Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

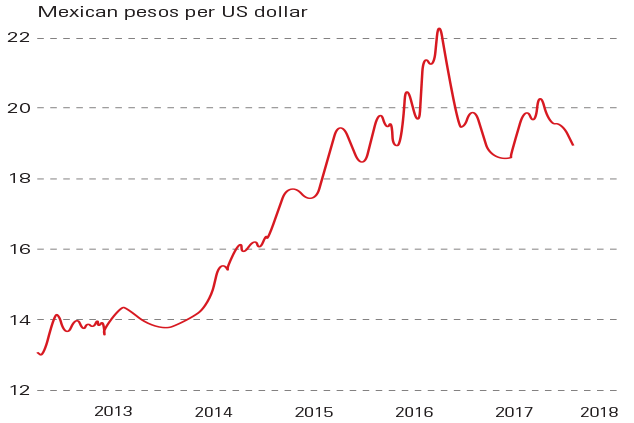

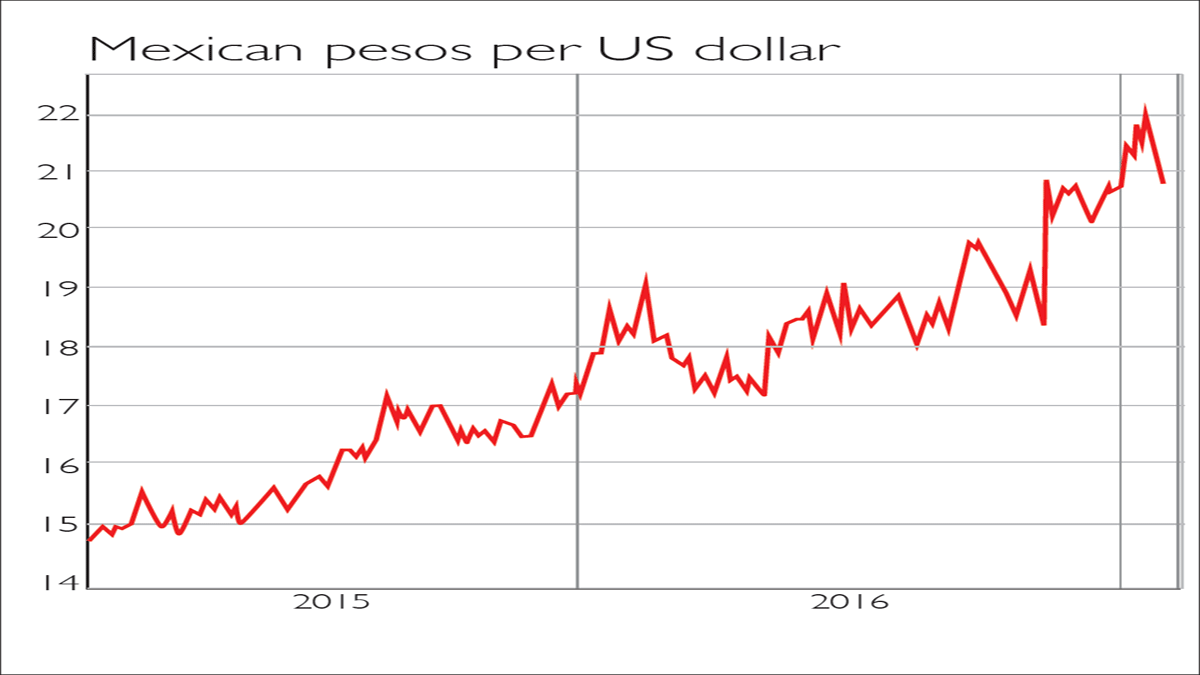

The Mexican peso has gained 8% against the dollar this year. That's "not bad", considering that Donald Trump has threatened to tear up the country's "economic lifeline", the North American Free Trade Agreement, while the likely next president, Andrs Manuel Lpez Obrador, has a reputation as a left-wing populist, says Craig Mellow in Barron's.

Analysts reckon Trump's focus has shifted from Mexico, which accounts for just a tenth of the US trade deficit, to China, which makes up 50% of it. And Obrador, who has surrounded himself with shrewd business people, is not expected to do anything radical in his first year or two. Even if both scenarios pan out, however, most of the optimism appears to be in the price: the peso has already recouped all its post-Trump losses.

Viewpoint

"[EU] trade policy is cumbersomeWithin the EU, Britain has argued strongly for free trade on the economically unassailable grounds that trade barriers raise costs to consumers and protect inefficient industries. Outside the EU, Britain could in principle unilaterally slash or even eliminate tariffs and thereby benefit from the reverse effect, with cheaper import prices. [This] makes theoretical sense but can only be done once. Unilaterally cutting or abolishing tariffs is consistent with WTO rules, provided it applies to every member of the WTO... That would cause hardship and possible closure for significant parts of Britain's economy (notably in agriculture and manufacturing) that would have to compete with an inflow of inexpensive imported goods and produce. It is not politically feasible that any British government would accept such costs."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The Times

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

UK interest rates live: experts expect MPC to hold rates

UK interest rates live: experts expect MPC to hold ratesThe Bank of England’s Monetary Policy Committee (MPC) meets today to decide UK interest rates. The last meeting resulted in a cut, but experts think there is little chance of interest rates falling today.

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension

-

How “support” and “resistance” can help you spot trading opportunities

How “support” and “resistance” can help you spot trading opportunitiesSponsored Technical analysis can help traders manage risk and decide where to enter and exit a trade. One simple form of technical analysis is the concept of “support” and “resistance”. Dominic Frisby explains how you can make it work for you.

