China’s central bank boss gives it to us straight

To the astonishment of financial market observers, who aren’t used to this sort of honesty, China’s central bank boss warned against getting overoptimistic, for fear of a “Minsky moment”.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It's a little bit ironic. In the week that held the 30th anniversary of Black Monday (and with a storm raging around us, just to add some additional deja vu echoes on this side of the Atlantic), stocks have proved unbeatable.

The S&P 500 continues to set new records. The FTSE 100 remained above 7,500 all week. Over in Japan, the Nikkei looks like it's making a break for it Nick Leeson, the trader who brought down Barings by playing a losing game of "double or quits" with the Japanese market and most of the banks' money, made a crack the other day that he'd just "broke even".

Can anything rattle this market? With Donald Trump promising to get some tax cuts pushed through, and apparently moving away from the idea of having an ultra-hawkish Federal Reserve governor replace Janet Yellen, investors certainly were feeling the cheer.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But China's central bank boss had an interesting thing to say. He actually to the astonishment of financial market observers, who aren't used to this sort of honesty from a central bank warned of the need to avoid getting overoptimistic, which could result in a "Minsky Moment".

Now, if you've read much MoneyWeek over the years just before the financial crisis kicked off, you'll probably be familiar with Hyman Minsky (there's a good explainer on him here, from way back in 2007).

But put very simply, Minsky said that when markets get too cocky, they borrow too much, and then collapse when everyone realises that the whole edifice is propped up by little more than matchsticks and blind hope. Stability leads to instability.

It's the sort of thing that's intuitively true, but not easy to model. That in turn is why this sort of thing tends to be ignored by the economics profession even though it's patently obvious that this represents the "real" world better than the efficient markets hypothesis and similar rational models.

Anyway, so that's quite a thing for a central bank boss to say. It suggests that, if nothing else, China will be looking at ways to rein in speculation. The country is certainly suffering from a huge property bubble I thought houses here are expensive (they are), but according to the FT, price to income ratios in China's major cities are now above the 40 level.

So it'll be interesting to see how they plan to unwind that. If they can do it painlessly well, it'll be a world first. Enjoy the lack of volatility while it lasts.

What the charts that matter can tell us this week

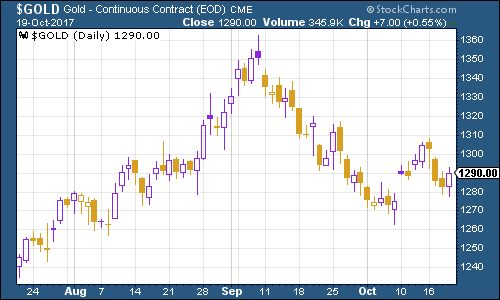

Gold had a pretty mediocre week when risk is "on" and other more exciting assets are going up, gold tends to go down.

(Gold: three months)

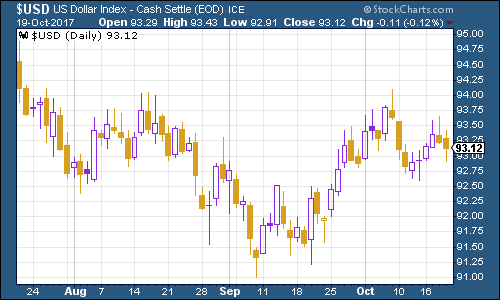

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners perked up a bit again this week as investors generally grew that little bit more confident on the US economy, with economic data that was solid, but not too strong (no one in the market wants interest rates to have any reason to go up any faster than they have to).

(DXY: three months)

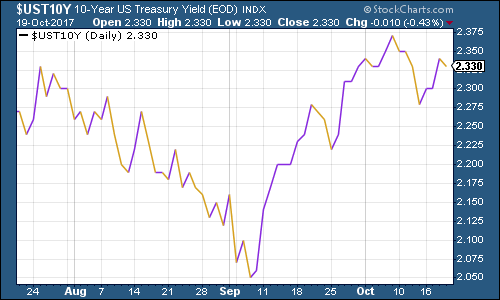

Meanwhile, the yield on ten-year US Treasury bonds has stayed virtually where is was at this time last week.

