If only you’d invested in: Hiscox

Hiscox is a group of companies that operate in the insurance markets in the UK and Europe. In February it reported reduced profits for 2017.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Hiscox (LSE: HSX) is a group of companies that operate in the insurance markets in the UK and Europe. In February it reported reduced profits for 2017 (down to £30.8m from £354.5m in 2016), which it blamed on the £160m it had reserved for insurance claims in a "historic year for catastrophes".

Earnings per share also dropped to 9.3p from 119.8p. During the same period, gross written premiums rose to £2.55bn, up from £2.4bn the year before, while net premiums earned hit £1.88bn, compared with £1.68bn in 2016. Hiscox also increased its dividend by 5.5%.

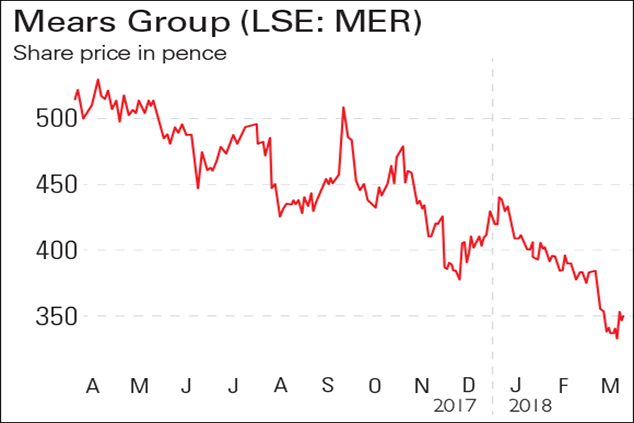

Be glad you didn't buy

Mears Group (LSE: MER) is a social-housing repairs and maintenance service provider. In March it reported a 7% decline in operating profits for 2017, down to £37m, while group revenue decreased 4% to £900m. It blamed this on the fatal fire at Grenfell Tower, which delayed planned work. This also sent housing revenues down 3% to £766m.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Meanwhile, the order book fell to £2.6bn from £3.1bn as Mears had a slow period of securing new contracts. Despite this, and due to positive results at its home-care division, the firm raised its dividend by 3% to 12p per share.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.