Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

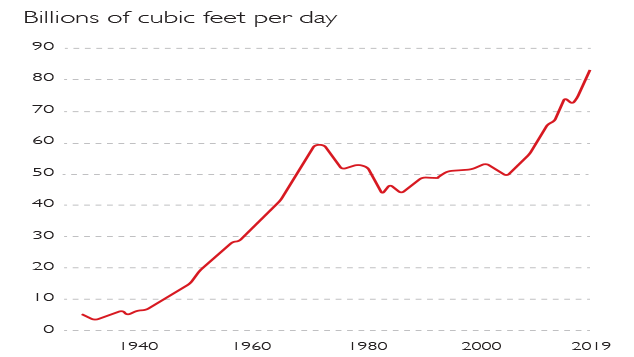

US natural-gas production will hit a record in 2018, just as oil will, says Liam Denning on Bloomberg Gadfly. Output should exceed 80 billion cubic feet per day, marking a 60% increase since 2005. The biggest annual jump in US production on record will take place this year, with another 7 billion cubic feet anticipated (equivalent to the annual output of Turkmenistan, a key gas exporter). Pipelines capable of transporting seven billion cubic feet from the "prolific" Appalachian region come into operation in 2018. Thanks to shale, the US a gas importer in the 2000s is now an exporter.

Viewpoint

"[Does] anyone seriously think that the railways were better run in the halcyon days of state ownership?They were starved of investment, having to plead for cash from the same pot that funds schools, hospitals, the armed forces and much else. In the five years that preceded privatisation there was virtually no investment in new trains. Since privatisation, more than £10bn has been spent on new rolling stock The railways are also a good deal safer today for passengers and workers alike, and they are also a great deal more popular now than before. Passenger journeys have doubled to 1.6 billion per year in the 18 years since privatisation despite the ever-rising fares."

Michael Harrison, Evening Standard

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how