How one of the first big property bubbles led to the Great Depression

John Stepek looks back at Florida’s property boom of the 1920s – and the inevitable crash that followed.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In last week's episode of our series on the Great Depression, we looked at how the UK experienced the Crash of 1929 just a month or so ahead of Wall Street.

At the end of September that year, the British stockmarket toppled over, as already-fragile confidence was hammered by the collapse of the Hatry group of companies.

This week, we look at the main event itself and how it unfolded...

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The top of the market

As we've said before, you can't have a bust without a bubble. The decade of the roaring '20s, as we looked at a few weeks ago, was in the US, certainly an era of rapid technological change, with huge advances in both communications and automation (what does that remind you of?), rapidly improving living standards, and urbanisation.

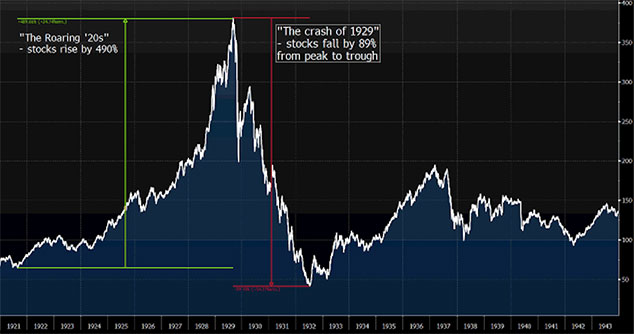

Like most booms, it got out of hand, and stockmarkets as usual, fuelled by financial innovation (investment trusts) and leverage (borrowed money) took it too far. Below is a chart looking at the boom, then the bust.

The Dow Jones Industrial Average had hit a low of 63.9 in August 1921 (just as the "depression that never was" ended). From that point, to when the stock market peaked on September 3rd, 1929, at 381.17, the market had risen by nearly 500% (in other words, you'd have turned one dollar into $6).

As you may have just noted, the top of the market came a good bit before the "Black Monday" of legend. So what exactly happened on and around 3 September?

The stockmarket was undeniably overpriced. Judging by the Shiller price/earnings ratio (which measures long-term earnings versus share prices), the US stockmarket in 1929 was more overvalued than at any point before then. And since 1929, the market has only been similarly overvalued in 2000, 2007, and well, today.

Meanwhile, the market was propped up with a staggering amount of borrowed money. According to Time magazine, "by 1929, two out of every five dollars a bank loaned were used to purchase stocks".

And in a marvellous example of the "magazine indicator" at work, that was the week that the very first issue of BusinessWeek (now Bloomberg BusinessWeek) came out, according to Liaquat Ahamad's Lords of Finance. The launch of new investment magazine titles aimed at the well-off often ties in with busts glossy publisher Conde Nast launched a short-lived magazine called Portfolio in 2007. (And indeed, MoneyWeek was conceived though not quite launched in the run up to the dotcom bust).

Interestingly though, BusinessWeek's view of the market was actually pretty bearish. America, the editorial said, was in a "cloud land of fantasy", and had been for at least the past five years, what with all the talk of a "new era" of "unparalleled prosperity".

They weren't the only ones. On 5 September 1929, Roger Babson a bright but fantastically eccentric stockmarket analyst and economist, who helped to invent the parking meter and also waged a personal vendetta against gravity (a story for another day) warned that disaster lay ahead and that America would suffer a "serious business depression".

Babson had warned of this before. But this time the market seemed to pay a bit of attention. The "Babson break" saw share prices dip by about 3%, and while they rebounded the next day, they never regained the 381 high.

This is worth highlighting, I think. Despite the general exuberance, there were plenty of bearish voices around, and there always are. It's not true to say that no one was aware of the vulnerable nature of the boom. They just needed it to keep going for the sake of their wallets.

However, there was still plenty of genuinely bullish sentiment around. Yale economics professor Irving Fisher (who I'll point out as we've noted Babson's eccentricities invented a precursor to the Rolodex, and was also, like many high-profile intellectuals of the day, a eugenicist) was wheeled out to counter Babson's bearishness.

He argued that share prices were not too high, and that "Wall Street will not experience anything in the nature of a crash".

That quote was nothing compared to the reputation-ruining hostage to fortune he came out with just a month later.

Come late September, news of the Hatry collapse in London hit the market hard, partly because investors who had lost money on the Hatry debacle had to pull their money out of the US market to compensate.

And yet, despite mounting concerns (and rising interest rates in Britain), by the close on 10th October, the market had regained a lot of its post-Hatry losses, and stood at around 352.

Then, on 16 October, 1929, Fisher was quoted in The New York Times as saying that stock prices had reached "what looks like a permanently high plateau." He went on to tell questioners in his audience that he expected "to see the stock market a good deal higher than it is today within a few months."

Famous last words. The sad thing for Fisher is that the crash ruined him, even although he went on to understand the causes of both the crash and the resulting depression perhaps better than anyone else.

The Crash of 1929

The crash itself began on the afternoon of Wednesday 23 October, when a late afternoon sell-off rattled investors. When the market opened on 24 October, "Black Thursday" began.

The market fell by 11%, and some of the biggest stocks fell by far more. A group of bankers stepped in late in the day to try to prop the market up JP Morgan-style and the market recovered somewhat the next day.

But the relief was short-lived. On Monday 28th Black Monday the market crashed again by 13%. No one stepped in this time. And the next day, Black Tuesday, it fell by another 12%.

Indeed, despite various attempts at verbal and other interventions, the market didn't hit any sort of temporary plateau until November 13th. That was the first genuine buying opportunity in the unfolding bear market. The Dow closed at 198.6, and rallied to reach 294.07 on April 17th, 1930.

We'll look at the economic fallout of all of this in next week's edition. But in summary, from its 3 September 1929 peak, the Dow Jones did not bottom out until 8 July, 1932. At that point, the Dow was sitting at 41.22, making for an 89% loss from peak to trough.

And what's far more striking, to me at least is that the Dow took more than 25 years to regain its pre-crash peak (just in nominal terms). It only managed that on 23 November, 1954.

(Just think, if Japan were to follow a similar pattern, it would recover its previous high in around 2024 which doesn't look entirely unlikely right now).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets