Beat the crowd into Japan’s bull market

As the yen weakens, stockpickers and Chinese tourists will be eager to get back into Japan. Canny investors should be first in line, says Rupert Foster.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

As the yen weakens, stockpickers and Chinese tourists will be eager to get back into Japan. Canny investors should be first in line, says Rupert Foster.

I last wrote about Japan for MoneyWeek in July 2015 with my head full of optimism about Abenomics, and my belly full of shochu aisu (a Japanese alcoholic beverage). From reading the Western media since then, you might feel that my high hopes were unjustified. I would argue that the Western press has once again misunderstood what is happening in Japan. In fact, I expect foreign investors to return to Japan in their droves, pushing its stockmarket much higher. Before I explain why, let's review what's happened since 2015.

In August of that year, global markets began to correct. Japanese stocks which were rather overbought at the time were no exception. Global investors, who had been expecting further interest-rate rises in the US and more money printing in Japan, began to fear that neither force would have quite the impact on asset prices that they had hoped. As investors became more cautious, the yen strengthened, from 122 to the dollar in November 2015 to 100 in September this year. The stronger currency hit Japanese exporters' profits in the six months to the end of September, Japanese companies' earnings fell by 12.2%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Meanwhile, Bank of Japan boss Haruhiko Kuroda, who took Japanese rates negative at the start of the year, seemed to change his mind about the efficacy of this plan but without fully explaining his alternative plan for jump starting the Japanese economy. As a result, while the MSCI Japan index has done well in US dollar terms this year because of the yen's strength, in local currency terms, all Japanese indices have lagged their Western rivals due to fears that monetary policy has hit a brick wall.

However, all that's now changed. Donald Trump's election as US president has brought on a bout of dollar strength as investors become increasingly convinced that the Federal Reserve will raise US interest rates next month. The yen has weakened from 103 to 109 against the dollar during this month alone. That means it has already reversed almost half of last year's move. Japanese corporate profits in the second half are now likely to be higher than currently expected. Companies had already been anticipating a cost-cutting-driven recovery in the second half. If the yen stays at current levels, or weakens even further, we could see a 10%-20% improvement in profitability on a half-on-half basis.

That should appeal to global investors, who are the key players in Japan's stockmarket, holding 30% of stocks in total. So far in 2016 they have sold $72bn of Japanese equities, but that looks set to reverse. Most other major players in Japan's market are net buyers and look set to remain so. Companies have bought back $50bn of their own stock; Japan's main government pension scheme, the GPIF, has bought a further $44bn of domestic equities; and Kuroda has been buying Japanese equities via exchange-traded funds (ETFs) at a rate of about $58bn a year. The only phenomenon offsetting all of these buyers is cross-shareholder unwind (where companies sell down their stakes in each other see the box on the left), but this proceeds at a more pedestrian pace. Meanwhile, in the US, Trump plans to splurge on infrastructure, and to free up mass-market credit creation by abolishing various financial regulations. Thus global growth may well get a US-driven boost in 2017 good news for Japan, which is the developed market most geared to global growth.

Change you can believe in

So it makes sense to buy Japan based simply on the weakening yen, foreign buying and improved global-growth expectations. But are there also reasons for longer-term optimism? Let's remind ourselves of the point of Abenomics, the economic strategy followed by Japan's prime minister, Shinzo Abe. After Japan's epic asset bubble burst in 1990, the country endured 15 years of deleveraging, falling asset prices (mainly in property, but also stocks), and falling nominal wages. This painful recalibration of Japan's ambitions and its people's hopes saw risk-aversion take hold among companies and individuals. Junichiro Koizumi, prime minister from 2001 to 2006, tried to inject life back into the economy and created something of a real-estate boom. However, the 2008 financial crisis, then the 2011 Tohoku earthquake, snuffed out any sign of a bounce. Meanwhile, global trade and growth struggled after the financial crisis, so there was nothing pushing Japan's export-driven economy forward.

When Abe came to power in 2012, his goal was to boost the appetite to consume and invest among Japanese citizens (who are sitting on $8.8trn in their current accounts) and companies (with cash of $2.6trn) by rekindling optimism. One way was to reflate the economy (helped by Kuroda), but he also wanted to inspire the Japanese people through patriotism. This stance looks prescient given the arrival of Trump in the White House. Japan will increasingly have to take responsibility for its own defence, but this may be the making of the country. Many of Japan's older generation abhor any hint of a return to militarism, but the younger generation needs something to make them proud to be Japanese. Abe now has the parliamentary majority needed to push through the constitutional change that would make Japan a normal military power again expect this to happen in the coming months.

