The charts that matter: what does 2018 hold?

Japan's Topix index breaks through its "coffin lid", gold starts the year well, and bitcoin is back on the rise. John Stepek looks through the global economy's most important charts.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

But first, if you missed any of this week's Money Mornings, here are the links to catch-up.

Tuesday: Is 2018 the year that we finally shake off the hangover from 2008?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Wednesday: Here are my ten big calls for 2018

Thursday: This is the year that central banks finally stop propping up markets

Friday: The Great Depression: what are the parallels between now and then?

We've got a few new charts to add to the watch list this week. Before we get to that, I just wanted to note something I've been talking about inflation as being the big thing to watch out for this year. So I was interested to see various little pointers to wage inflation cropping up all over the news this week.

As Barry Ritholtz highlights, in the US, the minimum wage is set to rise in 18 different states this year. Meanwhile, here in the UK, McDonald's, Lidl and Aldi are all set to lift wages, too.

None of these things necessarily mean that wage inflation is on the verge of taking off, but the level of attention they're drawing the McDonald's pay rise in particular has been presented as a reaction to its first strike ever, which took place in a couple of branches late last year shows that this is a big political issue, and one that companies are likely to pay attention to.

Anyway, let's get onto the charts.

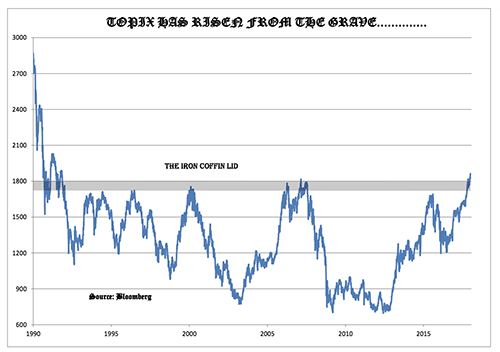

Late last year, I added the Topix index, Japan's key stockmarket, to our list (in Japan, the Nikkei is analogous to the Dow Jones; the Topix is the S&P 500).

The Topix index hadn't managed to claw back above the 1,800 level since the collapse of the Japanese bubble at the beginning of the 1990s. Jonathan Allum at broker SMBC Nikko describes the level as "the iron coffin lid".

Now though, as Allum notes in his latest newsletter, it looks as though the lid has been lifted. See his chart below:

This week the Japanese market got the year off to a cracking start, and the Topix closed today at around 1,880. That's looking like a pretty decisive breakout to me. And while I struggle given how expensive many things are, that's not only a bullish sign for Japan, but for global markets generally.

I'll keep an eye on the Topix, but now that it's broken through the coffin lid, I don't think we need to update on it every week.

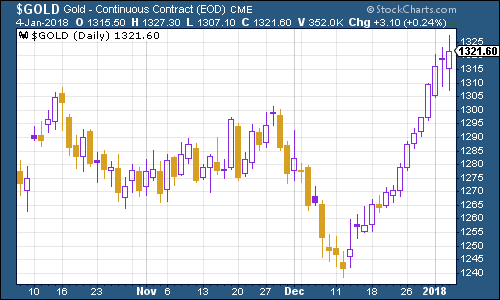

Gold had a good start to the new year too. In fact, believe it or not, gold has been enjoying one of its longest winning streaks on record it's been a relatively small move overall, but at the time of writing, gold had ended the day higher than it started out, for more than ten sessions on the trot.

This is partly down to the US dollar having a rough week. But there's also a "catch-up" trade going on (people buy gold because it hasn't moved much compared to other assets) and also a tentative reflation trade.

(Gold: three months)

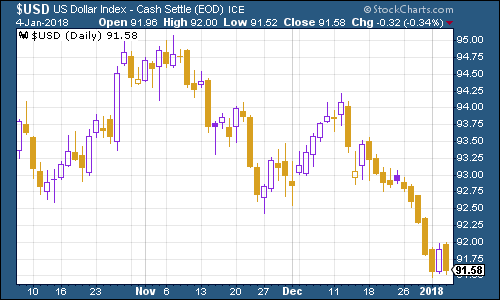

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners fell back this week. That's interesting given that more and more investors are increasingly starting to suspect that the Federal Reserve will raise interest rates more rapidly than had been expected this year.

However, one driver of the apparent dollar weakness is euro strength (the euro is the biggest component of the basket). Given the eurozone's unexpectedly strong economy recovery in 2017, investors expect the European Central Bank to rein in quantitative easing as soon as it can which is one reason why we'll be keeping an eye on the German bund yield, as I'll discuss in a moment and that has pushed the euro significantly higher this week.

