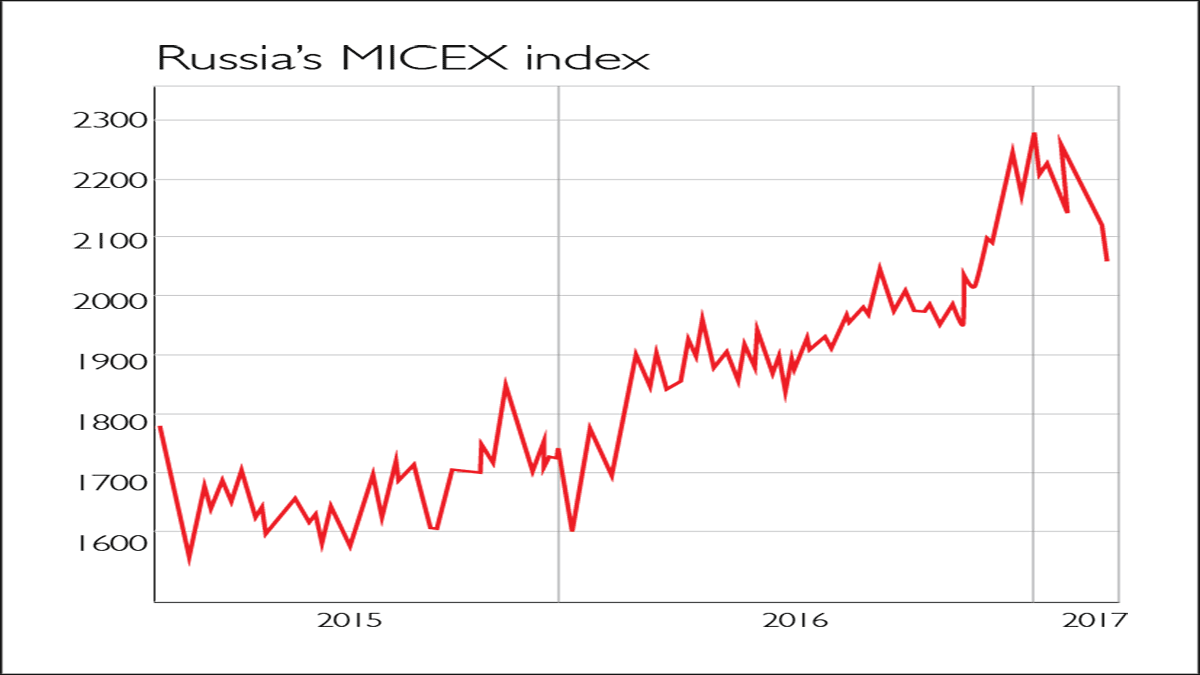

Chart of the week: Russia will get back on course

Russian stocks have slid recently, but the outlook remains favourable. The economy has stabilised and is slowly emerging from recession; there is ample scope for the central bank to stimulate the economy; and the market is still cheap.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Russian stocks have slid recently, but the outlook remains favourable. The economy has stabilised and is slowly emerging from recession, helped by the gradual rebound in the price of oil, Russia's key export.

There is ample scope for the central bank to stimulate the economy. Inflation is under control it has fallen below 6% but interest rates are still at 10%. The political backdrop is stable, albeit authoritarian, and America's President Trump could loosen sanctions against Moscow.

The market is also still cheap on a cyclically adjusted price-earnings ratio of six.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Viewpoint

"Sentiment remains frothy The [latest US] Investors Intelligence poll of advisers found 61.2% bullish, a shade lower than the 62.7% reading a couple of weeks earlier, which was the highest since December 2004 [Yet] amid the equity market's seeming complacency, the action in global bond markets suggests something else. The ten-year US Treasury yield ended [last] week at 2.317%, the lowest since late November, despite the reflation trade in stocks Even more startling was the slide in the German two-year yield, to minus 0.95%... amid growing concern about France's coming presidential election. While stock investors are smiling at daily Dow records, the bond crowd seems to be hunkering down.

Randall W. Forsyth, Barron's

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how