-

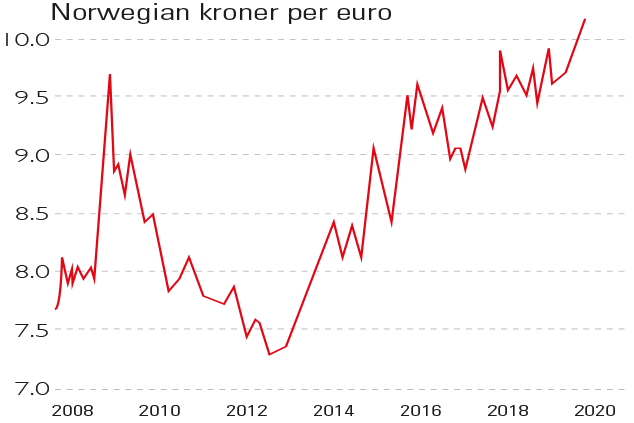

Chart of the week: Norway’s crown has slipped

Chart of the week: Norway’s crown has slippedCharts The Norwegian krone has slipped to a record low of more than ten to the euro.

-

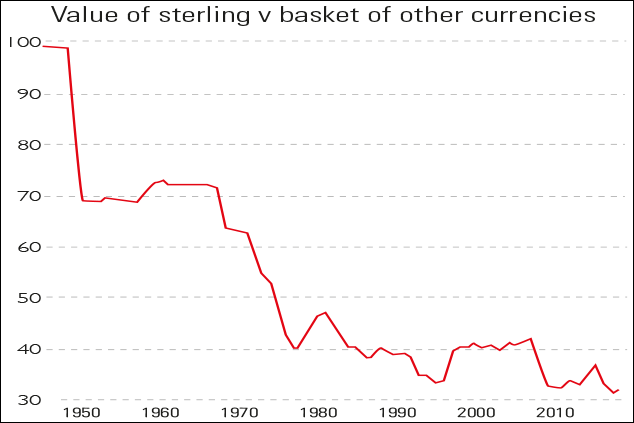

Chart of the week: the pound’s post-war swan dive

Chart of the week: the pound’s post-war swan diveCharts The pound hit a new 20-month low against the dollar this week as Prime Minister Theresa May postponed the Brexit vote.

-

Chart of the week: government splits rock the rand

Chart of the week: government splits rock the randCharts The South African rand slipped by almost 3% last week, its worst five-day showing since August amid worries that President Jacob Zuma may be set to sack his competent and economically literate deputy Cyril Ramaphosa.

-

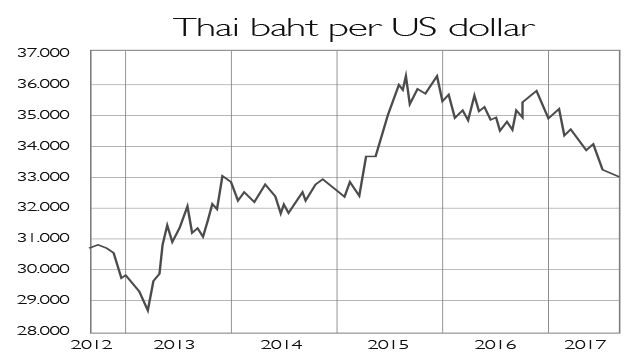

Chart of the week: Thai baht defies gravity

Chart of the week: Thai baht defies gravityCharts Tourism is booming, the current account is in surplus, and the yield on local assets is enticing. No wonder the Thai baht has risen by 8% against the US dollar this year.

-

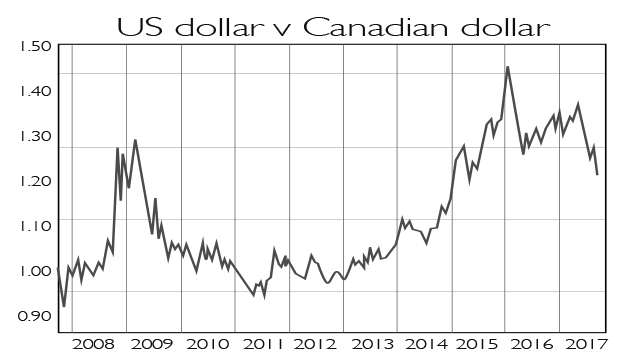

Chart of the week: the loonie takes off

Chart of the week: the loonie takes offCharts The Canadian dollar, nicknamed the loonie, has leapt to a two-year high around $1.21 against its US counterpart as a result of Canada's robust eocnomy and higher interest rates.

-

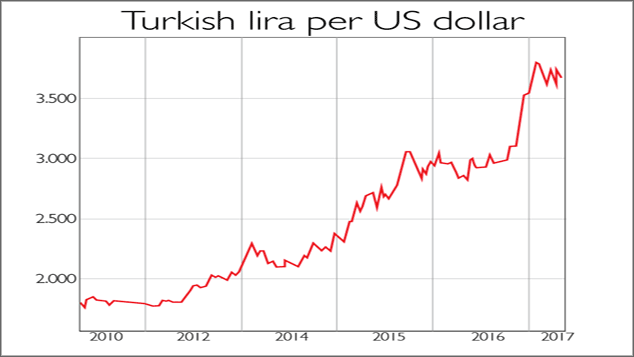

Chart of the week: vote for authoritarianism will crush the Turkish lira

Chart of the week: vote for authoritarianism will crush the Turkish liraCharts The Turkish lira has fallen as Erdogan’s authoritarian tendencies have unsettled foreign investors. It is at near record lows against the US dollar, and is unlikely to rebound any time soon.

-

Chart of the week: a pause in the peso’s decline

Chart of the week: a pause in the peso’s declineCharts The Mexican peso has bounced by around 5% from record lows against the US dollar in the past few days. But it has still lost 12% in a year.