It’s time to buy silver (and sell gold)

Over the years, silver has been something of a disappointment to investors. But Dominic Frisby is bullish. Here, he explains why you should sell your gold, and buy silver instead.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

For those of you with busy schedules who like to see arguments made in 280 characters or less, let me come straight to the point: the time has come to sell your gold and buy silver.

Got that?

Right. Now, those of you who are interested to know why I would make such an assertion, read on.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In an ideal world, gold would cost 15 times as much as silver

The gold-silver ratio measures how many ounces of silver it takes to buy an ounce of gold. If the ratio is at, say, 75, then gold is 75 times the price of silver and it would take 75 ounces of silver to buy an ounce of gold.

Geologists seem to agree that there is somewhere around 15 times more silver in the Earth's crust than gold. Gold is therefore 15 times rarer.

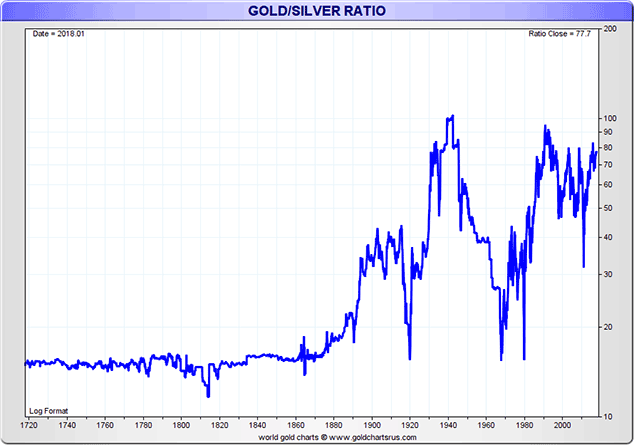

In theory, therefore, the gold-silver ratio should stand at 15 gold should be 15 times the price of silver. And until the 20th century, that was mostly the case. Indeed, there are many examples of nations which operated under a bi-metallic standard the USA until 1875 being perhaps the most famous where the exchange rate between the two metals was 15, more or less.

However, in the 20th century, as money and metal went their separate ways, that ratio of 15 has become an ever-more distant memory. One day it will get there again, the most ardent of silver bugs will tell you.

And on one day in 1980, it did on 18 January 1980, silver went to $50 as the infamous Hunt Brothers attempted to corner the market.

But since then the closest it has been was 30, in April 2011, when silver touched $50.

Here, courtesy of our man in Australia, gold and silver data hound Nick Laird of goldchartsrus.com, is the gold-silver ratio since 1720.

You can see how the ratio was constant around 15 until the late 1800s, after which it became a volatile beast, climbing as high as 100 (in World War II) before coming back down to earth at 15, then repeating.

Even today, with gold at $1,320, at a ratio of 15, silver should be $88. It isn't. It is $16.

Given silver's historical relationship with money and the flaws in the fiat money system, many including your author at one stage, until he grew cynical thought that silver would "do a bitcoin". But it didn't.

Then there are all the industrial uses, particularly in electrics. Many thought silver would "do a lithium", or a cobalt, or a uranium.

It didn't. It flirted with such notions in 2011, but $50 proved the cap.

Silver is like a friend's errant younger sibling oodles of potential, but never quite delivering on its promise, beyond the occasional glimpse of greatness.

The bottom line is this: for all the beauty of silver, and for all its potential as an investment, an industrial metal and a precious metal, the reality is that since it lost its monetary role, it has never delivered on its potential for more than a few days in market extremis. When it was official money, that backing meant its value held; without it, the value does not seem to sustain.

Silver might be a constant disappointment but it's time to buy

But now, having properly put the boot in, I am going to tell you to buy silver. Not only that, I am going to suggest that you should even sell gold which has been a much more reliable store of wealth to buy it. My reasoning is simple: the gold-silver ratio has gone above 80.

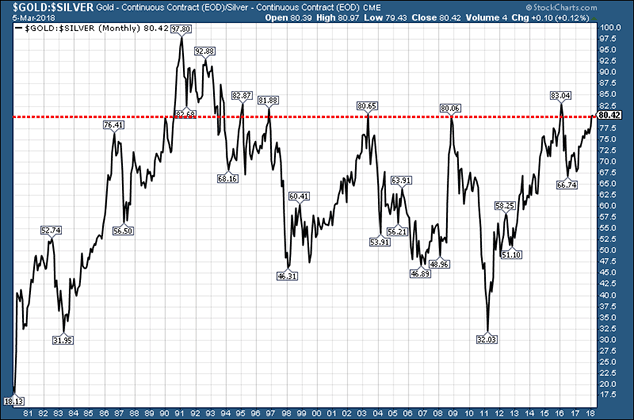

This chart shows the gold-silver ratio since 1980. You can see that, on every occasion since around 1994 that the ratio has gone to 80, or just above (where I have drawn the dotted red line), the ratio has soon fallen.

It happened in 2016, in 2009, in 2003, in 1997 and in 1995.

The risk is that it carries on going up to the 100 area, just as it did in 1991. Given that the ratio has only done this twice in all recorded history once in 1991 and once in 1941, during a world war I suggest that the probability of this happening is low. And, if it does go that high, it will come back again within a year or three.

The likelihood is that the ratio will come towards the lower end of the "normal range" in the high 40s or lows 50s, at which point you switch out of silver and back into gold. But then the gold you sold for 80 ounces of silver, you are now buying back for around 50 ounces, so you're ending up with a lot more of it.

The blue sky or BS argument is that silver goes back to 30, or even its historically and geologically-normal ratio of 15. One day it will. But don't hold your breath.

More reasons to be bullish on silver

In the meantime, there is another development that adds some fuel to the bullish silver fire. That is the latest positions of the traders on the Chicago futures exchanges.

These traders are bracketed into three groups the large speculators, the small speculators and the commercials. The commercials and, to a lesser extent the small speculators, are considered the smart money, while the large specs are considered the least wise of the three.

Nothing is so simple, of course. Nevertheless, the large specs (the uninformed money) are now net short for the first time since 2003. Back then silver was $5.

What's more, every time since then that the large speculators' net position has moved close to the zero line, that has proved to be a buying point for silver. All in all this is a very bullish development, given that the silver price is largely set in the futures markets.

It's worth noting that the equivalent position for gold is not nearly so bullish. To be uber excited, you would want to see them both in alignment. Shucks. You can't have everything.

There are all sorts of ways to buy silver. You can buy bullion from a dealer such as Sharps Pixley (although this can be VAT-able); you can buy an ETF from your broker; you can go to one of the online dealers who store it for you (GoldCore, Goldmoney, BullionVault); you can use a leveraged product; or you can buy one the silver mining companies.

I'll re-visit this ratio in six months or so to see how it's panning out.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?