The charts that matter: yields rise, but so does the US dollar

Bond yields are rising; the dollar is getting stronger; gold is getting weaker. John Stepek looks for clues to the future in the global economy’s most important charts.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

If you missed any of this week's Money Mornings, here are the links you need.

Monday:Has Big Tobacco finally run out of puff?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday:We could be heading for a golden age or a return to the 1970s

Wednesday:Bubble or no, cryptocurrencies aren't going away any time soon

Thursday:What the US housing market reveals about future inflation

Friday:Why you should keep an eye on the strengthening dollar

We missed the podcast this week (I lost my voice yes, yes, very funny, chap at the back there who shouted: "That'd be an improvement!"). We'll be back next week.

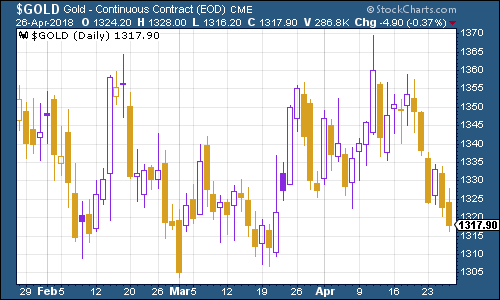

Gold took a decisive knock back down towards the bottom of its trading range this week. The $1,360-an-ounce level remains unbroken. Now everyone is worried that the risk is to the downside.

First, the dollar is getting stronger (partly helped by rising US Treasury yields). Second, the geopolitical picture is that bit less scary, what with North and South Korea shaking hands.

I wrote about gold in this week's issue of MoneyWeek magazine (you can subscribe here). Let me boil it down for you: gold will probably do well if inflation takes off and interest rates don't keep up.

Gold won't do so well if inflation takes off, but interest rates and economic growth take off along with it because that basically means we're all happy and keen to take risks and want to invest in something else.

And if deflation strikes again and we head back into a recession, then gold might not do brilliantly in the first instance, but fear over financial instability and the reactions of central bankers (more money printing) would end up being good for the metal.

So in short if you want to have some sort of diversification in your portfolio against the worst-case outcomes, then you should have some gold.

(Gold: three months)

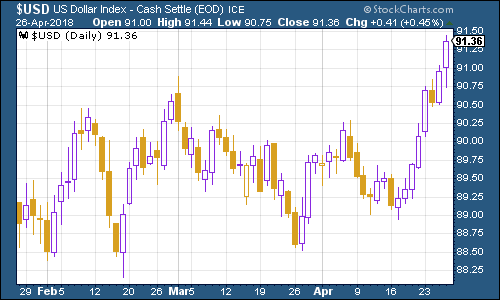

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners was rallying strongly this week as investors decided that a 3% US Treasury yield might be worth having.

(DXY: three months)

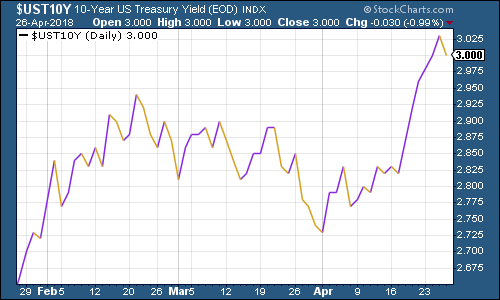

Meanwhile the yield on the ten-year US Treasury bond rose significantly, breaching the 3% mark to much excitement. That's the highest since 2014. And if it goes above 3.05% (not there yet), that'd be a real landmark the highest since 2011.

(Ten-year US Treasury: three months)

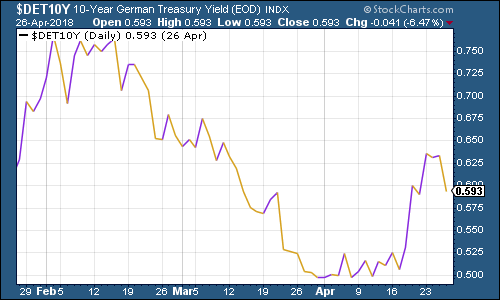

The yield on the ten-year German bund the borrowing cost of Germany's government, which is Europe's "risk-free" rate fell, driving the "spread" (the gap) between US and Germany yields higher. The move came because the European Central Bank's latest meeting seemed to be on the "dovish" side in other words, they may not end quantitative easing as quickly as the market had supposed, which means plenty more printed money to flow into bunds.

