The vultures are circling over the corpse of corporate Britain…

… but that could be good news for canny investors, says Jonathan Compton. Things can hardly be expected to get any worse, and the tidbits are looking cheap.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I realised long ago that diversification was a lower-risk/higher-reward investment strategy, so I have always had a high percentage of my money invested overseas, outside of the UK. Since Britain voted to leave the European Union (EU) in June 2016, this has been especially advantageous. For whatever your own views on its rights and wrongs, markets have loathed Brexit. Not only has sterling suffered considerably even falling against joke currencies such as the South African rand but the UK equity market has been feeble too. Yes, it has risen, but it has underperformed global equities in local-currency terms by around 15%, and by nearly a third in dollar terms.

This sort of global diversification is, unfortunately, unusual. That's because investment is like reading a map start in the wrong place and you will get lost. From junior investment advisers to lofty pension-fund actuaries, bad map reading has been the norm. For all have persistently promoted the spurious idea that in order to reduce risk (a concept usually conflated with uncertainty), investment should be aligned geographically to potential liabilities. As a result, individuals and pension funds in the UK are urged to invest mostly in UK equities and bonds to avoid what, risibly, is called a "mismatch". The result is that individuals end up with closet UK index trackers holding the largest and often flabbiest firms and, as interest rates fall making government bonds expensive so pension funds are forced to buy more overpriced gilts. Yet the real idiocies of this approach are that investors miss out on overseas opportunities and, worse still, have all their eggs in one basket surely much riskier than a geographical spread.

The opportunity cost of this approach has been high. Since 2000 the effective exchange rate of sterling against a basket of currencies has fallen by more than 20%. Meanwhile, the FTSE All-Share index has risen by 37% and the World index (excluding the UK) has gained more than 80% (in both cases this is prior to reinvesting dividends, which slightly improves UK returns). So by following lazy, parochial advice to invest at home, investors have endured pretty miserable growth. If they had been 100% overseas, then many pension funds would now be in surplus, while individual investors would be dining off gold plates. (Indeed, I may upgrade my own tableware).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Yet, having said all this, and despite the poor outlook for the British economy, chaotic political developments, and guaranteed continuing uncertainty I think it is time to start looking at UK stocks.

A depressingly sluggish performance

What is the outlook for UK growth? Depressingly sluggish. While Brexit is casting a long shadow, my opinion has nothing to do with partisanship it is all in the data. The negatives are clear. Since Brexit, UK economic growth has been sub-par, moving from being nearly the best among the larger economies to becoming one of the worst. From 2010 to 2016 growth was cranking along at about 2.3% a year, but since the vote it is around half that rate. Curiously (but not causally related), EU growth has improved since the day we voted. The global economy is in a strong upswing. We are not.

Consumer spending is the key driving force for all developed economies. In the UK it is weak and likely to stay so. Sputtering high-street sales are partially explained by the impact of the internet, but the steady slowdown in car sales, new mortgage approvals and big-ticket items are not. One cause is that, although total employment is at a record high, real (after-inflation) growth in wages outside the top 20% of earners is weak real take-home pay for these workers remains below the 2009 level. This is not just a British problem it applies to many advanced countries but the recent trends here are slightly worse than average. Growth in consumption in turn depends on two other factors, credit growth and savings levels again, both are weak. Growth in consumer credit has waned noticeably since 2016, while personal savings are near their lowest level since 1968. Neither are an immediate consequence of Brexit, but since the vote they have worsened. Sentiment indicators are subject to wild swings, but consumer surveys are distinctly negative, maybe because GDP growth in the last quarter of 2017 was at a five-year low.

Businesses are hardly champing at the bit to expand either. Capital expenditure and business confidence are flatlining. Profit margins are being squeezed sometimes desirably, because of higher minimum wages and pension contributions but also because of weakness in consumer demand and in sterling, which has driven import costs higher, meaning there is little hope of improvement from that quarter. This leaves the government to pick up the slack through higher borrowing and spending. Yet partly because of ideology an unproven consensus that the ratio of debt-to-GDP must be much lower as well as incompetent execution (think HS2 or Hinkley Point), there is little chance of an upturn here either.

The ultimate invisible hand

All these points are aced, however, by the actions of foreign investors. There is intense media coverage over minute, meaningless changes in the rate of inflation, unemployment or house prices but foreign direct investment (FDI) never gets a look in. Yet this is the ultimate invisible hand. It is well known that the UK has long been "living beyond its means", running a large perennial deficit in trade, offset by income from selling services overseas. So how come we remain so wealthy? The answer is FDI. This measures the amount that foreigners invest in a given country, be it shares, bonds, property or business.

