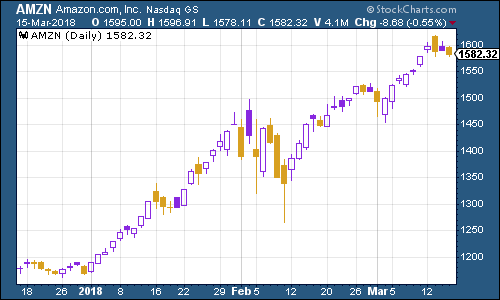

The charts that matter: Amazon’s unstoppable rise

Tech giant Amazon continues its march higher, with seemingly nobody concerned about any downside. John Stepek looks at this, and the rest of the charts that matter this week.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

If you missed any of this week's Money Mornings, here are the links you need.

Monday: Don't be fooled by the weak US wages data inflation is still on the cards

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday:What to expect from Hammond's spring statement: nothing, hopefully

Wednesday:It sounds mad today but the flying taxi could revolutionise our lives

Thursday:Ten years on: how the 2008 crisis spawned our era of populism

Friday: Central bankers won't tell you but they'd like inflation to be higher

And if you missed this week's podcast, listen to it now. Merryn and I ponder where we might be in the lifespan of this bull market, and whether we might just might be in the foothills of a massive surge in productivity. And we discuss Neil Woodford's latest bit of bad luck (that's in danger of becoming a regular feature).

Now on to the charts for this week.

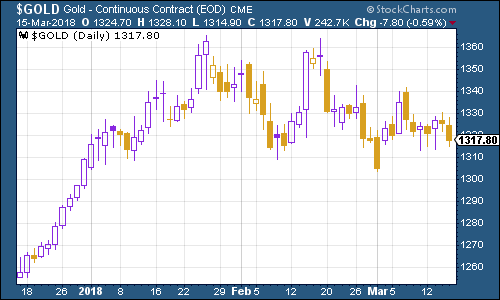

It's been about ten years since gold first surpassed $1,000 an ounce, back when Bear Stearns was bailed out and the financial crisis began in earnest, but gold wasn't in the mood to celebrate it was little changed on last week.

(Gold: three months)

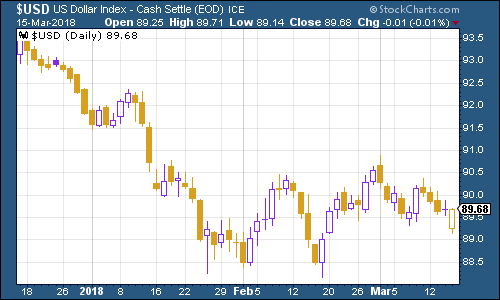

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners was similarly docile this week, as US economic data (on inflation in particular) met expectations and didn't unnerve anyone.

(DXY: three months)

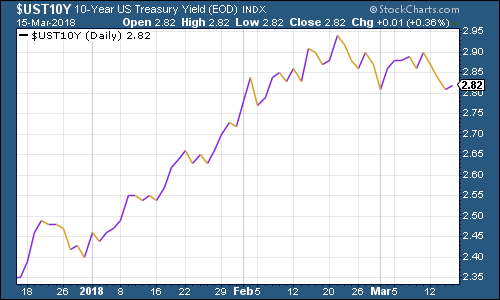

The yield on the ten-year US Treasury bond slipped back too as investors started to wonder if, on the one hand, inflation was more of a scare story than a reality, and on the other, whether the rising threat of a trade war was really good news for growth. Some analysts argue that we've already seen the top for this year, according to Marketwatch.com.

To my mind, this is more a case that human beings let go of old narratives with great reluctance. So far, it's been right for a long time to bet on bond yields going lower than higher. That bias won't change without some serious evidence to the contrary. We'll keep monitoring the inflation data as it comes in.

(Ten-year US Treasury: three months)

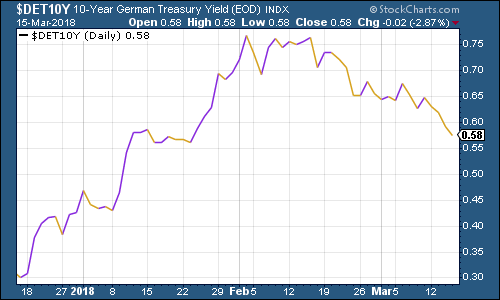

The yield on the ten-year German Bund the borrowing cost of Germany's government, which is Europe's "risk-free" rate has fallen this week. That's at least partly because of concerns about trade wars. As a major exporter, Germany would be one of the most hard-hit by rising protectionism. But in the shorter term it's more to do with dovish noises being made by the European Central Bank, which expects any exit from quantitative easing to be slow.

