A fund that pays a tempting 7% yield

This week, I’m going to begin building the two income portfolios I outlined last month with a fund that will be included in both portfolios.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

This week, I'm going to begin building the two income portfolios I outlined last month (see below) with a fund that will be included in both portfolios.

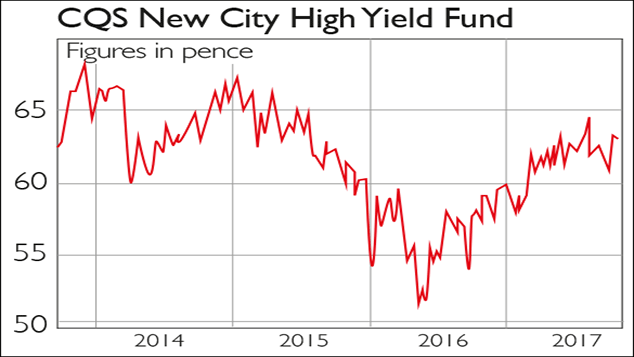

CQS New City High Yield (LSE: NCYF) is one of the least high-profile investment trusts focusing on generating income. However, I've watched the manager behind this fund Ian Francis for many years, and I think he's one of the hidden stars of the fund community, especially in multi-asset investing. Many big fund-management groups have built up an enviable business franchise from championing their clever strategies of chasing income wherever they find it across the range of asset classes. Francis has quietly ploughed his own furrow and done a great job, consistently churning out high levels of income from a diverse range of investments, which include bonds, preference shares and income-oriented equities.

The fund targets a generous income level, but this is well backed the yield on the fund is a bit over 7% (paid quarterly) with a yield-to-maturity from the underlying investments of 8.2%. The attractive yield helps explain why the fund has been so popular with wealth managers such as Brewin Dolphin, which is currently the largest single shareholder. This also helps explain why the fund has traded at a premium to net asset value (the value of the underlying portfolio) 90% of the time since its inception in 2004 the current premium is 5%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Observant readers will notice that the 7%-plus yield is at the top of the range of reasonable income yields I outlined last month and this investment trust is not without its risks. Francis goes higher up the risk scale in search of income opportunities, which means that you won't see many boring corporate-bond names in his list of holdings. Alongside well-known banking names such as Barclays, you'll also see credit-management company Garfunkelux, consumer-goods warranty provider Galaxy Finco, OneSavings Bank, PizzaExpress, and Unique Pub Finance dominating the top-ten holdings list. This tells you that the manager is buying riskier, almost certainly sub-investment-grade names to boost the yield like many corporate-bond managers operating in this field.

Of the fund's holdings, 83% are in bonds, 11% in equities, and 4.7% in preferences shares. In terms of sector exposure, just under a quarter of the portfolio is in banks or financials, and around 14% in both consumer services and insurance. If there is a synchronised market collapse, these bonds might fall in value, although not by as much as equities, one would hope.

Thankfully, the fund has been conservative with its balance sheet. It doesn't have masses of debt (and has access to cheap debt if needs be), and currently boasts 106% dividend cover (the ratio of profits to promised dividends), as well 101% revenue reserves for the year to 30 June 2017 (an amount of money put aside for future dividends). Dividends have increased every year for the last ten years another plus.

Overall, New City High Yield is close in style to unit trusts investing in higher-risk corporate bonds, but with the benefit of being small, and able to invest across asset classes and borrow cash. Whether you are an adventurous or cautious investor, it is an attractive fund with which to begin a diversified portfolio.

My plans for our portfolios

For those who didn't see last month's article, my aim is to build two portfolios focused on income generation. The first is the most mainstream, with an income target of 4.5%; the second more adventurous with an income target of 5.5%. I'd also quite like the possibility of small capital gains, possibly of around 1% per year although that isn't the primary purpose. Obviously, we are hoping to receive a higher income level compared with what you'd get from less risky bonds, such as government gilts, so these investments will be more risky. These are investments in funds and bonds that can go both up and down in value based on market conditions they are not a replacement for cash.

Why I favour investment trusts

I'm agnostic about the preferred investment structure of our income portfolios I'd be happy to invest in direct bonds, investment trusts or unit trusts but I want something that is cost-effective, and which can be easily traded in and out of if needs be. That means I will tend to have a bias towards investment trusts, where trading costs are (usually, though not always) low and charges generally reasonable.

For example, the costs for running the long-established New City High Yield Fund are quite reasonable. The annual management charge is 0.8% on assets up to £200m and 0.7% on assets over £200m. At the moment, the size of the fund is also close to ideal, at £249m. I say this because my fear is that too many fund managers in the business of seeking out unusual sources of income end up with too much money to put to work in good opportunities, whereas a sum of between £200 and £300m strikes me as being about right.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Stevenson has been writing the Financial Times Adventurous Investor column for nearly 15 years and is also a regular columnist for Citywire.

He writes his own widely read Adventurous Investor SubStack newsletter at davidstevenson.substack.com

David has also had a successful career as a media entrepreneur setting up the big European fintech news and event outfit www.altfi.com as well as www.etfstream.com in the asset management space.

Before that, he was a founding partner in the Rocket Science Group, a successful corporate comms business.

David has also written a number of books on investing, funds, ETFs, and stock picking and is currently a non-executive director on a number of stockmarket-listed funds including Gresham House Energy Storage and the Aurora Investment Trust.

In what remains of his spare time he is a presiding justice on the Southampton magistrates bench.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how