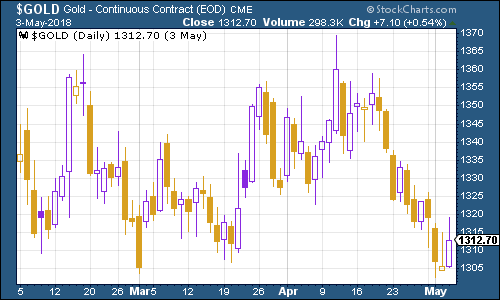

Gold has been struggling against the resurgent might of the dollar, but it's also enjoying a bit of support from the fact that the rising dollar is also causing quite a lot of angst in financial markets across the globe. So have some in your portfolio, and hope that it doesn't go up an awful lot.

(Gold: three months)

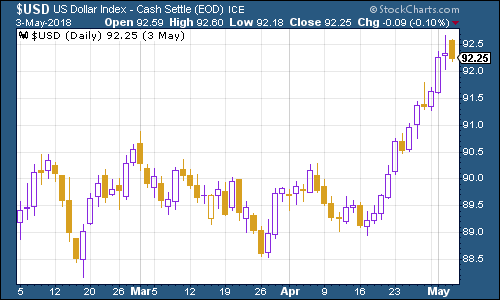

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners is still on a tear. The Federal Reserve has convinced investors that it remains on course to raise interest rates and there have also been few bits of data to indicate that the US economy is slowing down.

(DXY: three months)

Meanwhile the yield on the ten-year US Treasury bond fell back below the 3% mark. That does suggest that investors are getting a bit worried that the Fed might be too enthusiastic about raising rates - alternatively, it also suggests that a 3% yield on the US Treasury start to look very appealing to overseas investors when compared to the yields on similar bonds around the world.

(Ten-year US Treasury: three months)

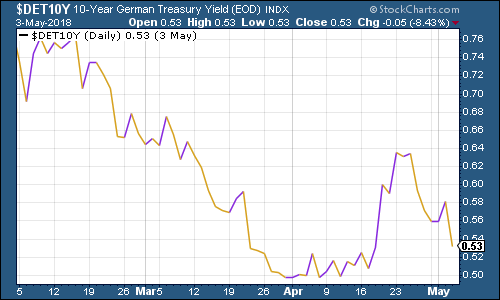

The yield on the ten-year German bund the borrowing cost of Germany's government, which is Europe's "risk-free" rate fell alongside its US counterpart.

(Ten-year bund yield: three months)

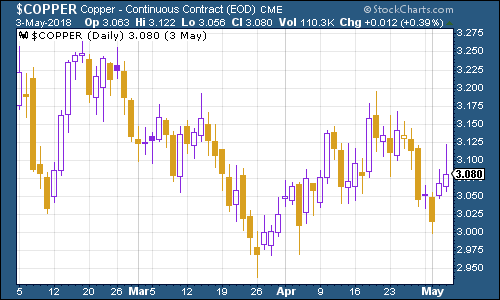

Copper remained relatively strong, despite the stronger US dollar.

(Copper: three months)

Bitcoin is bitcoin. The stronger US dollar appears to matter not a jot to the cryptocurrency, which is intriguing. Bitcoin is often viewed as the digital equivalent of a "hard" asset, but it must be the only "hard" asset in the world that doesn't wilt when the dollar picks up.

(Bitcoin: ten days)

Turning to US employment, the four-week moving average of weekly US jobless claims hit a fresh low for the cycle of 221,500 this week the lowest level since 1973 while weekly claims came in at just 211,000, the lowest weekly count since 1969, bar last week's 209,000 reading.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later. We've just hit a fresh trough, so if there's anything to Rosenberg's observations (and of course, they are drawn from a limited pool of past cycles), then really, we should see the stock market hit new highs before this cycle is out. (I haven't included the chart below, as at the time of writing it hadn't been updated on the Fed website).

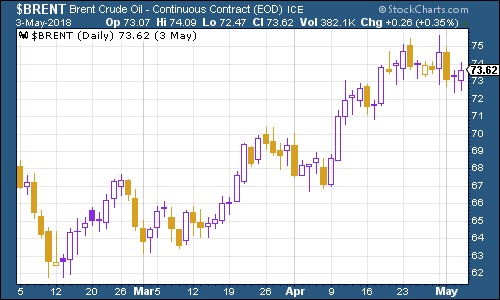

The oil price (as measured by Brent crude, the international/European benchmark) continued to trade sideways this week as the strengthening US dollar knocked some wind out of its sails.

(Brent crude oil: three months)

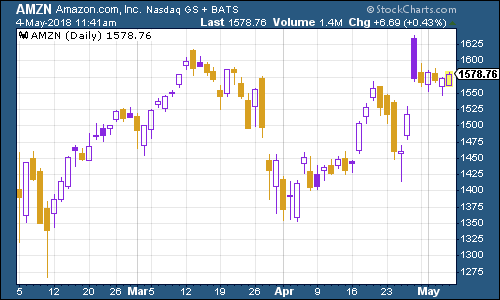

Internet giant Amazon slipped back from its spike above $1,600, dipping in line with most stocks this week.

(Amazon: three months)

Tesla had a tougher time of it - investors thought its first quarter results weren't too bad. But then CEO Elon Musk was very defensive and outright rude on the analysts' call - getting particularly prickly about various searching questions - which appeared to rattle confidence in the stock.

It's not a good sign when a CEO starts to rant about short sellers. But there are still plenty of acolytes willing to suspend their scepticism. Maybe they're right. But I'm not buying the dip.

(Tesla: three months)

Have a great Bank Holiday weekend! Slap on the suncream! Money Morning will be back on Tuesday.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how