How to cash in on the UK’s general election by the end of this week

The general election is unlikely to deliver the surprises of the EU referendum or the US presidential election. But you could still make money from it. Dominic Frisby explains how.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Whoever wins the general election tomorrow, you will be the one who pays.

Whether it's Theresa May or Jeremy Corbyn, taxes are going to go up (by quite a bit under the former, and by quite a lot under the latter).

The best way to play this is by investing in a company that provides efficient tax collection software although I'm not sure such a company exists.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In the meantime, we look at the next best way to play the British election and perhaps the easiest way to make (and lose) money over the next 48 hours.

That is via a punt at the bookies

Corbyn copies Trump May turns Clinton

The two big elections of 2016 Brexit and Trump were profitable nights in the Frisby household, so I'm perhaps a little over-excited about this one. (Note to self: don't get cocky.)

This election will not, I think, deliver the surprises of the previous two. Or if it does, I suspect the surprise will be rather like 2015 and 1992 more people will vote Tory than expected.

I get that Corbyn has run a good campaign. The speeches he's given have been good (those that I've seen, at least). He's shown character. He's been clear on his policies. The manifesto has been deemed strong.

Gaffes have been kept to a minimum. His only car crash was on Woman's Hour. The liability that is Diane Abbot has been kept, as far as reasonably possible, out of the limelight. And, for good or bad, John McDonnell, the shadow chancellor, has also been absent conspicuously so.

All in all, the campaign has shown a quality not previously associated with Corbyn and his team: that of discipline.

Theresa May and her team, meanwhile, seem to have made the mistake of copying rather than learning from the mistakes of Hillary Clinton. May has come across as a technocrat, at a time when "real" human beings have provoked a much more positive response from voters.

She tried to rise presidentially "above" grotty campaign demands such as debates, but in doing so she has distanced herself from the people, rather than appear like one of them. Her every instinct is not to commit on anything that's got her where she is today and it makes her less vulnerable but again, it also makes her appear removed and less human. Her repetition of rehearsed mantras and platitudes have had the same effect.

Despite all of that, Corbyn's message much higher taxes and much more government is one that I just don't think the majority of the British people want to hear. And so my view is that May will win although not by as much as she could have done, had she played this better.

The surprise, if we get one, will be that she does, in fact, win by the margin that was anticipated when campaigning began.

So that's my projection. How am I going to play all that?

What's the best punt on the election?

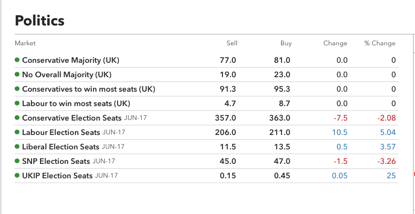

These are the prices currently being offered mid-afternoon on Tuesday 6 June:

I can buy a Conservative majority at 81. That means for a £1 per full point bet, I'll make £19 if they get a majority, but lose £81 if they don't. It's around 4:1 against effectively. I think the Tories will get a majority, but there's still that nagging doubt that we'll get a hung parliament, despite what I've just said above. I'm not sure I want to take that risk.

Hey, I'm a human being, not a politician: I'm allowed to be inconsistent.

The reverse of that bet is no overall majority a hung parliament. I can buy that for a pound at 23 and make £77 if it happens, and lose £23 if it doesn't. (That's not far off where Leave was coming into the Brexit vote, by the way.)

Next comes the bet I like the most: the Tories to win the most seats. I can buy that at 95.3, so, for a £1 per point bet, I'll only make £4.70. But if Labour win the most seats, I'll lose £95.30.

The odds are against me. But Labour are not going to win the most seats. As sure as eggs are eggs, the Tories are. The only question (in my mind at least) is whether it will be an overall majority (and by how much) or a hung parliament.

You can take the other side of the bet and make big bucks betting on Labour to win the most seats. But it isn't going to happen.

So, to the number of seats each party will win. That's where, to my mind at least, it looks a bit more risky. According to the current odds, the Tories are projected 357-363 seats, which is about 30 better than now. That looks about right to my limited knowledge, as do the predictions for the other parties. I can envisage scenarios where they all get a little bit more or a little bit less than anticipated. But there's nothing compelling enough here to make me want to bet.

I can't help smiling at Ukip's 0.15-0.45 of a seat. So if you bet £1 on Ukip, the most you can lose is 45p, but for every seat they win you'll get a pound. It's, effectively, a bit better than 2:1 that they'll win even just one seat which I don't suppose is a bad bet. I've had a small flutter. More so I can tell my friends about it in the pub.

So of all the bets listed there, I think that Tories to win the most seats looks like the best bet to me. Even although the odds are rubbish as I say, I'm told they are better with Betfair, so do your own research it looks like the safest return.

Here's another way of looking at it. Risk an entire pot to make 4.7% (or better from another bookie) in two days. In this case, I think it's a risk worth taking.

In the meantime, happy voting.See you under the next parliament.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King