(Ten-year bund yield: three months)

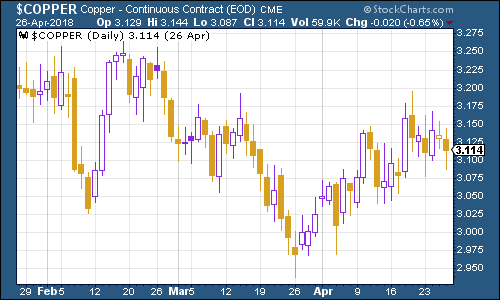

Copper remained relatively strong. Investors still can't quite shake their sense of disbelief over economic growth, and a stronger US dollar is usually a drag on commodity prices.

(Copper: three months)

Bitcoin continues to be popular. It's still well below its December 2017 highs, but I think any honest observer would have to admit that it's also hard to argue that we're picking through the debris of a burst bubble here. The end of a bubble is a lot more final than what we've seen with bitcoin. I wouldn't be surprised if we get another mania phase at some point in the future.

(Bitcoin: ten days)

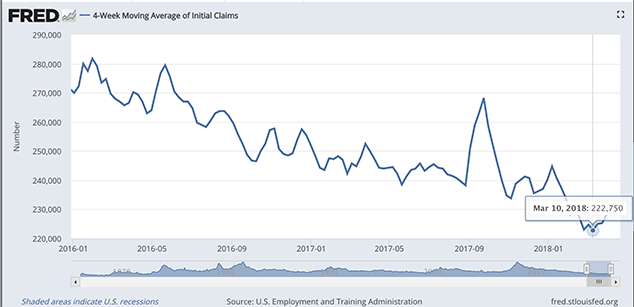

Turning to US employment, the four-week moving average of weekly US jobless claims remained low at 229,250 this week, while weekly claims came in at just 209,000, which is the lowest weekly count since 1969.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later.

As you can see, we're still only just above the most recent trough, and if the weekly claims keep falling, we could well dip below it in the near future.

(Four-week moving average of US jobless claims: since start of 2016)

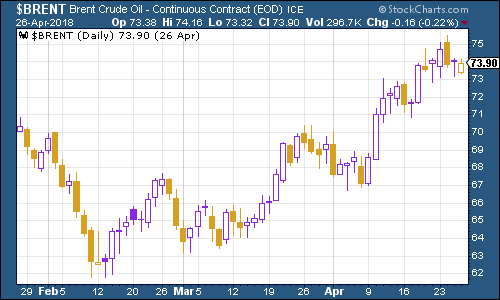

The oil price (as measured by Brent crude, the international/European benchmark) hit a bit of a wall this week as the strengthening US dollar knocked some wind out of its sails. However, the potential for renewed sanctions on Iran are underpinning prices for the time being.

(Brent crude oil: three months)

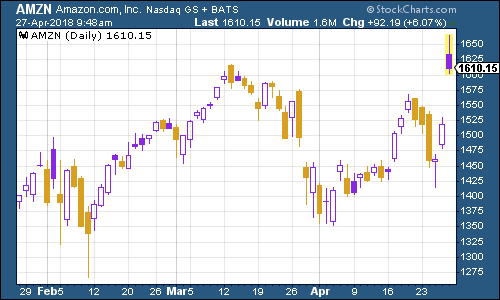

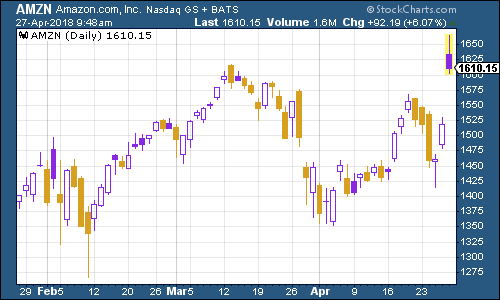

Internet giant Amazon rocketed to above $1,600 a new high this week as results trounced expectations. We've now got one excitable analyst saying that Amazon is set to hit $2,020 a share.

Oh and, talking of inflation, the company is finally raising the price of its Amazon Prime subscription. One theory has always been that Amazon would create a near-dependent audience and then milk it for profits. It'll be interesting to see if a) that price rise sticks and b) if this is the start of the great Amazonian consumer squeeze.

Again in this particular bull market, Amazon is the stock you will not get fired for owning. That means it has an awful lot of support, even in a waning market.

(Amazon: three months)

Tesla slipped back again this week. Investors are losing their nerve ahead of next week's first quarter results, which, as Liam Denning puts it on Bloomberg Gadfly, are "almost certain to be awful". The main focus will be on if and when Tesla will next need to raise more cash from investors.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King