Why Abenomics makes Japan the market to buy now

Most investors are behind the curve on Japan. They’re missing a trick, says Merryn Somerset Webb – Shinzo Abe’s reforms are breaking the “iron coffin lid” and bargains abound.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Most investors are behind the curve on Japan. They're missing a trick, says Merryn Somerset Webb Shinzo Abe's reforms are breaking the "iron coffin lid" and bargains abound.

In Japan in October I noticed something at a pop-up farmers' market in Tokyo that I had hardly ever seen before. Something you expect to see all over the place in every other major city in the world, but something oddly out of place in the Japanese capital: mothers with two small children one in a pram or in hand, and one in a sling. The Japanese fertility rate has been the lowest in the world for some time now, and it is firmly accepted conventional wisdom that this will continue to be the case and that this represents a crisis (it is "terrifying and unprecedented", says Business Insider, for example). It is certainly (as far as we know) historically unprecedented. But here's the key thing about it and the point that Tokyo's newly fraught mothers brought home to me around the goat pens (poor goats): it isn't a static situation.

As it happens Japan's fertility rate is higher than, or on a par with those of Germany, Hong Kong, Singapore, Italy, Taiwan and Poland (among others) and is also one of the very few that is rising. The average rate came to 1.35 in 2012 but 1.44 last year. This is fascinating stuff anthropologically, of course but it should also be a reminder that the long-term, dug-in, consensus views on things aren't always the correct ones, and that nowhere is this more true than when it comes to Japan.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It's time to change the record on Japan

Global investors are chronically underinvested here Japan might be the third-largest economy in the world, but UK investors have only 3.7% of their equity holdings in its stockmarket presumably because they are looking at it only in their rear-view mirror. In that mirror they see a country mired in deflation and persistent mild depression; one that has lost its exporting mojo and innovative edge to Asia; one in which entrepreneurs are horribly constrained by a nasty mix of tradition and regulation; and one in which wage rises, and hence positive inflation, can never take hold. They see an employment market full of insecure and part-time jobs (in the foreign investor's mind, pretty much everyone in Japan has been let go from a car-parts company and works in a convenience store) and one that wouldn't allow immigration even if there was suddenly a huge demand for full-time workers.

And, of course, they see a stockmarket that somehow manages to be simultaneously 40% off its highs, yet also expensive, and which seems to have no mind of its own: the rear-view mirror makes it clear over and over again that the Japanese market moves when the yen moves and that is that. You can't make money in it without hedging the currency something that makes it just too much of a bore to be bothered with.

All this was true. Almost none of it is anymore. On the same trip to Japan, I attended a lot of meetings with a lot of different companies. Some were fabulous. Some were very dull. But they were all different from the meetings I attended back in the days when I was a broker in Tokyo in several important ways. First, no one mentioned the economy. No one. Instead of the endless head-shaking and teeth-sucking about how awful things are that I was once used to, the macro-economic environment was simply ignored. Why? Because it's going just fine. The longest expansion since World War II (seven consecutive quarters) means that the thing occupying minds is no longer recession, potential depression or deflation. The OECD, the rich country think tank, estimates 1.5% growth from Japan in 2017, up from 1%, and expects (for what it's worth) 1.2% for 2018.

Note too that since 2012 GDP growth per head (the number that really matters) has been consistent with that of most other OECD members. Last year was Japan's best year for exports since the financial crisis: they are now at a record in volume terms, with exports to Asia at an all-time high. Confidence levels at most types and sizes of firm are good; there is very little spare capacity left in the economy and some firms are even beginning to add capacity. Companies are increasingly internationally minded (Toyota's local revenues are down to about 10% of the total, for example). Government policy, managed by an exceptionally stable government (Prime Minister Shinzo Abe won a super majority in last year's election), is geared towards deregulation. And the start-up scene is obviously exciting, with entrepreneurs finding fertile ground for their ideas: in a country full of the risk-averse and old, one fintech founder told me, "there is huge opportunity for the young and entrepreneurial". The lost decades seem very far away indeed.

There aren't enough staff to go round

What was mentioned, over and over again, in my meetings, however, was the labour shortage.We heard of shortages of delivery drivers ("Uber drivers are getting rich!", said the CEO of one delivery firm); shortages of engineers; and shortages of gaming developers. Someone pointed me to the size of the working-age population in Aichi Prefecture (home of Toyota). It's currently around two million. But on current trends, it will be down to 1.5 million in 30 years' time. Employers told me of offering housing allowances, stock options and long-term incentives to hang on to employees and everyone agreed that, with 1.5 jobs on offer for every applicant, wages must rise.

This is all easily painted as a bad thing. But it is almost entirely a good thing. Already there has been a clear shift in the way firms are behaving: they have been moving employees from unstable temporary contracts to permanent contracts. Full-time employment is also rising fast: up 3.2% in the year to last November. And firms are looking abroad. Another thing that anyone who arrives in Japan with the impression that worker immigrants aren't welcome will notice is that in fact they're very welcome, and not, as Jonathan Allum points out in The Blah, just as low-paid, part-time workers. As of last October there were 1.3 million foreign employees in Japan that's 2% of the working population, up 18% in a year and 87% since 2012. In total, foreigners made up nearly half of the 0.7% rise in Japan's workforce last year. About 20% of them are part of the Technical Intern Training Programme (a smart-sounding name for a scheme that allows in low-skilled workers), but, thanks in part to the fact that you can now (since last April) apply to be a permanent resident in Japan after as little as one year of living there (it was ten years previously), permanent residents make up the largest share of foreign workers.

This is a huge change for Japan and a trend likely to continue: the Japanese might not reckon it is possible to become Japanese however long you live in their country, but they aren't as bothered by foreigners as they used to be and their bosses clearly grasp that until robots really can do everything (not long now...) foreign labour is essential. Research group Capital Economics points to a 2016 survey by the Japanese Institute for Labour Policy and Training that tells us that "only 20% would feel uneasy about working alongside foreigners". The (I think correct) conclusion: "the number of foreign workers should continue rising rapidly, providing some relief for employers and allowing the economy to grow faster than would otherwise be possible". In the meantime the labour shortage should also be a recipe for more automation (it is robots that will save Japan and give the rest of us a demographic road map along the way), for better returns to workers, and for high productivity where Japan has significant room for improvement. Good news all round surely.

The drive to push inflation higher

So what about wages? One of the things that has been maddening Japanese policymakers has long been their inability to get inflation up, however bonkers-looking the Bank of Japan makes its monetary policy. There has been quantitative and qualitative easing (QE); negative rates on bank reserves; and a slightly desperate-sounding commitment to continue to buy assets until inflation "exceeds the price stability target of 2% and stays above the target in a stable manner". That's something even the FT's Martin Wolf (usually keen on QE) says is a "commitment to future irresponsibility". So why doesn't it seem to be working? Why aren't the Japanese getting out there and spending money?

The answer is probably in part down to a time lag. Hourly wages really have been rising in Japan's three biggest cities since 2013; incomes are rising across the board now; and those wage rises are beginning to push up wider prices. Asahi recently raised beer prices on the basis that distribution prices are rising, for example. The long-term deflation-anchored mindset of the Japanese might also finally be beginning to shift. A mere 10% or so of the population still think that prices will be lower in future than they are now (although not many yet believe they will be higher, despite headline inflation now running at a full 1%).

Abe pulls a Trump

But whatever it is, Japan's deregulating and reforming prime minister Abe would like things to move a little faster. So he's doing a Trump. The thing all Japan watchers should have their eye on, says Christopher Wood of CLSA in Greed & Fear, is Abe's plan to offer tax incentives to firms in exchange for putting in place significant capital expenditure plans (much needed, given the age of much of Japan's machinery see the point above on productivity) and granting 3% pay rises to employees. This, says Wood, could easily gain significant traction and be a "bigger deal than US tax reform" as the hikes then become an effective obligation and then "prove a catalyst for a change in Japanese consumer psychology". In other words, if it works, it could get Japan spending, stimulate economic growth, embed a little inflation and keep the current momentum behind corporate earnings going. It's not the Japan you thought you knew is it?

There's more. Corporate governance improvements are continuing and firms are increasingly focusing on shareholders' demands. The recent spate of scandals over product quality (at Kobe Steel, Toray, Mitsubishi, etc, etc) can be seen in a bad light (scandals!) or in a good light (finally whistleblowers feel able to come forward!). And possibly best of all from a MoneyWeek reader's point of view, Japanese equities are still trading at perfectly reasonable valuations. Price-to-earnings ratios average out at about 14 times; price-to-book ratios at 1.3 times; and dividend yields are now about 2% up about 30% in the last year. That's a huge leap for Japan, where companies have long hoarded cash rather than pay it out in either wages or dividends.

Finally, it is worth noting that with all this behind it, the Japanese market has at last broken through what was known as its "iron coffin lid" the 1,750-1,800 level on the Topix index, something it hasn't managed to do since Japan's great stockmarket crash. We've been recommending that investors hold Japan in their portfolios for a long time now. If you still aren't, then now really might be the time to move a little money out of the markets where all good things are priced in (and might not happen) and into this one, where they aren't. See the box below for some interesting fund options.

