The future of flight: from London to New York in just 29 minutes

Elon Musk reckons he can launch a hypersonic rocket by 2022, while groundbreaking work is also going on in the UK. The sector could soon present fresh opportunities, says Chris Carter.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Elon Musk reckons he can launch a hypersonic rocket by 2022, while groundbreaking work is also going on in the UK. The sector could soon present fresh opportunities, says Chris Carter.

It's Monday morning in London. You have a business meeting in an hour in New York. Standing beside the Thames, you present your passport and walk down a gangway, onto a ferry that shuttles you to a floating platform. As the ferry approaches, you gaze out of the window at the cylindrical rocket towering into the grey sky.

Safely in your seat, the rocket propels you through the air at 16,777 miles an hour, then brings you back down to Earth, landing on another floating pad. Already, you can smell the coffee as you step off the gangway into New York City. It's taken you just 29 minutes.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This is the subject of a video posted online last Friday by private-space exploration firm SpaceX only the voyage depicted is from New York to Shanghai (39 minutes). But this is no science fiction. Silicon Valley entrepreneur Elon Musk admittedly not known for understatement has plans for an initial launch in 2022, before waving off a mission to Mars using the same vehicle two years later.

Musk has announced that he is refocusing SpaceX to work solely on this vehicle, the BFR (Big F****** Rocket yes, we know). And it won't be solely for the wealthy Musk reckons a trip on the BFR should cost about the same as an economy ticket on a regular flight.

US space agency Nasa has put its faith and its budget in the hands of SpaceX before. SpaceX's Dragon spacecraft has resupplied the International Space Station, and in 2014, Nasa awarded the company a $2.6bn contract to take its astronauts into space. That said, it may be worth taking the ever-optimistic Musk's timeline with a pinch of salt.

"You can't fly humans on that same kind of orbit," Brian Weeden of the Secure World Foundation, a group that promotes responsible space use, tells tech website The Verge. "The acceleration and the G-forces for both the launch and the reentry would kill people it's a lot more than the G-forces on an astronaut we see today going up into space and coming back down, and that's not inconsiderable."

The UK returns to the space race

We will have to wait and see who's right. However, there might be a more realistic halfway house along the road to Musk's travel utopia. Groundbreaking work in hypersonic flight is now going on in Britain, years after we quit the first space race. (Hypersonic flight is considered to start at Mach 5 that's five times the speed of sound.

For comparison, the F-35B Lightning II fighter jets ordered for the Royal Navy's new Queen Elizabeth-class aircraft carriers one of the most technologically advanced aircraft in the world will have a top speed of around Mach 1.6.)

Oxfordshire-based Reaction Engines has spent years perfecting the technology to one day take its Skylon spaceplane to the International Space Station and back. And it's the revolutionary Sabre (which stands for Synergetic Air-Breathing Rocket Engine) propelling the Skylon that has got investors excited.

One of the key problems with travelling at hypersonic speeds is the extremely high temperature at which the air enters the engines. At Mach 5, this air is heated to around 1,000. But thanks to thousands of thin-walled coolant-filled tubes within Sabre, the air is cooled to 150 in 1/100th of a second.

The heat thus removed from the air is then used to drive a compressor, which in turn produces high-pressure air for combustion. The net effect is that the engine produces so much thrust for its weight it can reach speeds of Mach 5.4 fast enough to get you to Australia in around four and a half hours.

When in "rocket mode" for space flight, the engine will use onboard liquid oxygen, and be capable of hitting Mach 25. The government has sunk £60m into the project, and BAE Systems has invested £20.6m more. Reaction Engines hopes to run further tests by 2020, and from there move on to a test flight "a veritable Kitty Hawk moment for the 21st century".

Meanwhile, on Monday of last week, its US subsidiary was awarded a contract by America's Defence Advanced Research Projects Agency (DARPA) to conduct high-temperature airflow testing of its precooler heat exchanger.

Here's the rub

There's another big problem. With speed, comes friction. And at Mach 5, surface temperatures can reach 3,000 hot enough to melt most materials. Ping Xiao, from the University of Manchester, and Xiang Xiong at Central South University in Changsha, China, along with their colleagues, think they may have come up with the answer, reports The Economist a new type of ceramic.

