The charts that matter: markets bide their time

Donald Trump may be serious about imposing trade restrictions, but you’d struggle to see much sign of that in the charts this week.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

If you missed any of this week's Money Mornings, here are the links you need.

Monday:The golden age of central banking is nearly over. What happens now?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday:Forget Brexit here's the real reason the UK housing market is fragile

Wednesday:It's time to buy silver (and sell gold)

Thursday:Why you can't rely on markets to tell you anything useful

Friday: Searching for a market top? Keep an eye out for mega-deals

And if you missed this week's podcast, you can catch it here. Merryn and I take turns to rant about everything from protectionism to gun control to the deep lack of comprehension about what a pension actually is.

The big news this week was of course, the fact that Donald Trump appears to be serious about imposing trade restrictions. However, you'd struggle to see much sign of that in the charts this week. Markets still appear to be feeling a sense of paralysis as to which way the wind is turning. I'm sticking with my inflation view though whether it will be "good" inflation or "bad" stagflation is a trickier call (the latter is far more likely if we get serious protectionism kicking in).

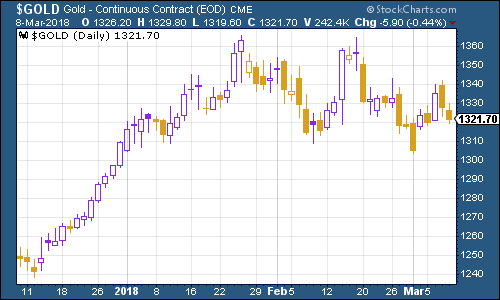

Gold continued to meander as markets moved from wondering whether to worry about protectionism, or whether everything was going to be just fine. Hang on to it, just in case.

(Gold: three months)

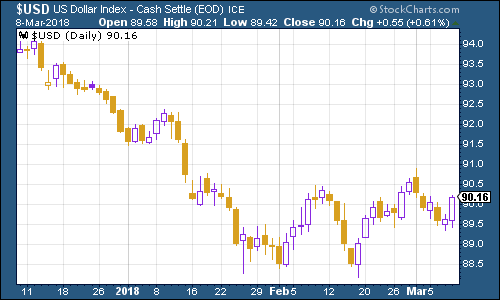

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners was flat on the week.

(DXY: three months)

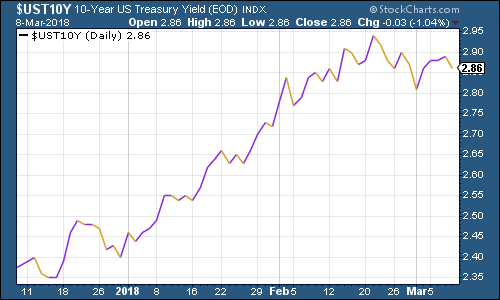

Meanwhile the yield on the ten-year US Treasury bond picked up again from last week. Whatever else investors are feeling, they don't currently see US Treasuries as the first-call "safe haven".

(Ten-year US Treasury: three months)

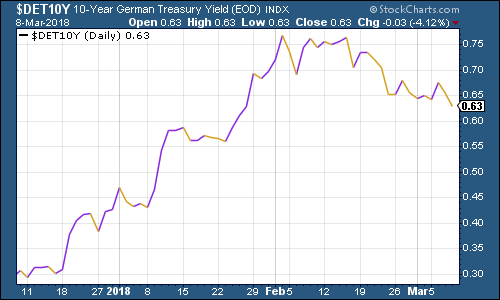

The yield on the ten-year German Bund the borrowing cost of Germany's government, which is Europe's "risk-free" rate dipped. This week, the country finally got a government. Meanwhile, Mario Draghi at the European Central Bank started to flag up the end of eurozone quantitative easing.

(Ten-year bund yield: three months)

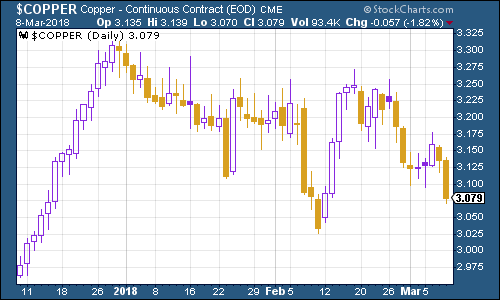

Copper continued to fall as concerns about Chinese demand continued.

(Copper: three months)

Bitcoin, ever the contrary investment, had a rather more exciting week than anything else in the charts this week. Having made a decent comeback in the past month or so, it suddenly wilted halfway through the week. Central bankers are making noises about regulation again, particularly in Japan. Meanwhile, there's a big overhang of bitcoin waiting to come onto the market, as the bankruptcy trustee at Mt Gox (a crypto-exchange that went bust a while ago) sells some of its bitcoins to repay creditors.

(Bitcoin: ten days)

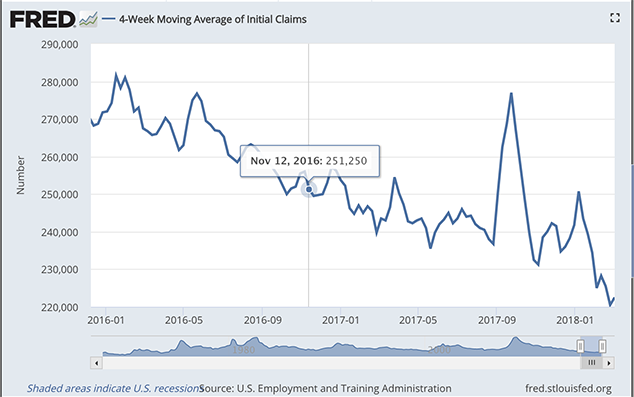

Turning to US employment, the four-week moving average of weekly US jobless claims edged up to 222,500 this week, as weekly claims came in at 231,500, rebounding from last week's near-50-year low.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later. We keep making new troughs, and pushing that recession out further and further.

(Four-week moving average of US jobless claims: since start of 2016)

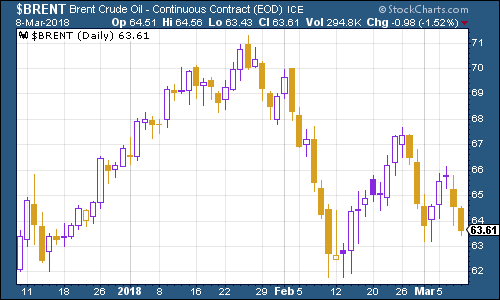

The oil price (as measured by Brent crude, the international/European benchmark) was little changed this week.

(Brent crude oil: three months)

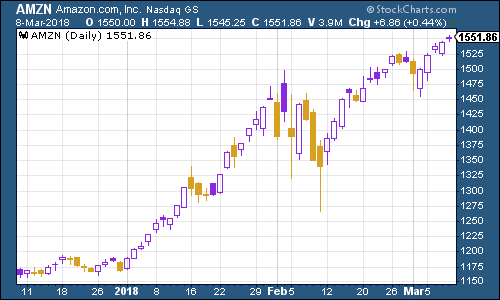

Meanwhile internet giant Amazon continued to sail higher. As I keep saying, if you're a fund manager, you won't get fired for owning Amazon. In this cycle, it's the ultimate defence against career risk.

(Amazon: three months)

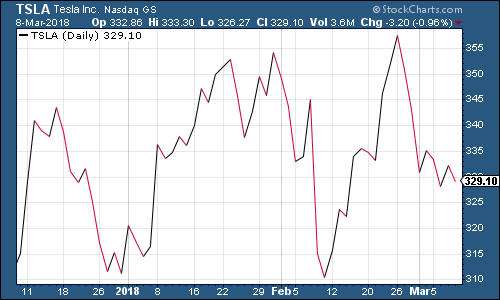

Tesla was little changed.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton