Another US stockmarket domino has toppled

Tech stocks have been propping up the US stockmarket. But the Facebook allegations have triggered a change in sentiment. This could be a major turning point,, says Dominic Frisby.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today, I consider the outlook for big tech.In particular, Facebook.

The "Fang" stocks Facebook, Amazon, Netflix and Google plus the likes of Apple and Nvidia, have almost been propping up the US markets by themselves.But now we have Datagate, can this continue?

I'm no longer long the Nasdaq

Going into the weekend, I was long the Nasdaq my reasoning was technical, not fundamental.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In fact, there are and were many fundamental reasons to be short. Tech stocks are too expensive. The Fang stocks plus Apple now account for a quarter of the value of the Nasdaq. Normally when that much relative wealth is concentrated into so small a space, it ends badly.

And while over 80% of tech stocks are currently above their 50-day moving averages (ie trading at or around new highs), the rest of the US market, financials aside (55% are above their 50 DMAs), is nothing like as healthy. The Nasdaq may have broken to new highs, but both the Dow and S&P 500 did not. They were weaker.

Would tech pull the rest of the market up, as it has done so many times lately? Or would the weight of the underlying weakness eventually pull hitherto impervious tech down?

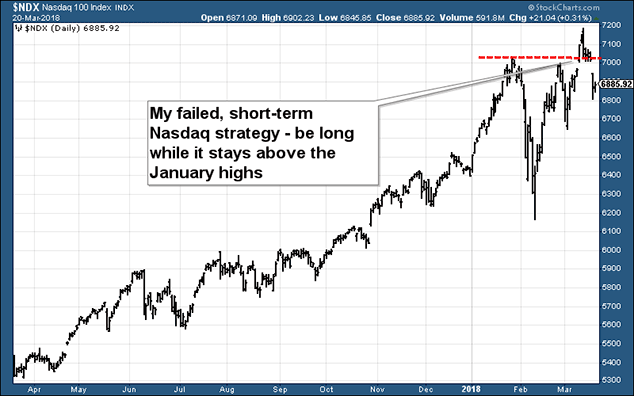

Only time would answer that one. Momentum, sentiment and narrative were still strong. My position was pretty straightforward. As long as the Nasdaq was above 7,000 the old high I would stay long.

But early on Monday morning I started reading about the Cambridge Analytica story in The Guardian. The Guardian has had it in for big tech for some time now, but I could instantly sense that there was more to this than the usual stuff.

The markets seemed to sense it as well. Both Facebook and the Nasdaq were sliding in out-of-hours trading. 7,000 was breached. I was out. In fact, I was more than out. I went short.

If you look at the top right hand corner of that chart the break to new highs above the red dotted line and the break below, leaving a gap on both sides that might be what is known as an "island reversal", which is an extremely bearish and ominous sign.

It's too early to say whether this is the end or not for goodness sake, island reversal or not, the chart above is in an uptrend, anyone can see that but, along with the potentially dodgy island reversal, what appears to have changed is that the anti-big-tech narrative, which has been bubbling under the surface for some time now, suddenly got some traction.

I won't say it erupted, because that's too strong a word. But it seemed to take hold somehow in a way that it hadn't before.

The battle for control of our data

"Whereas land was the raw material of the agricultural age and iron was the raw material of the industrial age," writes US technology policy expert, Alec Ross, in his book Industries of the Future, "data is the raw material of the information age." The stage is being set for the mother of all battles over its ownership and use. (By the way, if you like podcasts, listen to my interview with Alec from 2016. He's now running to be governor of Maryland. In my view, you're looking at a potential future president.)

Twenty years ago digital data had practically no value. The likes of Google and Facebook have effectively created a whole new asset that didn't previously exist. A major issue in the future is going to be: who owns the data? The company that mined it? The company they sold it to? You?

Big tech won't relinquish its control that easily.

On 25 May, the EU's General Data Protection Regulation comes into effect. The regulation means that citizens will own their own data. They are also conferred with "digital rights".

In the battle for who owns this essential raw material, this is a blow against big tech. What's more, there is scope for fines of up to 4% global sales. Sales, not profits. That's some fine!

It's not just Facebook that is coming under fire. At the weekend my dad presented me with an extract from James Bloodworth's new book Hired: Six Months Undercover in Low-Wage Britain, in which he describes the conditions working in an Amazon warehouse.

The book has been getting plenty of exposure and, while not enough to puncture the bubble of big tech, is nevertheless another jab to the face of that organisation in this current onslaught.

It's looking ugly for Facebook

So is this the end of the Nasdaq, and by extension, the US stockmarket's run?

We are all going to carry on using smartphones, watching Netflix, searching Google and buying on Amazon. These habits are entrenched. But there has been a change in sentiment, and with it a change in narrative that means we might not ascribe the future growth to these companies that we previously have. The share prices may be harder hit than "on the ground" operations.

And without big tech, US markets would look a lot weaker than they have done.

But these companies could all quickly recover. About Facebook, however, I am less sure. It is the most damaged.

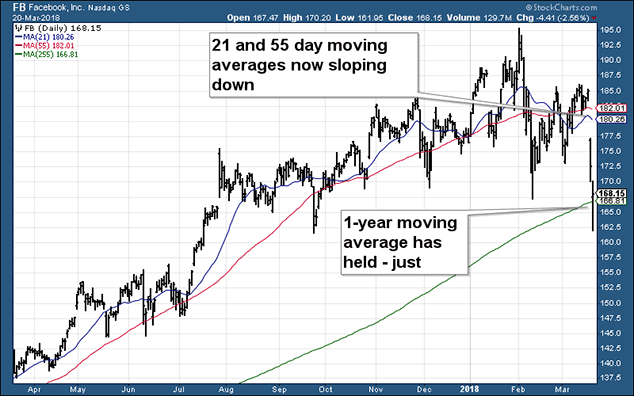

While the Nasdaq made a new high last week, Facebook didn't. It is weaker than its peers. It went through its one-year moving average yesterday (the green line in the chart below), albeit briefly, and closed the day above (some succour for the bulls). However, the shorter-term trends are all pointing down (red and blue lines). You see, I'm resorting to the technicals again. The chart is a bit of mess.

Maybe it has the strength to recover, but I think we can expect some choppiness over the next few weeks as Datagate unfolds. The likely rate rise this week will not help.

For now it seems that one more domino in the US stock market has fallen.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how