Elsewhere, Kuroda has been using aggressive monetary policy to reflate the economy. Nominal GDP growth in 2015 was 2.2%, and third-quarter GDP is running at the same rate. Japan has been through its balance-sheet recession, and has been creating new private credit for a number of years. Land prices in Japan have begun to rise, particularly in Tokyo and Osaka. Prices of condominiums in Tokyo are up 20% since Abe's election. In 2015 Tokyo commercial property was up 4.8%. And this year, amid a boom in Chinese tourists shopping in Ginza (Tokyo's most upmarket shopping district), a property there was finally valued at a higher price than during the 1980s bubble. Kuroda has now moved from quantitative easing to qualitative easing. He is no longer guaranteeing to buy a specific quantity of assets, but is instead targeting a ten-year bond yield of 0% until inflation becomes firmly entrenched. This is effectively an open-ended commitment, and the global spike in bond yields following Trump's election has already pushed Kuroda to defend the target. In theory, if the market challenges his promise, he will have to be much more aggressive in his buying, which would make the case for buying Japanese equities even more obvious.

Abe has also had some success with boosting female participation in the workforce, now only 1% behind that in the US. However, this improvement cannot change the overall size of the working-age population, which has fallen by an incredible 10% over the last 15 years. The total population of workers is only being bolstered by an increasing population of over-65s still in work. Currently, 29% of Japanese workers work beyond official retirement age. That's behind Korea's 42%, but way ahead of the typical European country just 3% of French workers go on working beyond retirement age. Of course, a shrinking population means GDP per head in Japan has, since 2000, actually grown at a faster rate than that of the US.

This is a valuable reminder that the notion that Japan has been a "basket-case" economy since 1990 is mistaken. The stockmarket has been a trading market at best, and the economy has been through a painful retrenchment but the effects have been successfully masked from most of the population. Since 1990, real median household incomes in Japan have risen at twice the pace of the US, and only a little more slowly than the UK. The unemployment rate is 3% and youth unemployment 6%. There is little sign of disaffected populism in Japan.

In recent years, Japan has seen a construction boom as Tokyo prepares for the 2020 Olympics, and casinos are set to be legalised for the first time amid an expected influx of Chinese tourists. The growth in Chinese tourism has slowed this year, due to the stronger yen and efforts by China's government to discourage capital outflows by restricting the use of credit cards overseas. But with the yen weakening, I'd expect growth to reaccelerate. Given that just 5% of the Chinese population currently has a passport, this tourism boom is in its infancy.

There are some caveats. Japan remains a highly industrialised economy. Historically its strongest sectors have been electronics, factory automation and cars, all three of which face threats to growth. As the smartphone boom ends, investment growth in the electronics sector may wane, with the much-touted "internet of things" likely to prove a disappointment. Factory automation relies on the car industry for 50% of its demand. But electric cars have far fewer metal machined parts than today's cars, so as their sales grow, demand for such parts will collapse. The advent of electric cars will also lead to a restructuring of the industry, which could hurt Japan's global market share.

Yet Japan remains cheap on 12 times earnings, at a time when earnings growth is accelerating, dividend payouts are rising, and between them, firms and the central bank are buying up 3% of the market a year. Any growth shocks in the West (perhaps caused by upsets at European elections next year) will delay the positive effects of change, but Abenomics now has a strong enough head of steam that one can safely predict Japan will emerge from any general market retrenchment much faster than the West. This week Rakuten, Japan's top online retailer, announced it would be the main shirt sponsor for Barcelona for the next four years, fighting off many global rivals. Hopefully this is just the start of a new-found optimism from corporate Japan.

Rupert Foster was an Asian equities fund manager for 20 years. He is now an investment strategist.

