A darkening outlook for European stocks

The hope in Europe that the current financial turmoil could be confined to the UK and US took a blow as the eurozone's second-quarter growth figures showed a 0.2% contraction in the second quarter, the first negative figure since the euro's inception in 1999.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Since the credit crisis began, many investors have hoped that "the worst of the economic and financial trauma" could remain "largely confined to the Anglo-Saxon world", says Gary Duncan in The Times. That illusion was finally shattered last week as the eurozone's second-quarter growth figures showed a 0.2% contraction in the second quarter, the first negative figure since the euro's inception in 1999. And with the malaise set to worsen, the eurozone is on track to become the first major economy in the developed world to post two successive quarters of negative growth and thus fall into recession.

High raw materials prices, the effect of past interest-rate hikes, a high euro and the credit squeeze have taken their toll, and there is scant prospect of improvement. Key indicators such as business confidence in the three biggest economies Italy, Germany and France have turned down sharply. GDP has fallen in all three and there are "worrying signs that the export motor that drives the German economy is sputtering", says The Economist. Foreign orders for German engineering goods slid by an annual 7% in June.

Note that the euro area corporate sector is actually weaker than many assume, says Michael Saunders of Citigroup. The non-financial sector deficit the gap between firms' spending, including investment and interest costs, and their profits is at a five-year high and slightly above American levels. As the outlook worsens and credit tightens, "major corporate retrenchment", hitting jobs and investment, is looming. This economic downturn is likely to be "deeper and longer" than the consensus expects.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Can lower oil and the weaker euro now come to the rescue? Exports take months to respond to changes in exchange rates, says Capital Economics, and in the meantime Britain and America, the top two extra eurozone export markets, are set to weaken further. And the hawkish ECB will not cut rates until it is convinced the danger to inflation from high oil has passed, by which time Europe may already be shrinking, as The Economist points out.

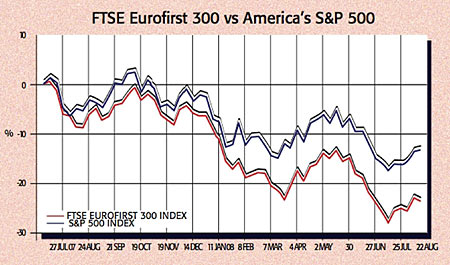

Meanwhile, European financial stocks look vulnerable to renewed bouts of global jitters over the financial system, as well as further writedowns as economies worsen. The fact that European indices are relatively heavy on bank stocks, along with the Fed's rapid reduction in interest rates (contrasting with the ECB's recent hike) and increasingly disappointing European data, helps explain why stock prices and valuations have slid further in Europe than in America.

And it seems the overall market has yet fully to adjust to the worsening outlook. European earnings are expected to rise by 13% next year, with German profits expected to jump by 19%. That's "a joke", says Bernd Mayer of Deutsche Bank, considering the economy is set to deteriorate faster next year as emerging markets slow down following weaker demand in the industrialised world. When the global economy heads down, corporate profits usually fall for around two-and-a-half years, says Philip Isherwood of Dresdner Kleinwort. Given the massive problems out there, are we really likely to get through this downturn much faster than usual? European stocks may well be historically cheap on under 11 times expected earnings. But with earnings forecasts so outlandish, supposedly cheap valuations are hardly going to entice buyers anytime soon.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn