If you'd invested in: XP Power and Connect Group

XP Power designs and manufactures products used to supply, regulate and distribute electrical power.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

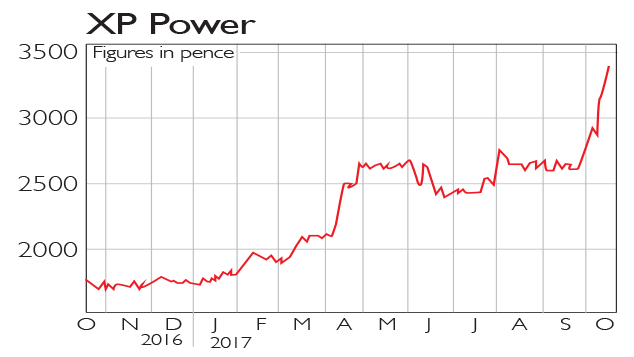

XP Power (LSE: XPP) designs and manufactures products used to supply, regulate and distribute electrical power. At the start of October, the company announced plans to buy US-based Comdel, a manufacturer of power systems, for $23m. For the first nine months of its financial year, XP Power saw an increase of 34% in its revenues compared with the same period a year earlier, thanks to its continuing strong growth in North America.

Be glad you didn't...

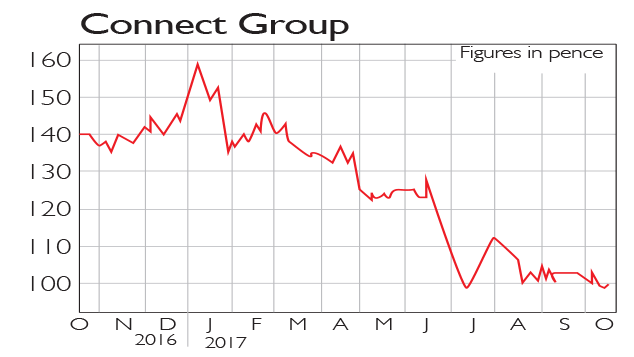

Connect Group (LSE: CNCT) is a UK-based specialist distribution firm with a market capitalisation of £249.4m. The company, originally known as WHSmith News, was created in 2006 after the demerger of WHSmith. It has seen significant share price volatility over the past few months, and earnings are expected to fall by nearly 8% on the year. Meanwhile, revenue is anticipated to decrease from £1.9m to £1.76m over the next few years.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how