The charts that matter: the 2017 retrospective

John Stepek casts his eye over the global economy's most important charts, takes a look at how they've fared over the last year, and how they might perform in 2018.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

Today we'll run down the charts, look at what they've done over the past year, and what they might do come 2018.

But first, if you missed any of this week's Money Mornings, here are the links to catch-up.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Monday: The biggest threat to investors in 2018 the return of inflation

Tuesday: Five must-read books for your Christmas break

Wednesday: Here's how my 2017 predictions panned out

Thursday: The story of 2017 an epic bull market in complacency

Friday: Will this despised market make a comeback in 2018?

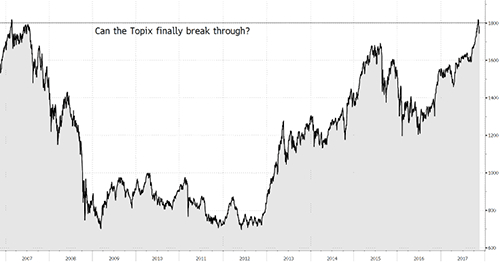

In the last month or so, I added the Topix index, Japan's key stockmarket, to our list. (In Japan, the Nikkei is analogous to the Dow Jones; the Topix is the S&P 500). Here's why.

The Topix index hasn't managed to claw back above the 1,800 level since the collapse of the Japanese bubble at the beginning of the 1990s. Jonathan Allum at broker SMBC Nikko describes the level as "the iron coffin lid". As the chart below shows, the last time it was challenging this level, was in 2007.

This week the Topix made a proper run at surpassing and staying above the 1,800 mark. It managed to spend most of this week above 1,820 and it's closed at close to 1,830 this morning.

I'll be keeping a close eye on the Topix into 2018 but this, it has to be said, is so far a pretty bullish sign for Japan, and for global markets generally.

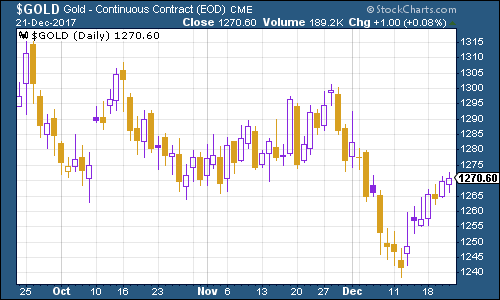

Gold rallied strongly this week. Much of this seems to be down to the Trump tax bill finally going through.

Here's the basic take: whatever you think of the details of the tax bill, it involves the US loosening fiscal policy. Taxes are being cut and the US government will have to borrow more as a result. Looser fiscal policy (all else being equal) should mean higher inflation. In turn that is the sort of thing that's good for gold.

(Gold: three months)

Looking back over the past year, gold has felt like rather a dull asset - but it's still managed to rise by around 10%. It's worth hanging onto now - both as portfolio insurance and also because if inflation does take off, and next year ends up being the year that we see proper hard choices having to be made by the Federal Reserve, then it could end up being very good for gold.

(Gold: past year)

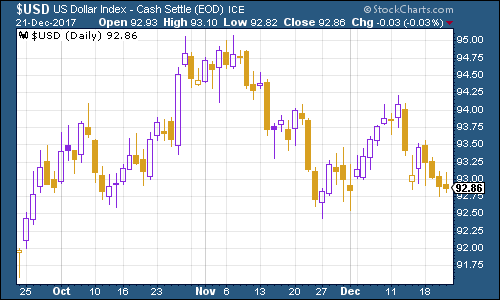

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners dipped this week. This is the flipside of the Trump tax bill. Looser fiscal policy plus monetary policy remaining loose, should spell a weaker currency.

(DXY: three months)

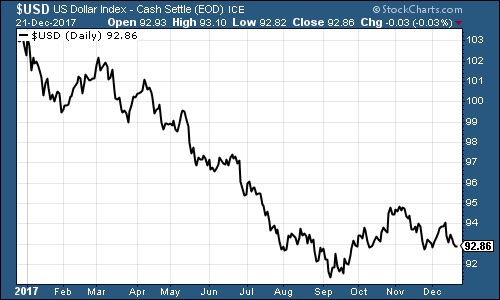

Going back a year, you'll notice that Trump's election bounce - which catapulted the dollar to a high point by the start of this year - ended and the dollar has been in decline since. In September, the direction changed a little as investors began to price in a more bullish Fed, but that was a brief turning point it seems.

As we've pointed out on several occasions in the past, the dollar is one of the most important prices in the world. As it goes up, global monetary policy is effectively tightening. As it falls, the opposite is happening.

(DXY: past year)

What's on the cards for next year? I suspect we'll see more dollar weakness. Indeed, we might find that the yen is the strongest currency next year - if inflation really can take off, then the Bank of Japan will be able to start tightening without causing a collapse in the economy or the stock market. In turn, you'd expect the yen to start carrying the burden of being the "strong" currency again.

For now that's a theory - but a weaker dollar would certainly fit with the inflationary outlook scenario.

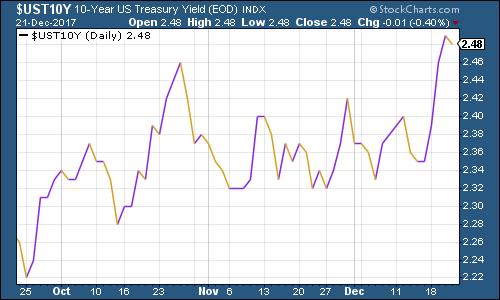

Carrying on that theme, the yield on ten-year US Treasury bonds finally broke above the 2.4% mark that's seen as a major line in the sand by many analysts. Again, this is the loose fiscal policy story in action.

(Ten-year US Treasury: three months)

Can it finally make it to the 3% mark? This time last year it look inevitable. And then you can see what happened - it retreated at the 2.6% mark that some bond gurus had decided was the point at which the bull market would definitively be over.

My own view remains that we saw the lows for bond yields in 2016. Politics remains inflationary (populism is inflationary); monetary policy remains inflationary (the Fed still wants to lag); so the logical conclusion is that bond yields will have to go higher. It's really just a matter of how disruptive that process is.

Also, the market is still clinging to deflationary psychology and it may take a big shock to knock that out of investors.

(Ten-year US Treasury yield: past year)

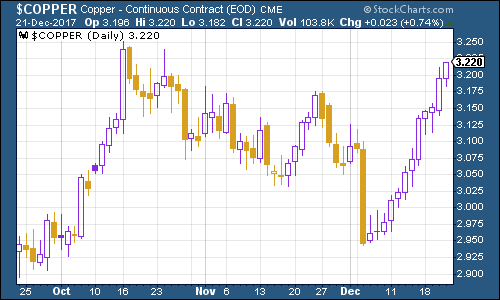

Copper's sharp rally continued this week. Upbeat manufacturing data from China helped, as well as essentially solid global economic growth. There's a touch of electric car fairy dust being sprinkled on copper too, which always helps the bull case.

(Copper: three months)

In fact, this looks like it's set to be copper's best year since 2010.

(Copper: past year)

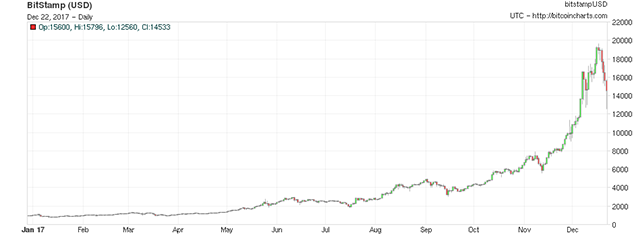

Bitcoin has had an even more exciting week than usual. As I wrote this morning, the bitcoin price had crashed by well over 20%. And yet it was also showing signs of rebounding fast.

(Bitcoin: ten days)

On the one hand, a lot of people must feel they missed the boat on bitcoin and would like to get in now. On the other hand, a lot of people will be nursing major regrets for not selling up near $20,000 and will be looking to get out with their life-changing wealth intact.

(Bitcoin: past year)

Of course, if you'd held bitcoin since the start of this year (or better yet, before that), you might feel sanguine with your five-fold gains or more so far remaining intact.

It's fascinating as always, but certainly a market I'm watching from the sidelines. We do have plenty on bitcoin in the Christmas issue of MoneyWeek magazine, out now. If you're not already a subscriber, sign up now to get your first four issues free.

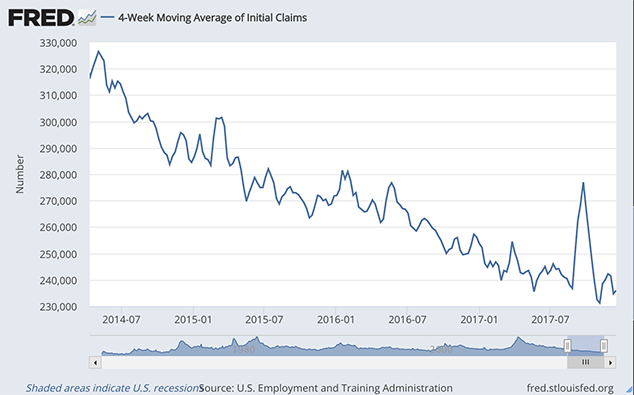

The US employment figures ticked higher but remained strong this week the four-week moving average of weekly US jobless claims rose to 236,000, while weekly claims rose sharply to 245,000.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), a recession follows about a year later.

As the chart below shows, the most recent cyclical trough was just a few weeks ago, at 231,250. So we could still be some way from the peak.

(Four-week moving average of US jobless claims: since 2014)

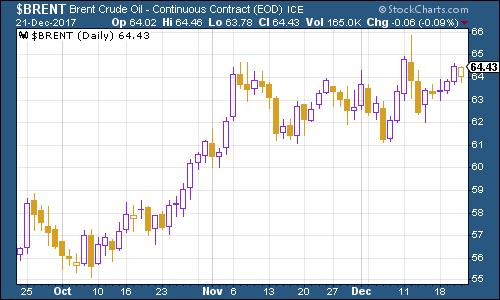

The oil price (as measured by Brent crude, the international/European benchmark) kept going up this week. So much attention is being paid to pretty much every other market that oil is still creeping under the radar somewhat.

It also helps that the "macro" take on oil is currently still so bearish - everyone is smarting from the 2014 crash, and the dominant paradigm is this idea of "peak oil demand", whereby electric cars are going to render oil useless.

It's an almost-direct reflection of the "peak oil supply" argument that everyone was spouting by the time the financial crisis came around.

(Brent crude oil: three months)

As you can see, oil has made a pretty decisive comeback from the summer lows and if it continues to rise into 2018 - well, that would fit nicely with the inflation narrative too.

(Brent crude oil: past year)

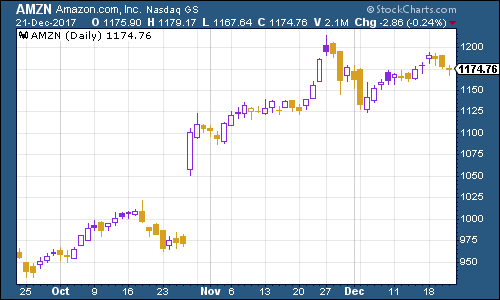

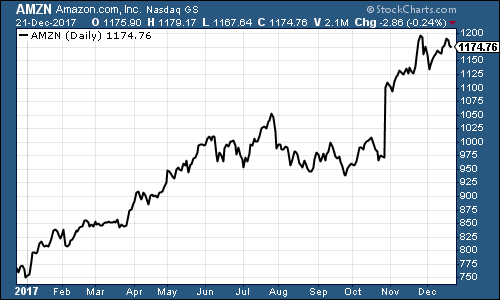

Finally, internet giant Amazon had an uneventful week price-wise again. I think it's fair to say that lots of investors are wondering how much further the Big Tech, momentum, "growth in a low-growth world" trade can keep going for. Government regulation is a threat; a fightback from bruised traditional retailers is a threat; rising interest rates are a threat (it makes the "just try it" model of business expansion a little trickier when money actually costs something) - there are a lot of headwinds coming up for what is a very expensive, if fantastic, company.

(Amazon: three months)

Of course, there's also the fair point to make that it's been a spectacularly successful investment over the past year, and so maybe now investors are just wondering if it's time to take profits and move on to a more undervalued sector.

(Amazon: past year)

We're taking a break next week - we'll be back in the office "officially" on Tuesday 2 January.

But never fear, we'll still be sending you the daily morning email next week, presenting a selection of the best of our financial history Money Mornings from the past year.

Have a Merry Christmas and very Happy New Year!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how