(DXY: three months)

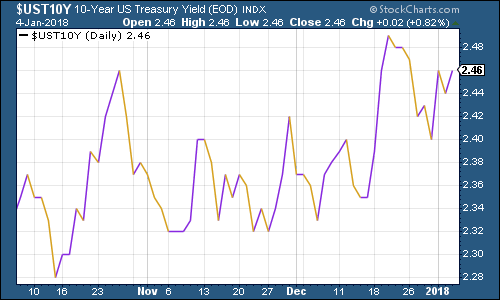

If inflation is just around the corner, the bond bulls are still sceptical. The yield on ten-year US Treasury bonds may have finally broken back above the 2.4% mark, but so far it's struggling to get much higher. My own view is that disinflationary psychology is so entrenched that investors are conditioned to see deflation risks all around them. But I reckon this is the year that the psychology finally flips, and when it does, I imagine bond market volatility will rise sharply.

(Ten-year US Treasury: three months)

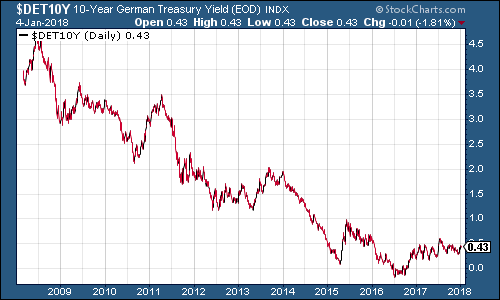

Now for an addition to our charts that matter this time the yield on the ten-year German Bund. This the borrowing cost of Germany's government essentially represents Europe's "risk-free" rate. As you can see from the ten-year chart below, it's fallen a long way in a decade, and it's also a lot lower than the US equivalent.

However, like most other bond charts, it looks like it bottomed out in summer 2016. Now that the ECB may be ready to pull back from quantitative easing quicker than expected, it'll be interesting to see how long the gap between bunds and US treasury yields (currently at levels not seen since the days of the Berlin Wall) can persist.

(Ten-year bund yield: ten years)

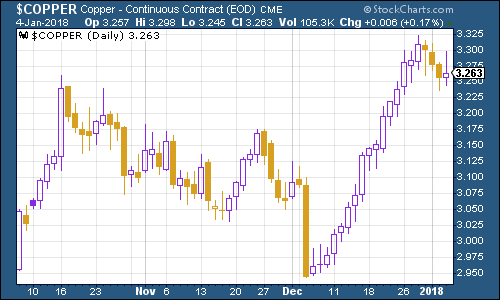

Copper went out on a high last year, and while it eased back a bit this week, that's small wonder given the scale of its rally in the past month or so. Chinese demand has remained strong and then there's the whole "Dr Copper" thing strong global economic growth should generally mean a strong copper price, so the solid performance shouldn't come as a surprise.

(Copper: three months)

Bitcoin is, as ever, bitcoin. It seems to have spent the Christmas period consolidating, and now looks to be heading higher again.

(Bitcoin: ten days)

It's fascinating as always and now rival cryptocurrency Ripple appears to be taking off in a similar manner but it's still a market I'm watching from the sidelines.

Dominic is putting together another piece on bitcoin for next week, and we also had an interesting discussion on it at the most recent MoneyWeek roundtable it didn't make the final cut in the magazine, but we'll be putting the content from that chat up on the website next week too, so keep an eye out for it.

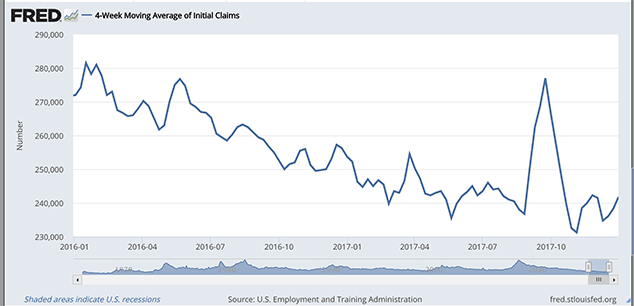

As for US employment the non-farm payroll figures came in at 148,000 for December,missing expectations. But the indicator we prefer to keep an eye on is the four-week moving average of weekly US jobless claims, which rose to 241,500 this week, while weekly claims rose sharply to 250,000, versus expectations for 240,000. This is a volatile period though, so I wouldn't read too much into the jump as yet.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), a recession follows about a year later.

