High-yield bonds are heading back to junk

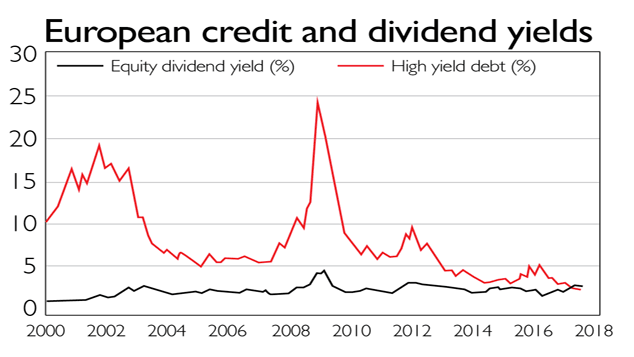

Yields on high-yield bonds have fallen so far in Europe that they are lower than the dividend yield available on equities.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

"Equities are the new high yield," says Ioannis Angelakis of Merrill Lynch. Yields on high-yield bonds (the riskier part of the debt market, often known as junk bonds) have fallen so far in Europe that they are lower than the dividend yield available on equities. And while US junk bond yields remain higher than dividend yields, the trend there has also been down. "Investors are getting the lowest yields on the riskiest bonds in almost three years, another sign of the high level of complacency in financial markets," says Jeff Cox on CNBC.

Low default rates on junk bonds, coupled with low interest rates on both sides of the Atlantic, have attracted yield-hungry investors into riskier parts of the credit market. This has helped push up bonds prices and delivered stellar returns in recent years but that's unlikely to continue in future, Percival Stanion of fund manager Pictet tells Bloomberg. "This is an asset class we have loved for a number of years. Now you have to believe in a very benign outcome for government yields, default rates and recoveries. That is a foolish way to invest Prices have become irrational."

That's because for several decades, "high-yield bonds have been one of the best-performing asset classes on a risk-adjusted basis of any in the world", says Fraser Lundie of investment firm Hermes in the Financial Times. But "like all things too good to last, capital markets have come to chew the fat off this remarkable record". Firms are increasingly issuing bonds that offer both far lower potential returns and far less protection for buyers. That bodes poorly once the credit cycle turns. "It is ironic that an asset class that has taken decades to rid itself of the unflattering junk' tag now finds itself in a state more likely to exhibit junk status than ever before."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

James has previously written about financial markets for MoneyWeek. He has a bacherlors degree in management and he has been awarded an investment advice diploma by The Chartered Institute for Securities & Investment (The CISI). James then worked at Moran Stanley as a U.S. Equity Sales Analyst for two years, then moved into hedge fund sales and investor relations at 36 South Capital Advisors, and then became the Global Multi-Asset Sales at Credit Suisse. Now, James is the Associate Director of US Equity Sales at Oppenheimer & Co. Inc, where he is responsible for servicing a range of clients including asset managers, hedge funds and wealth managers.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.