If you'd invested in: Rio Tinto and Tate & Lyle

Rio Tinto, the world’s second-largest mining firm, recently declared a record dividend, while experts expect Tate & Lyle's earnings per share to decline.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If only...

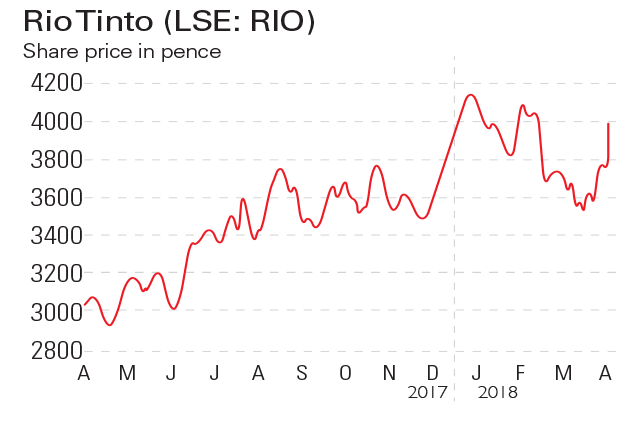

Rio Tinto (LSE: RIO) is the world's second-largest mining firm. In February this year the firm declared a record final dividend of $1.80 per share and unveiled a $1bn share buyback after higher commodity prices lifted full-year profit. Underlying earnings for the year to 31 December jumped 69% to $8.63bn from a year earlier, broadly in line with analysts' estimates of $8.74bn. Earlier this month it also reported a 5% rise in its first-quarter iron-ore shipments and kept its forecast for aluminium production steady, despite new US sanctions on its Russian partner Rusal.

Be glad you didn't buy...

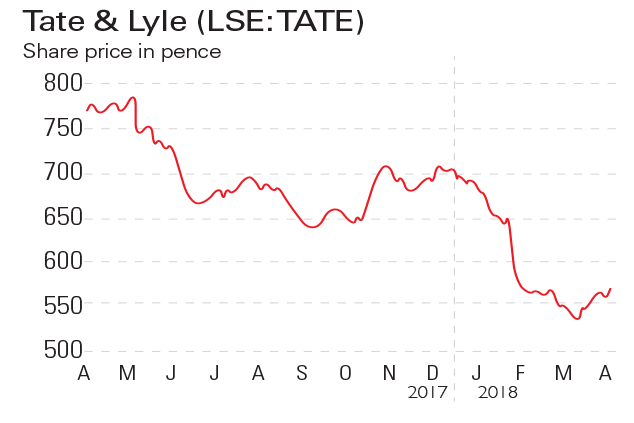

Tate & Lyle (LSE: TATE) produces ingredients for the food, beverage, and agriculture industries. The firm, which sold its sugar-refining business in 2010, has had a few difficult years amid a price war in the sucralose market and posted three profit warnings between 2014 and 2015. In November last year it reported a 26% increase in first-half profits. Sales of new products are now expected to hit $200m in 2020, up from $69m in 2014. Despite this, analysts are expecting the company's earnings per share to decline over the next two years as the tailwind from weaker sterling vanishes.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?