Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

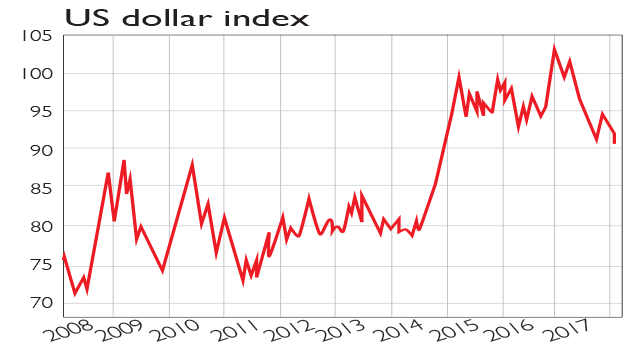

Measured against a basket of America's trading partners' currencies, the dollar fell by 10% in 2017, says Ira Iosebashvili in The Wall Street Journal. It could now slip further. Japan and Europe are now finally joining the US in recovery, making their currencies and assets more attractive, especially because tighter monetary policy is finally on the horizon in these regions. A stronger US economy and further interest-rate hikes have long been factored in. Tax reform will raise the fiscal deficit; overspending and borrowing tend to reduce a currency's appeal.

Viewpoint

"An NHS winter crisis is now an annual event The only upside seems to be that the high level of human suffering is at last opening up the beginnings of a measured debate about whether there may be alternative models of healthcare provision that are preferable to the UK system When winter comes in Germany, the Netherlands, Switzerland or Belgium, it is not typically accompanied by their health systems plunging into crisis. They appear to be able to deal with a change in the seasons effortlessly and without spending a great deal more money than we do in Britain."

Mark Littlewood of the Institute of Economic Affairs, in The Times

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how