As the chart below shows, the most recent cyclical trough was late last year, at 231,250. So we could still be some way from the peak.

(Four-week moving average of US jobless claims: two years)

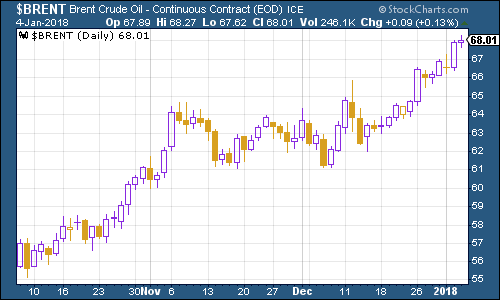

The oil price (as measured by Brent crude, the international/European benchmark) is starting to draw attention to itself. And little wonder. The rally has continued into the new year amid protests in Iran (which, incidentally, have had literally no impact at all on Iranian oil production as yet) and now we're seeing people talk about oil getting back to $80 a barrel before too long.

As bullishness returns, chances are we'll see oil take a breather before too long. But I have to agree with my colleague Dominic on this one I think oil's bull market will continue overall this year. If global economic growth continues to take markets by surprise and the sheen comes off the electric car story somewhat as Tesla over-reaches itself then the path of least resistance is higher.

That of course, will make the inflation figures look scarier.

(Brent crude oil: three months)

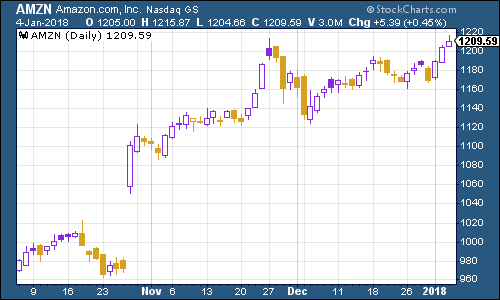

Internet giant Amazon continues to move higher alongside wider markets. The threat of government intervention into "Big Tech" is ongoing. But at the same time, the high street continues to falter in the face of online competition (see Debenhams' profit warning this week).

Amazon is an interesting tech giant it's not in the direct line of potential regulatory fire (Facebook and Google are more vulnerable) because it's not seen as an exploiter of data or manipulator of news (Jeff Bezos may own The Washington Post, but that's on a much more level playing field). Yet, given its propensity for turning markets upside down, it's also seen as one of the bigger threats to jobs.

I'm not sure how the interaction between Big Tech and Big Government will play out this year higher minimum wage laws? Slowing up automation by requiring supervision of machines by humans? More self-regulation as Facebook boss Mark Zuckerberg hinted at in his new year resolution message? Tighter tax laws? but the sector is going to have to address the social concerns it has created one way or another. All things considered that's likely to make them less profitable, but whether that actually impacts on the share price is another matter given that profits have never been especially important to tech investors.

(Amazon: three months)

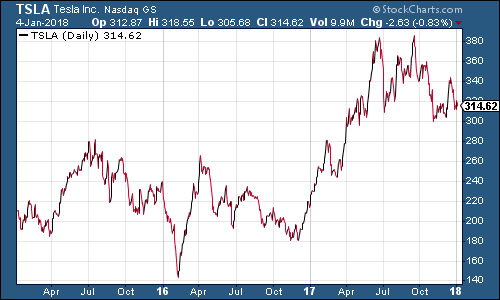

Finally, I want to throw in another tech company to keep an eye on Tesla. Tesla baffles me. It looks, from the outside, like a triumph of hype over substance. I like Elon Musk's ambition (I'll usually have a soft spot for anyone who likes the idea of space travel) and I admire the way that he's pushed the electric car to the point where it now feels almost guaranteed to be the dominant mode of transport before the next decade is out.

But other car manufacturers who have actually been doing this stuff for decades are now catching up, inspired by "dieselgate". And Musk is still burning a ludicrous amount of money every quarter. Yet his investors seem to be ridiculously forgiving, prone to "oohing" and "aahing" every time he points to a marvelous new idea he's had while asking them for an extra billion or so for the bonfire.

That might be fine while interest rates are still near 0%, but I'll be interested to see how it plays once capital actually has a cost. Note that the Tesla share price has struggled over the past few months compared to a more broadly rising market.

So I don't know let's keep an eye on the share price chart and consider it an "investor credulity" index for the time being. (If you're more interested in electric car hype then I reckon the lithium price might be the one to watch there Tesla is now no longer the only electric car manufacturer out there, which I have to see as one of its big problems).

(Tesla: three years)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King