The world’s greatest investors: Philip Carret

Philip Carret was a value investor, buying stocks in obscure companies that he felt were undervalued, aiming to at least double his investment.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Philip Carret was born in 1896 in Massachusetts. After World War I he worked as a financial reporter before setting up the Pioneer Fund, oneof the first investment funds, in 1928, which he managed until stepping downin 1983. In 1963 he set up Carret & Company, which focused on private accounts, and was still managing portfolios until shortly before his death in 1998.

What was his strategy?

Carret was a value investor, buying stocks in obscure companies that he felt were undervalued, aiming to at least double his investment. As well as a cheap price, he liked the companies he invested in to have good balance sheets, growing earnings and managers who invested in the company. He was also a firm believer in "buy and hold".

Did this work?

Over 55 years the Pioneer Fund returned about 13% a year, which meant that a $10,000 investment would have been worth $8m by the time Carret stepped down in 1983. In contrast, the US stockmarket produced an annual return of 8.3% between 1928 and 1983, which means that a similar amount invested in it would be worth $723,000. Carret's record as a private wealth manager isn't available, but he was managing about £225m in assets during the early 1990s. Warren Buffett called him one of his heroes.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

What were his biggest successes?

Carret made a lot of money buying into a Cuban sugar company in 1939, on the belief that World War II would drive prices higher. At various points during the 1940s, he sold the stock for 37 to 144 times the asking price.

What lessons are there for investors?

Carret had 12 pieces of advice for investors. 1. Never holdfewer than ten shares covering five different fields of business.2. Reappraise every share you hold every six months. 3. Keep at least half of your fund in income-producing securities. 4. Consider yield the least important factor in buying stocks. 5. Take losses quickly, but let profits run. 6. Don't put more than 25% of your fund in securities where information is not regularly available. 7. Avoid inside information. 8. Seek facts, not advice. 9. Ignore mechanical valuation formulas. 10. When stocks are high, place at least half of your assets in short-term bonds. 11. Don't borrow too much money. 12. Set aside some of your funds to buy long-term options on promising companies.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets

-

The Stella Show is still on the road – can Stella Li keep it that way?

The Stella Show is still on the road – can Stella Li keep it that way?Stella Li is the globe-trotting ambassador for Chinese electric-car company BYD, which has grown into a world leader. Can she keep the motor running?

-

How to pay for the pandemic

How to pay for the pandemicOpinion Covid-19 has proved extremely expensive. It’s time to consider fresh sources of government revenue, says Edward Chancellor

-

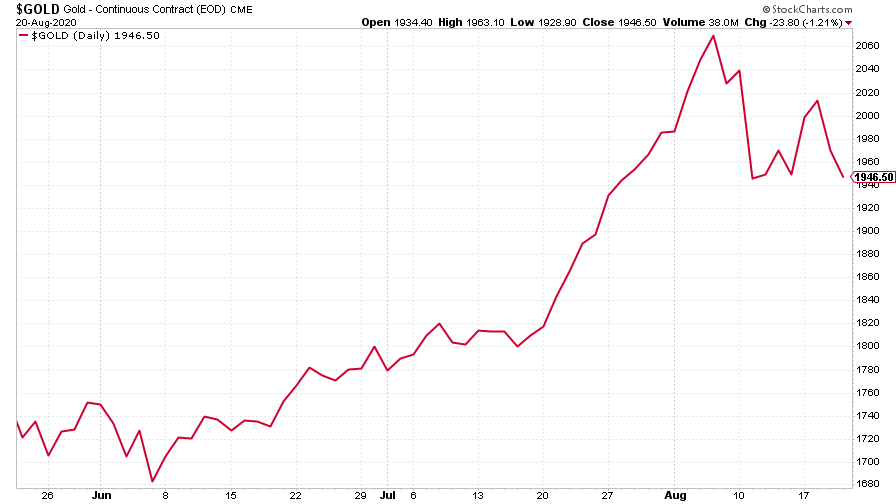

The charts that matter: gold dips after Buffett buys in

The charts that matter: gold dips after Buffett buys inCharts Warren Buffett bought into gold's bull market just as the price slipped again. Here's how the charts that matter most to the global economy reacted.

-

Buffett’s bet: can a tracker trounce the hedgies?

Buffett’s bet: can a tracker trounce the hedgies?Features There’s no sense in handing 1%-2% plus fees to fund managers when a cheap tracker gets results, says Stephen Connolly.

-

Why gold really is your best defence

Features Gold is still scorned by many investors. But they're missing the point of owning gold. With inflation rising and government debts out of control, it's not something you should be without, says Merryn Somerset Webb.