(Ten-year US Treasury: three months)

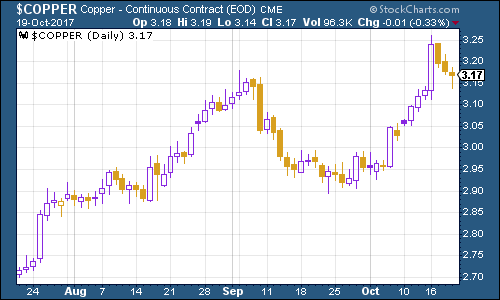

The strong rally in copper continued.

(Copper: three months)

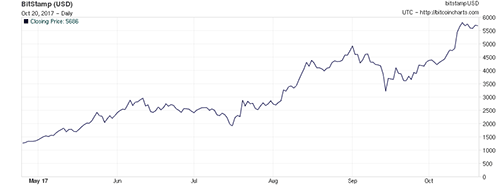

Bitcoin has also managed to maintain its impressive recent gains. (By the way, if you still feel baffled by cryptocurrencies, my colleague Ben Judge wrote a good piece for MoneyWeek magazine this week on the three biggest cryptocurrencies I had a bit of an aha!' moment when I read it I must admit [LINK]).

(Bitcoin: six months)

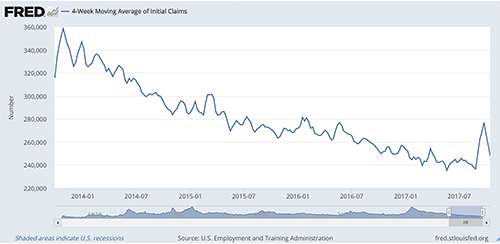

This week, weekly US jobless claims dived to the lowest level in more than 44 years. The four-week moving average slipped back to 248,250 as claims came in at 222,000, much lower than the 240,000 expected. The hurricane disruption has clearly passed, although the fall in claims was probably exaggerated by a public holiday, says Reuters.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), a recession follows about a year later.

So far, 20 May has been the cyclical trough, but the stockmarket keeps setting new peaks. If the jobless claims stay around these levels, we're likely to see a lower trough in the next few weeks.

(Four-week moving average, US jobless claims, since 2014)

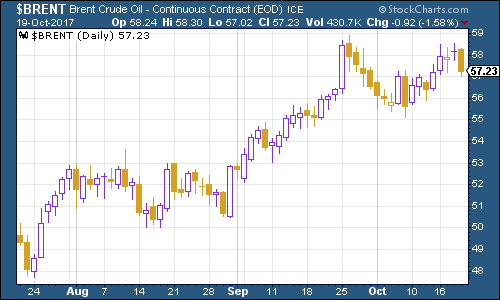

The oil price (as measured by Brent crude, the international/European benchmark) has had another uneventful week. This is odd, given that the Iraqi army took over oilfields that had been held by Kurdish forces hoping for an independent Kurdistan. However, it appears that the $60 a barrel level at which everyone expects a never-ending gusher of shale oil to appear is still capping any prospect of crude oil price gains.

(Brent crude oil: three months)

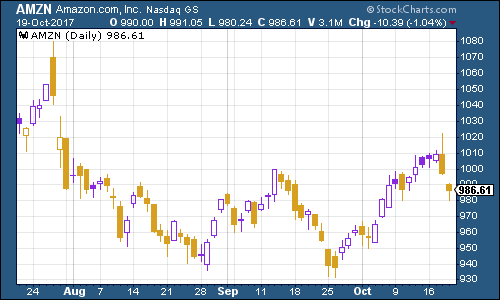

Finally there's Amazon. Again the online retail and publishing giant struggled to stay above the $1,000 a share mark, despite the wider market advancing. Political risk facing the sector is one issue, as is the fact that tech stocks have been in the lead for a long time in this bull market, and as the bull ages, investors start wanting to play catch up by buying stocks that have lagged.

(Amazon: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how