Until 2015 the UK ranked third in the world both in terms of the total stock and of net FDI investment inflows. The gross stock, at over $2trn, is enormous and, relative to GDP, far higher than the two global leaders, the EU and US. In terms of inflows, net annual FDI has also been gigantic, beaten only by the world's two economic super powers, China and the US. This foreign appetite for British assets has been the key factor in allowing us to live a lifestyle that we could not otherwise afford. Until 1995, FDI was relatively minor at 1%-2% of GDP. Since then it has soared, often to 4%-8% of GDP. The UK is a world favourite for well-known reasons: an impartial legal system, good contractual laws and property rights, and relatively mild bureaucracy. You may not like Russian hoods buying top properties or Kraft taking over a "national jewel" in Cadbury Schweppes, but foreign investors have been the economic paymasters for nearly a generation. (Cadbury, by the way, is now employing more people, spending more on research and development, and paying more domestic tax than ever.) Yet since 2016 these flows have abated dramatically hence the feeble growth numbers. In the UK equity markets the outflows have continued hence the relative underperformance.

Finally there is political uncertainty. You would have to be an unquestioning apparatchik to believe that either of the major parties enjoy good management, economic competence or a clear vison. Their debates are puerile. The Conservatives, lacking a majority, are forced to make trivia seem important: an entire week of ministers announcing a possible ban on cotton buds and plastic straws. The Labour party is riven by factions, internal problems and unable to fill the policy vacuum. No party has the vision yet to forge a coherent post-Brexit policy. Such weakness and uncertainty are what markets loathe the most.

Sell the rest of the world; buy the UK

So why do I recommend a gradual reduction of overseas investments in favour of the UK? First, economic growth has at best a low correlation with stockmarket returns. There are many examples. China's Shanghai index halved over the five years to 2012, even as the economy enjoyed breakneck growth; America's S&P 500, meanwhile, doubled between 2010 and 2015, despite feeble economic activity.

Then there is valuation. Look at the widely used cyclically adjusted price/earnings ratio (better known as Cape, or the Shiller p/e), which measures how expensive a market is based on ten-year average earnings. On this measure, almost all larger markets are highly priced compared with their history. However, the UK, on 15 times ten-year earnings, has risen by less and is far less stretched than, say, France or Germany (on 20), Japan (on 27), or the US (on 30).

Another issue to consider is shrinkage. This is an under-researched market factor. Normally as an index rises companies issue more shares, and public offerings also increase. As a result, the total number of shares in issue rises rapidly. In the UK, however, this increase has been low and over the last six months it appears that the number of shares in issue may have in fact contracted. This is highly unusual; if the amount of money flowing into a market increases and the number of shares in issue is unchanged then prices must rise. This has not happened yet because UK-orientated funds have been suffering considerable outflows by local investors in favour of overseas markets (which has been the right call so far) and domestic government bonds (which is simply idiocy). This will reverse because such flows are cyclical.

Apart from Cape, other valuation measures also suggest the UK is now relatively better value than most other developed markets. The yield on the All-Share index is close to 4%, twice that of Japan or the US and better than the majority of developed countries. That's appealing investors are always yield-hungry, particularly institutions. Broader valuation comparisons using not only Cape and yields but also many other key ratios, such as price-to-book (or replacement cost) or price-to-cash-flow, show a similar picture: the UK is scoring far better. Investors tend to respond positively to such valuation changes.

Fund flows are notoriously difficult to forecast, but overseas investors have been "underweight" the UK for nearly three years, and the consensus advice they receive has been to remain so. Yet those who want "out" have long gone. The almost-zero foreign appetite is likely to reverse, and even the mere absence of selling pressure can have a significant impact. Another consideration is the currency outlook. As mentioned, sterling has been a pretty rotten investment for prolonged periods. However, on the basis of purchasing power parity (PPP) and similar measures, the pound is now at about "fair value" its weakness has already more than compensated for the worst outcome of potential EU tariffs.

The vultures are circling (which is good news)

Yet I suspect these reasons to be cheerful will be dwarfed by a resurgence in FDI, especially as a result of takeovers and threats to restructure companies and change management. The more savvy foreign investors clearly sense opportunity in our under-performing market, currency and government, and are moving fast. Approaches, bids or break-up threats have been made recently to well-known index giants, including banking group Barclays, drugs producer Shire, broadcaster Sky, commercial-property giant Hammerson, leisure conglomerate Whitbread, metal-basher GKN and transport group FirstGroup. The trend is rising, the shrinkage will increase, and capital inflows and sentiment will improve. Vultures maybe, opportunists definitely, but such activity creates its own momentum.

I am not suggesting the UK is a slam-dunk, that shares will soar, or that our politicians will suddenly develop leadership qualities. Markets globally are looking pricey (which will only worsen if interest rates keep rising), so my suggestion to invest in the UK is a call based on relative value and cyclical factors. But the current loss of confidence will reverse and a Brexit solution (which hopefully everyone will dislike, and so will be about right) will emerge, reducing uncertainty. The outlook may certainly deteriorate further but the problems are largely priced in.

The best stocks to buy now

The performance of UK equities falls into two broad categories: those with considerable overseas earnings, which, because of sterling weakness, have fared better; and the more domestically oriented companies. The latter group has largely underperformed the broadest index and trades on a multiple about 15% lower. This is where the value lies and, in some cases, the potential for a takeover bid. I own all of the stocks below, having bought most quite recently.