(Ten-year bund yield: three months)

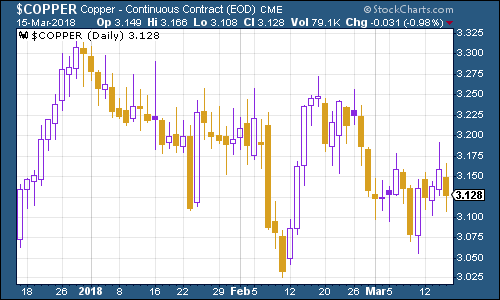

Copper saw relatively small moves this week. Antofagasta, the London-listed Chilean copper mining giant, had a good week as it more than doubled its dividend based on strong copper prices.

(Copper: three months)

Bitcoin had a tough week as Google announced plans to ban adverts for cryptocurrencies. Bloomberg cites one technical analyst as calling for bitcoin to fall to $2,800 a coin soon. You should always take these things with a pinch of salt. But at the same time, in the absence of other obvious measures to value it with, bitcoin (and its fellow cryptocurrencies) are often viewed as being particularly responsive to technical analysis measures, so your guess is as good as mine.

(Bitcoin: ten days)

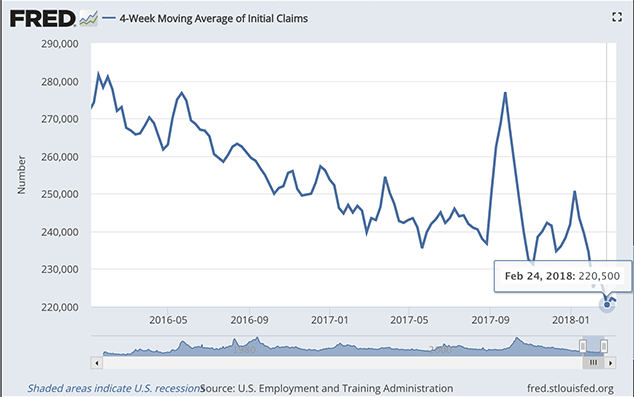

Turning to US employment, the four-week moving average of weekly US jobless claims edged lower to 221,500 this week, as weekly claims came in at 226,000, a small drop from last week and in line with market expectations.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later. As you can see, we're only just above the most recent trough. If Rosenberg is right (and obviously, there are a limited number of instances to go by historically, so this is "finger in the air" stuff) then it looks as though we're likely to keep on pushing that recession out further and further.

(Four-week moving average of US jobless claims: since start of 2016)

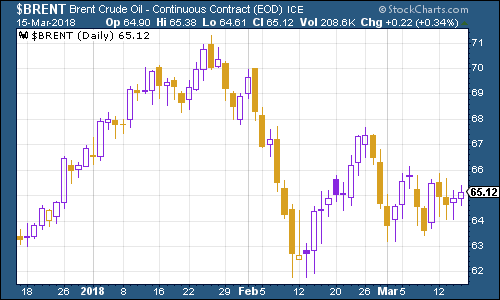

The oil price (as measured by Brent crude, the international/European benchmark) rallied this week, amid forecasts of strong demand growth from the International Energy Agency.

(Brent crude oil: three months)

Internet giant Amazon just won't stop. Analysts are now competing to offer ever more bullish share price targets. Wells Fargo now sees the price going to $1,755 over the next 12 months. That's not the highest target either Jefferies has an $1,850 target now. It's fascinating to watch Amazon is the teflon stock and no one seems to be concerned about any downside.

(Amazon: three months)

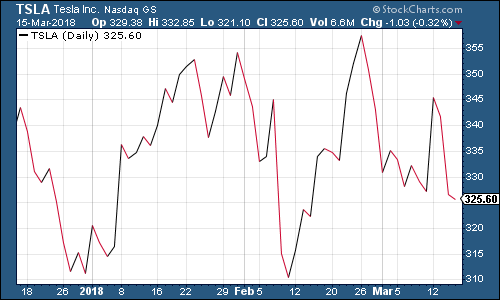

Tesla is still having problems with ramping up production of its Model 3 saloon according to press reports, but that's not particularly fresh news, and Elon Musk's believers aren't going to worry until something more concrete happens.

(Tesla: three months)

I suspect the bigger issue in the longer run is rising competition. Volkswagen has locked in some big deals with battery manufacturers as it plans what Bloomberg calls "an aggressive push" into the electric vehicle market. Volkswagen is, of course, trying to claw its reputation back after the diesel emissions scandal, and becoming the biggest name in electric cars would certainly be one way to do that.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how