Rhodium: the niche alternative to gold

Bored with gold? Uninspired by silver? Platinum too cheap for your tastes these days? Perhaps, says Chris Carter, you need to find a more intriguing metal – here’s one that fits the bill.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Gold is a long-term store of value. Silver is its rather more capricious little sister. But what about the other precious metals? The platinum-group metals have attracted increasing amounts of attention in recent years. Platinum itself is currently at a low ebb it's used widely in catalytic converters for diesel vehicles, and so has been hammered in the fallout from Volkswagen's emissions-rigging scandal.

An ounce of platinum now costs significantly less than an ounce of gold, a historically rare occurrence. The next best-known platinum-group metal is probably palladium, which has had an excellent run, mostly for the same reasons that platinum has been struggling palladium is used in non-diesel catalytic converters.

However, there's another, much rarer member of the platinum family that you might want to start paying attention to. Rhodium is a "new metal that not many people can have", says Lorena Baird of Baird & Co. Physical rhodium, which Baird sells in bars (an ounce costs around £1,750), "is incredibly popular with investors", she says.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It's also hard to work with. You can write your name on a piece of silver with a hammer. To do the same on rhodium, Baird & Co uses a machine that applies pressure equivalent to the force of two elephants standing on top of you. Yet while rhodium is hard, it is also brittle if you drop it, it breaks. That's why rhodium typically isn't used to make jewellery. However, it is resistant to tarnishing, and so it is used to plate other metals, such as silver.

These are not monetary metals

One thing to remember when you are considering investing in precious metals is the distinction between industrial and monetary metals. Platinum and its fellow metals are not monetary metals they are not typically viewed as reliable stores of value. Instead, they are much more correlated with industrial demand.

As far as rhodium goes, about 80% of the metal is snapped up by the car industry, where as with palladium and platinum it is used in the manufacturing of catalytic converters. Other major areas where rhodium is used are glass-making (due to its resistance to heat), and electronics, where it's employed to make electrical contacts.

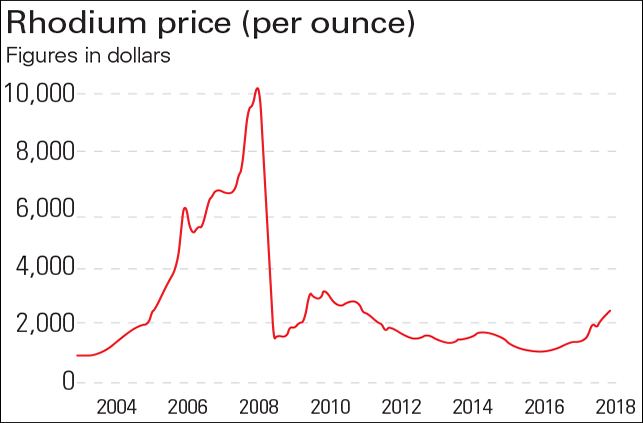

Not that there is a lot of the stuff to go around. Rhodium is found alongside platinum and nickel, and mined production only amounts to about 21 tons a year (compared with about 200 tons for platinum). Over four-fifths of the rhodium supply comes from South Africa, followed by Russia with around 15%. Geopolitical concerns, a burgeoning global economy and the commodities boom helped to make the rhodium price soar rapidly to $10,000 an ounce in 2008 at the height of the commodities boom.

The rhodium boom and bust

Then the financial crisis hit hard. Sales of vehicles crashed and the price of rhodium did likewise, plummeting by 90% before the year had even ended. Today the price per ounce is around $2,110, and in the last 12 months the price has more than doubled. Global car sales have picked up and are projected to soar over the coming decades. So while we can't see rhodium reclaiming its bubbly $10,000 high in the near future, nor is it heading for a huge fall.

Baird & Co, meanwhile, reckons it has found another use for the metal. Earlier on, we said that rhodium was too hard and brittle to make jewellery with. Well, Baird & Co say that they've come up with a way to make it more resistant to shocks. "We are the only company in the world that, if you drop our bar, it bounces back. It's solid," says Baird. "We have developed the technology for rhodium so much that we are the only ones who, at the moment, are making jewellery in rhodium." It's unlikely to set the rhodium price alight but at least you can now wear it.

How to invest

As there is so little rhodium about, the price tends to be volatile. And bear in mind that you may not be able to sell your rhodium in a hurry. It is still quite a niche investment, and just ten years ago there wasn't even a way to track the price via a passive fund. That changed in 2011, when the DB Xtrackers Physical Rhodium ETC (LSE: XRHO) came along. The exchange-traded commodity fund is 100% backed by physical rhodium, and tracks the dollar price of the metal, less a 0.95% management fee. It is up by 112% over the last 12 months.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge