Three reasons why bitcoin could go to $100,000

Cryptocurrencies - bitcoin in particular - are the bull market of the decade. It’s just possible the price of one bitcoin could hit $100,000, says Dominic Frisby. Here’s why.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

$100,000 bitcoin!

I thought that would get your attention.

A stupid, unfounded prognostication?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Probably.

But here are three reasons it could happen.

How to justify an extraordinary headline

Get this wrong (and he very rarely does) and yours truly gets the headline fired back at me two years later by petty trolls anxious to undermine my every utterance.

So just to qualify this headline (which actually happens to be one that I did write), I am describing why bitcoin could get to $100,000. I am not saying that it will.

1. Portfolio allocation and career risk

Bitcoin and cryptocurrencies are a new asset class. They have qualities of cash, qualities of gold and, as the ICO (initial coin offering launches of new cryptocurrencies) movement grows, they will have qualities of shares too, but they are in themselves an asset class. As the space grows, crypto could become a core feature of portfolios, just as other assets now are.

With the market currently rising as it is, investors will demand it of their fund managers and financial planners, who will then have to deliver, or many will take their business elsewhere.

It's a process that financial blogger Josh Brown, aka The Reformed Broker, calls "institutional ass-covering". He argues that the career risk involved in not being in an asset-class that is rising, is what fuelled the hedge fund mania of the 1990s and the commodities boom of the 2000s.

More and more crypto products will be invented to meet this rising demand, including, eventually, a proper bitcoin exchange-traded fund (ETF) of some kind (we'll get there eventually). This is the gradual institutionalisation of the space.

The total value of the global stocks is around $80trn. The government bond market is perhaps twice the size. The current bitcoin and crypto market cap is sub-$200bn. It's tiny in comparison.

My colleague Charlie Morris points out that by the end of its 70s bull market, the global gold market reached a value equivalent to the size of the New York Stock Exchange (NYSE). The same happened with Japan by the end of the 80s, dotcom by 2000 and commodities by the end of the bull market of the 2000s.

It's pretty clear that crypto is the bull market of this decade. The current value of the NYSE is around $20trn. Even if the market cap goes to a fifth of the size of the NYSE, then at $4trn, that would make the crypto market 20 times bigger than it is today, with bitcoin comfortably surpassing $100,000.

It "only" needs to rise around 14 times from today's price of $7,100. Cripes it's gone up 14 times enough times in the past!

2. "It's another one of those"

If you read my piece last week, you might remember billionaire hedge fund manager Ray Dalio's principle of asking "which one of those is it?"

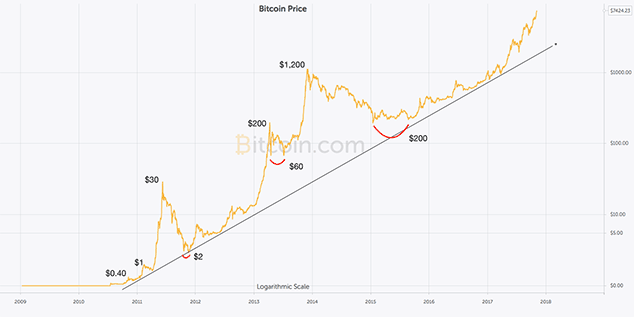

Fractal patterns, in a way, follows that principle. Below is a log chart of bitcoin since shortly after its inception. Log charts measure percentage gains rather than price.

I've marked the major highs in bitcoin's evolution $30, $200, $1,200 with round numbers. I've put little red curvy lines marking the crash lows, which have followed (notice how it always seems to make a double bottom).

On a log chart, the current move, compared to those in the past, looks almost sober. If it were to enjoy a final spike such as in 2011 when it went to $30, or 2013 when it went to $1,200, lord knows where it would take us on the chart.

You can see that it went from $2 in late 2011 to $1,200 in 2013. A move of similar percentage magnitude from the 2015 low of $200 would take it over $100,000.

3. Satoshi Nakamoto, the architect of bitcoin, was a gold bug

He intentionally designed bitcoin to be a digital replica of gold.

Gold, much as I love it, is an analogue asset in a digital age. It's why it's often described as a barbarous relic (although this is in fact a misquote Keynes was actually talking about the gold standard when he made the remark).

Nevertheless, bitcoin is digital gold. (By the way, searches for "bitcoin" on Google already exceed those for "gold".)

There are roughly 190,000 tonnes of gold in existence. The value of a tonne of gold is about $40m. Thus the value of all the gold in the world is currently around $8trn.

Let's say all the 21 million bitcoins there will ever be are mined. If the value of those 21 million bitcoins were to match all the gold that has ever been mined, you're looking at a price of $380,000 per bitcoin ($8trn/21 million).

Once upon a time in fact even at the beginning of this year the idea of one bitcoin exceeding the price of an ounce of gold seemed far-fetched. The ultimate target for die-hard bitcoin bugs must be market cap parity.

Then again a swift reality check

I'll enjoy looking back in five years time and considering how stupid or prescient these projections are.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how