The Japanese funds to buy now

There might not be much global interest in Japanese equities, but there is no shortage of funds for those who are interested to choose from. The best-performing of the investment trusts are both in the Baillie Gifford stable the Japan Trust (LSE: BGFD) and Baillie Gifford Shin Nippon (LSE: BGS) (of which I am a non-executive director). Shin Nippon is the number-one favourite of The Daily Telegraph columnist Ian Cowie.

However, you might also look to the Fidelity Japan Smaller Companies Fund (top quartile ranked over every period of the last ten years), or perhaps the T Rowe Price Japanese Equity Fund, which has a mandate to invest in any size of company but has a current bias towards smaller ones. Also of interest is the Atlantis Japan Growth Fund (LSE: AJG), a favourite fund of investment trusts manager Nick Greenwood (see our previous interview with him on the MoneyWeek website). It has lagged some of the other Japan funds over the last three and five years, but possibly thanks to a change of manager has done well over the last year and trades on a slightly larger discount than most of the other trusts (currently 8%).

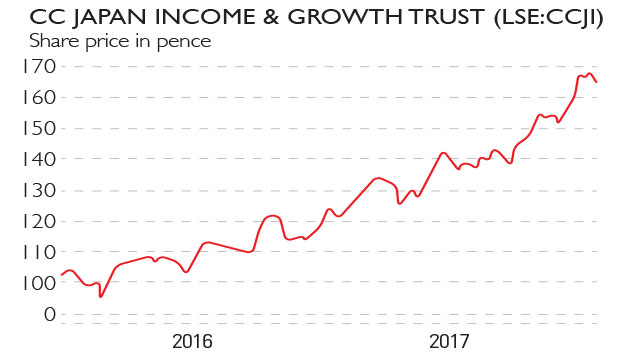

For another take on value in Japan and exposure to some of the names you might know (Toyota, Honda, Mitsubishi Estate), look at the GLG Japan CoreAlpha fund, which tends to focus on the large and medium-sized value companies its managers reckon outperform in Japan the majority of the time. Alternatively, if you want to take full advantage of the new fashion for paying out dividends in Japan, try the CC Japan Growth and Income Trust (LSE: CCJI).

Finally, for a cheap index fund that will take all of the decisions about what kind of companies are best to hold right out of your hands, go for a tracker fund: the Fidelity Index Japan Fund tracks the MSCI Japan Index and comes with an annual fee of 0.1%.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Governments will sink in a world drowning in debt

Governments will sink in a world drowning in debtCover Story Rising interest rates and soaring inflation will leave many governments with unsustainable debts. Get set for a wave of sovereign defaults, says Jonathan Compton.

-

Why Australia’s luck is set to run out

Why Australia’s luck is set to run outCover Story A low-quality election campaign in Australia has produced a government with no clear strategy. That’s bad news in an increasingly difficult geopolitical environment, says Philip Pilkington

-

Why new technology is the future of the construction industry

Why new technology is the future of the construction industryCover Story The construction industry faces many challenges. New technologies from augmented reality and digitisation to exoskeletons and robotics can help solve them. Matthew Partridge reports.

-

UBI which was once unthinkable is being rolled out around the world. What's going on?

UBI which was once unthinkable is being rolled out around the world. What's going on?Cover Story Universal basic income, the idea that everyone should be paid a liveable income by the state, no strings attached, was once for the birds. Now it seems it’s on the brink of being rolled out, says Stuart Watkins.

-

Inflation is here to stay: it’s time to protect your portfolio

Inflation is here to stay: it’s time to protect your portfolioCover Story Unlike in 2008, widespread money printing and government spending are pushing up prices. Central banks can’t raise interest rates because the world can’t afford it, says John Stepek. Here’s what happens next

-

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?Cover Story Joe Biden’s latest stimulus package threatens to fuel inflation around the globe. What should investors do?

-

What the race for the White House means for your money

What the race for the White House means for your moneyCover Story American voters are about to decide whether Donald Trump or Joe Biden will take the oath of office on 20 January. Matthew Partridge explains how various election scenarios could affect your portfolio.

-

What’s worse: monopoly power or government intervention?

What’s worse: monopoly power or government intervention?Cover Story Politicians of all stripes increasingly agree with Karl Marx on one point – that monopolies are an inevitable consequence of free-market capitalism, and must be broken up. Are they right? Stuart Watkins isn’t so sure.