Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

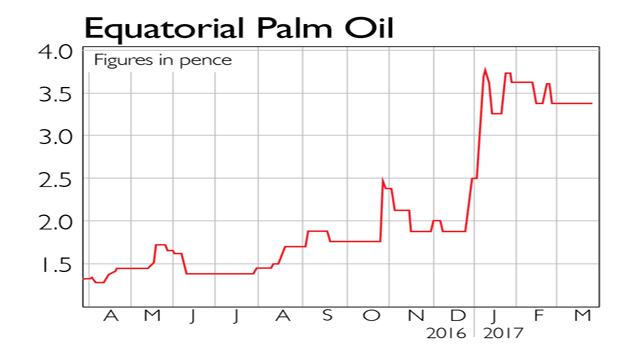

Equatorial Palm Oil (Aim: PAL) produces crude palm oil from its two estates in Liberia. It is 60% owned by the Malaysian agricultural giant, KLK, and has recently started planting again after a two-year land development moratorium; it is also building a palm oil mill. In the year to 30 September it made a pre-tax loss of $1.276m, down from $1.391m the previous year. Since listing in 2009, the share price has fallen by more than 70%, but in the last year it has rallied by more than 140%.

Be glad you didn't

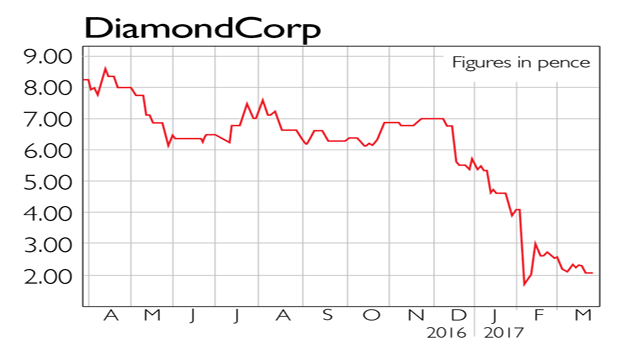

DiamondCorp (Aim: DCP) is a diamond producer operating the Lace mine in South Africa. The company says it is "focused on maximising shareholder value" through development of its "high-margin diamond production assets". It listed on Aim in early 2007 and shortly after peaked at just over 100p. Since then, it's been downhill all the way. The shares now stand at 0.5p, a loss of more than 99%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King