Japanese stocks and funds to buy now

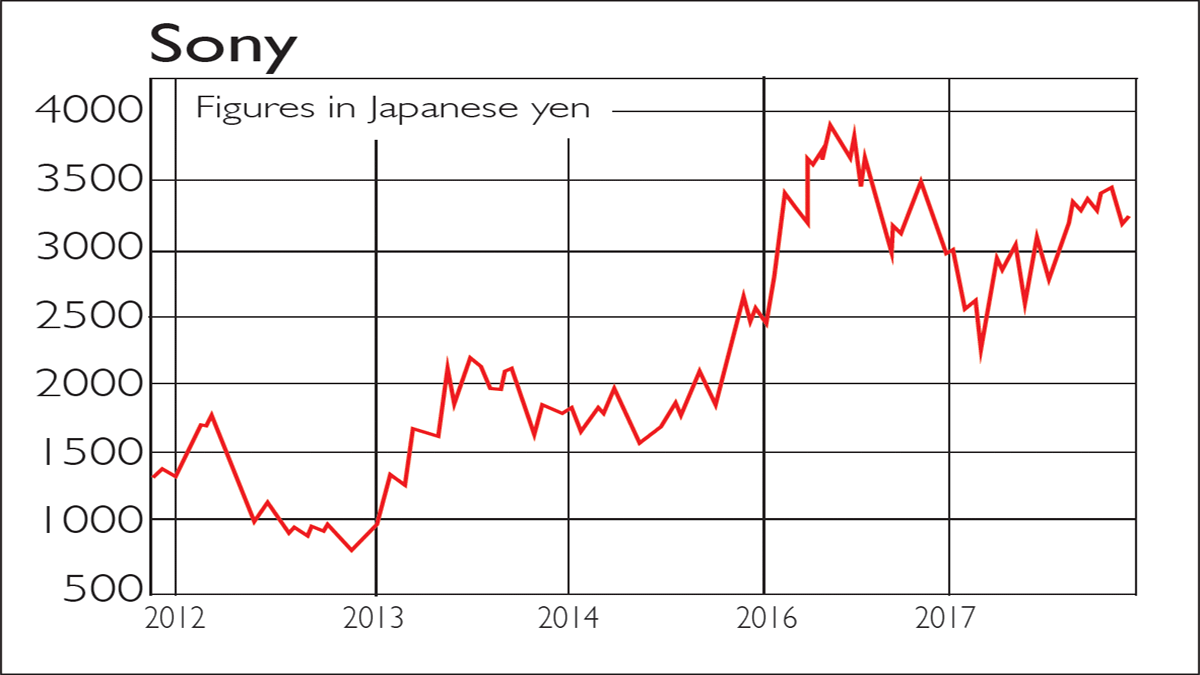

Electronics giant Sony (Tokyo: 6758; NYSE: SNE) represents many of the best attributes of Japan. It is a big beast that is progressing through a brutal cost-cutting operation, but is now starting to invest aggressively again, and has high ambitions for renewed global dominance in selected areas. The company is one of the leading players in virtual reality its Morpheus headset is likely to be the dominant player for the next few years because of its compatibility with an installed base of 45 million PlayStation games consoles. Sony's combination of in-house video games, music, films and hardware is finally likely to pay off in the new content-driven world.

Fast Retailing (Tokyo: 9983) is Japan's answer to M&S. The company is now rapidly expanding in China and the southeast Asia region and looks likely to be the most successful foreign brand in both. Domestically, the company continues to be a great play on the likely upside to Japanese consumption in the years ahead.

Isetan Mitsukoshi (Tokyo: 3099), meanwhile, is the Harrods of Japan. It is opening duty-free stores that make it a great geared play on booming Chinese tourism to Japan.

If you're looking for a broader play, several Japanese equity ETFs offer a cheap and easy way to invest in Japan. If you prefer to hedge your currency exposure (as I do), the iShares MSCI Japan GBP Hedged UCITS ETF (LSE: IJPH) is one option. Alternatively, if you favour unhedged exposure (you make less on the upside if the yen weakens as stocks rise, but are somewhat cushioned should the yen strengthen and stocks fall), then the iShares MSCI Japan (LSE: IJPN) is the unhedged version. On the actively managed fund side, the Invesco Perpetual Japan Fund and the JO Hambro Japan Fund are both attractive, but my personal favourite is the Baillie Gifford Japan Smaller Companies Fund, which I feel has superior stock selection skills and slightly more zing. The fund was up 56% in the year to end-October and has an ongoing charge of 0.63%.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is an investment strategist and adviser at J & C Foster, providing Asian, Consumer and Global Equities Strategy advice to a number of family offices and portfolio management organisations. He writes on Asia and Global Macroeconomics for a number of investment publications including MoneyWeek and HL Investment Times.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how