The charts that matter: it’s all about the US dollar this week

The US dollar is near its lowest level since 2014. John Stepek looks to the ten charts that matter to find out how that could affect the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

If you missed any of this week's Money Mornings, here are the links you need.

Monday: How passive funds could save shareholder capitalism

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday: Now that the bond bull market is over, what comes next?

Wednesday: The new bull market in sterling is just beginning

Thursday: Is this a turning point in gold's fortunes?

Friday: Here's why the US dollar is weak it's a sign of a global bull market

This week's podcast will be out on Monday (we're experimenting with some tweaks to the format). If you haven't already tried the podcast, you can hear last week's here.

Let's go straight to the charts this week.

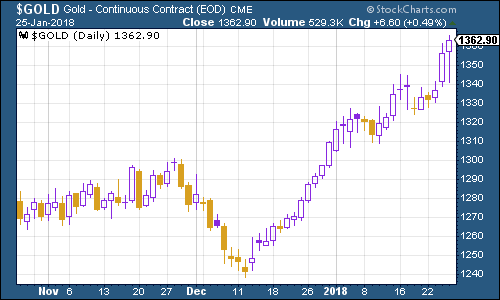

Gold has advanced strongly this week as the US dollar has tanked. Careless words from the US Treasury Secretary didn't help but more generally concerns about inflation are nudging higher up the agenda and that tends to be good for gold.

(Gold: three months)

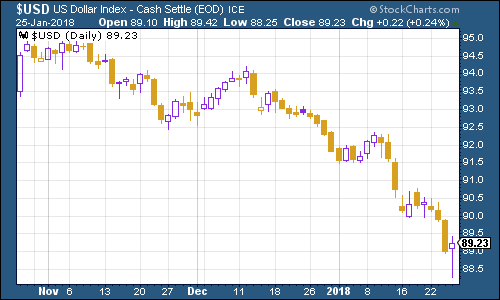

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners fell sharply. It's now near its lowest level since 2014. European Central Bank boss Mario Draghi's apparent insouciance about the strengthening euro didn't help.

(DXY: three months)

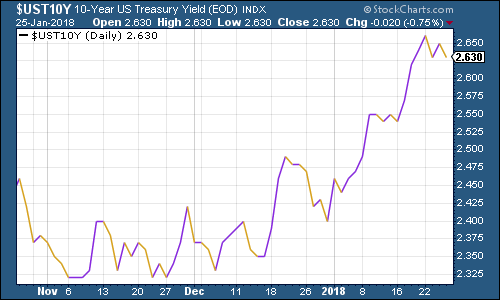

The yield on the ten-year US Treasury bond is still hovering around the 2.63% mark. That means it's hanging onto the "bear market" territory line in the sand cited by various bond market "gurus". I looked at what might come next in Money Morning early last week.

(Ten-year US Treasury: three months)

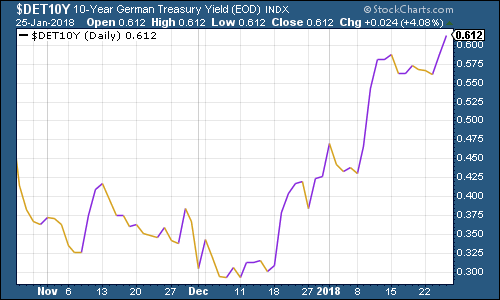

How about the ten-year German Bund? This the borrowing cost of Germany's government essentially represents Europe's "risk-free" rate. As you can see, the large "spread" or gap between this and the US rate is starting to close up ever so slightly as the German yield rises and the US yield remains broadly static.

(Ten-year bund yield: three months)

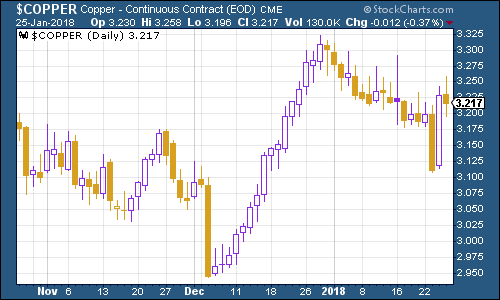

Copper had a bit of a slump, then bounced this week. That's partly about the gyrations in the dollar as much as anything else.

(Copper: three months)

Bitcoin is still hanging in there. It's had a rough year so far, but equally it's hard to write its epitaph at the moment. I won't be buying in, but as Merryn points out in her letter in MoneyWeek magazine this week, the underlying technology is (and I know it's a clich to say this now, but it's true) quite likely to be both important and useful in the future. But whether the tokens themselves the bitcoins will retain their value is another question.

(Bitcoin: ten days)

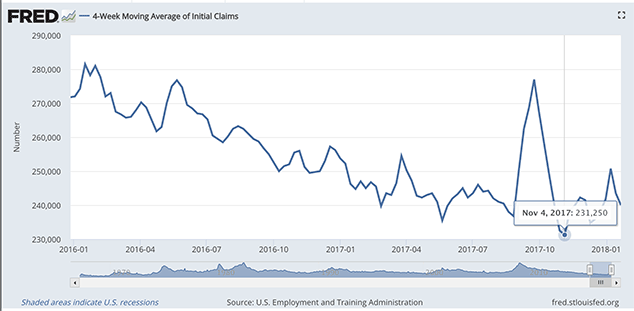

As for US employment the indicator we like to keep an eye on is the four-week moving average of weekly US jobless claims, which fell back to 240,000 this week, while weekly claims came in at 233,000.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), a recession follows about a year later.

But as the chart below shows, the most recent cyclical trough was in November, at 231,250. So we could still be some way from the peak. And if they stay at current levels then we may hit a new low before too long.

(Four-week moving average of US jobless claims: since start of 2016)

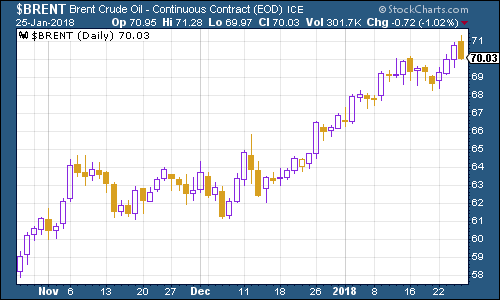

The oil price (as measured by Brent crude, the international/European benchmark) was back above $70 a barrel again, which was as with every other commodity partly assisted by the weak dollar. The main thing for the oil bulls to keep an eye out for now is supply revving up. At these levels, it becomes ever more tempting to get pumping more aggressively.

(Brent crude oil: three months)

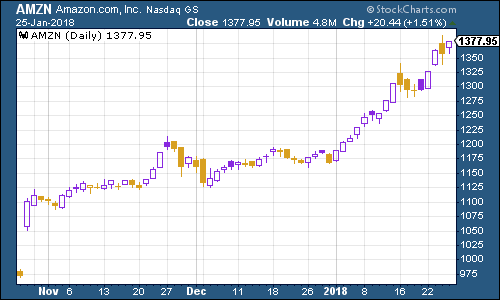

Internet giant Amazon continues to look like the ultimate "melt-up" stock. Once upon a time, no one ever got fired for choosing IBM. Nowadays, no fund manager will get fired for owning Amazon. That Jeremy Grantham of GMO might argue is one reason why they're all so keen to own it now, because on the one hand they're terrified of a crash, but on the other they don't want to miss out on the gains between now and then.

That makes Amazon the perfect stock for a manager living in fear of their career during a melt-up because if and when the crash comes, no one's going to tell you you were a fool to be holding a worldbeater stock like Amazon.

(Amazon: three months)

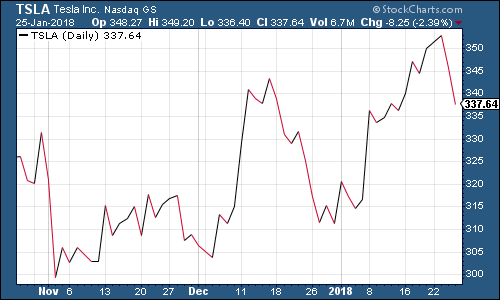

Tesla dipped a little this week on rumours that there are further problems with the construction of its Model 3 mass market car. CNBC reported that employees reckon that there will be further delays and that quality control is slipping.

Yet Tesla has slipped up on many deadlines in the past. And it's not clear what will make the bulls change their mind this time around. I imagine Tesla is just a bull market stock, and it won't collapse until the bull market does.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?