Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

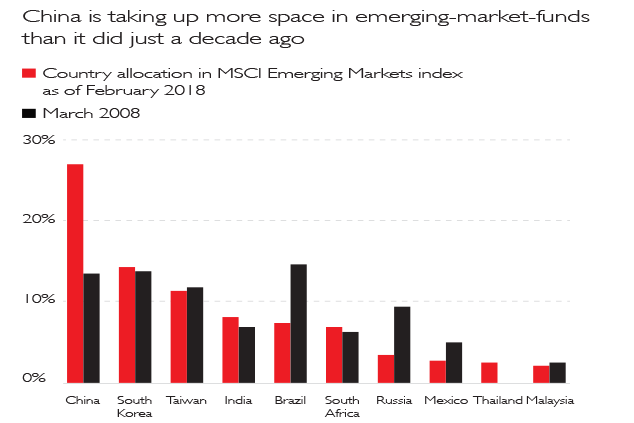

In 2008 Chinese companies comprised 9% of the key benchmark for emerging-market funds, the MSCI Emerging Markets index, says Nir Kaissar on Bloomberg Gadfly. Today, its companies make up 27% of the index. And no wonder, when the International Monetary Fund expects China's economy to surpass America's in a decade. Nonetheless, China doesn't set the tone for other markets. There is little correlation between Chinese stocks' performance and those of other developing-country indices; the same goes for links between China and developed markets. So any jitters over creeping authoritarianism shouldn't hamper other major equity indices. "What happens in China is likely to stay in China."

Viewpoint

"Will the Beast from the East and Storm Emma have an impact on the economy?... Weather-related disruption usually has a minimal effect. There are exceptions. The first sign Britain's post-crisis recovery would be a long... haul came in early 2011, when the ONS released [GDP] data for the fourth quarter of 2010. It showed a 0.5% fall on the quarter, with the ONS attributing the drop to weather effects. December 2010 had been snowy The figures did not prevent three members of the Bank of England's monetary policy committee (MPC) voting to raise interest rates in February 2011. Some who were on the [MPC] at the time say there would have been a majority for an increase if not for the drop in GDP. Thus did snow intervene in monetary policy, delaying the start of the normalisation process for interest rates by many years The ONS now thinks that GDP rose by 0.1% in the key quarter, rather than falling 0.5%."

David Smith, The Sunday Times

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how