The £670m Henderson Smaller Companies Investment Trust (LSE: HSL) is entirely UK-focused. Performance has been market beating, with a five-year annualised return of 18.2%, yet it trades on a near-10% discount to underlying net assets (the value of its portfolio). Fees are tolerable, while its holdings are often left field and interesting. It is likely to maintain its steady record.

In the mid-cap domestic sector the £1bn Old Mutual UK Mid Cap Fund has been a strong performer too, with a five-year annualised return of 16.9%. With markedly different holdings to Henderson Trust, between them they provide a good spread. Research agency Morningstar rates both as "high risk" but I think its definitions are childish.

Some UK bank stocks are simply bargains. Lloyds Bank (LSE: LLOY) is a stand out on a prospective multiple of nine times and yield of 6%. The large fines for various misdemeanours are history, the cost cutting ruthless, and key ratios and reserves at good levels. Barclays (LSE: BARC) is coming under pressure from Sherborne Investors, which is controlled by Edward Bramson, who successfully shook down both the flabby Foreign & Colonial and Electra trusts. He wants the international investment-bank arm cut back I think he's wrong on this, but it is focusing the board mightily on shareholder returns. While the CEO has done a workmanlike job, his blundering internal investigations over whistle blowers means he should probably go. Barclays is still suffering fines and penalties for historic wrongs, but these are about to end, which should turbo-charge profit growth. Trading at 65% of book value and on a forward multiple of nine, it's too cheap.

There are two punts I also like. First the hapless De La Rue (LSE: DLAR), the bank-note design and manufacturing company. It is rightly under fire from activist investor Crystal Amber. But there's a good business underneath poor management who turned down a £9.00 per-share bid in 2011 (it's now £5.30). It's in the crosshairs and I think one of its big three European rivals will snap it up.

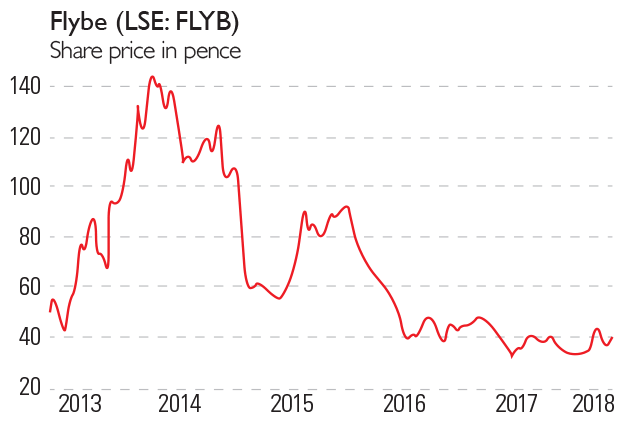

Last, and for the brave, is the small regional airline company Flybe Group (LSE: FLYB). It is struggling with overexpansion but has pruned back and should return to profitability later this year. Recently the Stobart group made a feeble "what if" approach (now withdrawn), but consolidation is rife in the industry and it seems only a matter of time.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jonathan Compton was MD at Bedlam Asset Management and has spent 30 years in fund management, stockbroking and corporate finance.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Governments will sink in a world drowning in debt

Governments will sink in a world drowning in debtCover Story Rising interest rates and soaring inflation will leave many governments with unsustainable debts. Get set for a wave of sovereign defaults, says Jonathan Compton.

-

Why Australia’s luck is set to run out

Why Australia’s luck is set to run outCover Story A low-quality election campaign in Australia has produced a government with no clear strategy. That’s bad news in an increasingly difficult geopolitical environment, says Philip Pilkington

-

Why new technology is the future of the construction industry

Why new technology is the future of the construction industryCover Story The construction industry faces many challenges. New technologies from augmented reality and digitisation to exoskeletons and robotics can help solve them. Matthew Partridge reports.

-

UBI which was once unthinkable is being rolled out around the world. What's going on?

UBI which was once unthinkable is being rolled out around the world. What's going on?Cover Story Universal basic income, the idea that everyone should be paid a liveable income by the state, no strings attached, was once for the birds. Now it seems it’s on the brink of being rolled out, says Stuart Watkins.

-

Inflation is here to stay: it’s time to protect your portfolio

Inflation is here to stay: it’s time to protect your portfolioCover Story Unlike in 2008, widespread money printing and government spending are pushing up prices. Central banks can’t raise interest rates because the world can’t afford it, says John Stepek. Here’s what happens next

-

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?Cover Story Joe Biden’s latest stimulus package threatens to fuel inflation around the globe. What should investors do?

-

What the race for the White House means for your money

What the race for the White House means for your moneyCover Story American voters are about to decide whether Donald Trump or Joe Biden will take the oath of office on 20 January. Matthew Partridge explains how various election scenarios could affect your portfolio.

-

What’s worse: monopoly power or government intervention?

What’s worse: monopoly power or government intervention?Cover Story Politicians of all stripes increasingly agree with Karl Marx on one point – that monopolies are an inevitable consequence of free-market capitalism, and must be broken up. Are they right? Stuart Watkins isn’t so sure.