Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

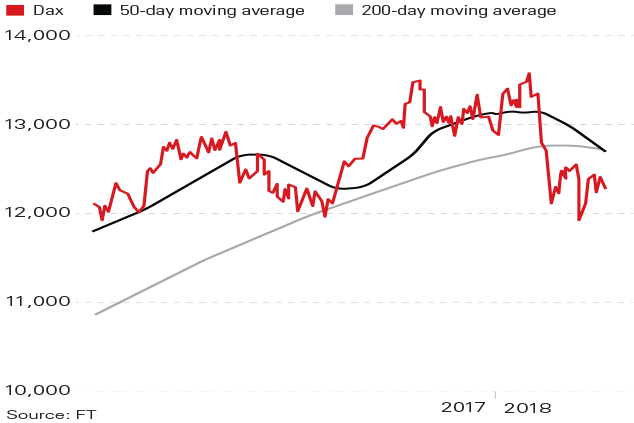

Last week, Germany's benchmark index, the Dax 30, produced a "death cross": a widely watched technical indicator that often heralds further falls. It occurs when the 50-day moving average of a share or index slips below the 200-day moving average.

It is apparently especially worrying when both averages are declining, as is currently the case. In the last decade there have been four death crosses in the Dax, Matthew Maley of Miller Tabak + Co told the Financial Times, "and they were all followed by significant declines".

The fundamentals aren't looking very encouraging either: Germany's heavyweight industrial and car stocks are considered to be vulnerable to further US protectionism.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Viewpoint

"World markets are taking another step to embrace China. Bloomberg will add the country's [government debt and bonds issued by state-backed banks] to the Bloomberg Barclays Global Aggregate index [to] attract foreign investors and encourage more liberalisation [China's] $9trn domestic bond market is the world's third largest after the United States and Japan but most international investors have little exposure The bond index news landed one day after US president Donald Trump announced new tariffs on Chinese imports... aimed at reducing the US trade deficit with China, which hit $375bn in 2017. But money flows vastly exceed those of goods and services, with daily trading in currencies averaging more than $5trn A move that encourages more financial transactions with China offsets Trump's barriers to traditional trade."

Tom Buerkle, Breakingviews

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how