Ceramics are nothing new in space. Nasa's space-shuttle fleet, retired in 2011 (hence the contract with SpaceX), were encased in over 24,000 ceramic tiles to protect against atmospheric friction on re-entry into the Earth's atmosphere. The strong bonds between the atoms make ceramics heat resistant. But this property also makes them brittle, which resulted in tragedy in 2003, when damaged ceramic tiles on the Space Shuttle Columbia led to the heatshield failing, and the death of the crew.

Professors Xiao and Xiong began with a carbon-carbon composite that is, carbon reinforced with carbon fibres, which is already widely used in the aerospace industry and used a process known as "reactive melt infiltration" to infuse the composite with a liquid mixture of zirconium, titanium, carbon and boron. Put simply, this process ends up coating the fibres in a tough ceramic compound which means the material can better stand up to "ablation" erosion caused by extreme heat at hypersonic speeds.

It can also be more easily moulded. The professors' work was hailed as a major breakthrough in getting hypersonic flight off the ground although, as The Economist put it, "it is the thought that the plane you board at Heathrow at 7am will deliver you to Sydney two hours later, just in time for dinner, that will excite most people".

Putting the "shhh" in whoosh

As someone who grew up not far from Heathrow, I remember the way the house used to rattle and shake every time a Concorde flew overhead. When an aeroplane travelling at 30,000ft reaches a speed of 660mph, it breaks the sound barrier, resulting in a 30-mile-wide sonic boom, explains Thomas Black in Bloomberg Businessweek. (Concorde pilots typically waited until they were over water before doing this.) But new research means that supersonic flight shouldn't have to be this loud in future.

This summer, Nasa tested its Quiet Supersonic Technology at its Langley Research Center in Virginia. It used a high-speed wind tunnel to test a scale model part-designed by US aerospace giant Lockheed Martin. It uses "fluid dynamics modelling" to disperse sound waves over several points behind the aircraft. The end result, says Nasa, is a sound level equivalent to the background noise in a restaurant. Better yet, it will cut the eight-hour flight time between London and New York by more than half, says Bloomberg.

In August, Nasa put out to tender a five-year $390m contract to build a working demonstration model of the aircraft, known in the media as "X-Plane". If all goes to plan, tests are scheduled to begin in 2022. For now, America has a ban, dating back to 1973, on commercial supersonic flight. But having overcome both the noise and pollution objections (new planes will be greener), it's hoped the government will reconsider.

Airlines are queueing up

Commercial airlines certainly like the idea. In June, at the Paris Air Show (where Concorde debuted 48 years ago), Blake Scholl, chief executive of Boom Technology, revealed that his Colorado-based start-up had already taken 76 orders from five airlines for its supersonic aircraft, one of which was Virgin.

The other four will be named at "special events", CNBC reported. "Airlines are excited for something new and different to offer their passengers", said Scholl, adding that the reservations were backed by "tens of millions" of dollars in non-refundable payments.

At this stage, Boom is still working on the aeroplanes. It will be testing its XB-1 Supersonic Demonstrator in Denver late next year, and hopes to have the first in the air by 2023. The planes, costing around $200m each, will fly at Mach 2.2 (1,451 mph) covering the distance between New York and London in three and a quarter hours, according to Boom. Tickets will cost $2,500 each way.

It's too soon to pack your bags. But in all, over the next five to six years, there's a lot riding on hypersonic or at least improved supersonic flight becoming a reality. Below, we look at the stocks to watch.

The stocks to watch

As with many fast-moving, exciting new technologies, many of the companies most heavily involved in the sector are unlisted and therefore either difficult or impossible to access. Take Reaction Engines, for example. The company was founded in Abingdon, Oxfordshire, in 1989 by engineers Alan Bond, John Scott-Scott, Richard Varvill "The Three Rocketeers" and is probably one of the most exciting small businesses in Britain, working at the coalface of hypersonic-engine design.

It's also private. But with the patents Reaction must be clocking up, the company may well one day fall under the greedy eye of a bigger company, particular as hypersonic flight technology develops and matures.

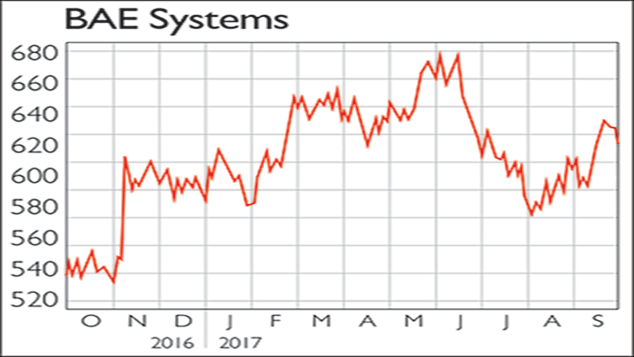

One possible future buyer could be BAE Systems (LSE: BA). The aerospace and defence company already owns a fifth of Reaction Engines after sinking £20.6m into the development of the Sabre engine in 2015.

However, concerns over BAE's order book for its bread-and-butter fighter jet business have pulled the shares down somewhat recently. The company now trades on a forward price/earnings (p/e) ratio of 14, and pays a dividend yield of roughly 3.5%. It's not hugely cheap, but the yield is attractive and as one of our biggest aerospace companies BAE is certainly likely to play a key role in the future development of hypersonic travel.

There are other options in the sector. Aerion, a private company founded by billionaire businessman Robert Bass in 2002, has teamed up with Airbus (Paris: AIR) to produce the world's first supersonic private jet the AS2.

This would not be as revolutionary as the Sabre engine the so-called "Son of Concorde" would be able to fly between London and New York in just three hours, about the same as Concorde but it promises to be a must-have status symbol for the super-rich, assuming that all goes to plan.

It will be powered by General Electric (NYSE: GE) engines when it takes off for its first test flight, scheduled for 2021. However, Airbus looks expensive on a forward p/e of 24, and while GE is cheaper on 16, it is hardly a pure play. Put these two on your watch list for better times to buy.

Lastly, Boeing (NYSE: BA) and Lockheed Martin (NYSE: LMT) are both working on secretive projects involving unmanned hypersonic aircraft with military applications the Boeing X-51 Waverider and Lockheed's SR-72 "Son of Blackbird" aircraft that would be capable of outrunning missiles. Lockheed expects the SR-72 to be in development by the early 2020s.

At a recent aviation exhibition in the US, Lockheed executive vice-president Orlando Carvalho told Business Insider that: "simply put, I believe the US is on the verge of a hypersonics revolution".

Unlike its predecessor, which was a spy plane, the SR-72 is also being developed with attack as well as surveillance in mind. Both companies, along with General Dynamics (NYSE: GD), can look forward to benefiting from Nasa's plans to share its technology with US aeroplane manufacturers.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Governments will sink in a world drowning in debt

Governments will sink in a world drowning in debtCover Story Rising interest rates and soaring inflation will leave many governments with unsustainable debts. Get set for a wave of sovereign defaults, says Jonathan Compton.

-

Why Australia’s luck is set to run out

Why Australia’s luck is set to run outCover Story A low-quality election campaign in Australia has produced a government with no clear strategy. That’s bad news in an increasingly difficult geopolitical environment, says Philip Pilkington

-

Why new technology is the future of the construction industry

Why new technology is the future of the construction industryCover Story The construction industry faces many challenges. New technologies from augmented reality and digitisation to exoskeletons and robotics can help solve them. Matthew Partridge reports.

-

UBI which was once unthinkable is being rolled out around the world. What's going on?

UBI which was once unthinkable is being rolled out around the world. What's going on?Cover Story Universal basic income, the idea that everyone should be paid a liveable income by the state, no strings attached, was once for the birds. Now it seems it’s on the brink of being rolled out, says Stuart Watkins.

-

Inflation is here to stay: it’s time to protect your portfolio

Inflation is here to stay: it’s time to protect your portfolioCover Story Unlike in 2008, widespread money printing and government spending are pushing up prices. Central banks can’t raise interest rates because the world can’t afford it, says John Stepek. Here’s what happens next

-

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?Cover Story Joe Biden’s latest stimulus package threatens to fuel inflation around the globe. What should investors do?

-

What the race for the White House means for your money

What the race for the White House means for your moneyCover Story American voters are about to decide whether Donald Trump or Joe Biden will take the oath of office on 20 January. Matthew Partridge explains how various election scenarios could affect your portfolio.

-

What’s worse: monopoly power or government intervention?

What’s worse: monopoly power or government intervention?Cover Story Politicians of all stripes increasingly agree with Karl Marx on one point – that monopolies are an inevitable consequence of free-market capitalism, and must be broken up. Are they right? Stuart Watkins isn’t so sure.