This metal is enjoying one of the quietest bull markets of 2016

Zinc isn’t a glamorous, rare or particularly controversial metal. But it’s had a stellar year so far. Dominic Frisby examines way, and picks the best ways to buy in.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today we turn our attention to a metal which often passes without notice.

It isn't glamorous like gold or silver, nor is it rare like platinum or rhodium.

It isn't controversial like uranium, strategic like tungsten or cobalt, nor even widely talked about like iron or copper.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But it has, quietly, had a stellar 2016. It's currently up almost 60%.

Today we're talking zinc

Zinc is in short supply

Here's the chart. If there's a clearer uptrend in any asset class this year, I'd be glad to know what it is.

All of the usual factors have been driving the price. Firstly, there's a lack of supply. China is the world's top producer, contributing some 37% of global supply last year. However, last year it shut down some 26 lead and zinc mines for environmental reasons.

In addition, Australia's Century mine and Ireland's Lisheen mine, which between them produced about 5% of the global supply of zinc, have shut down due to depletion. Meanwhile, Glencore Xstrata's Perseverance and Brunswick mines also recently closed.

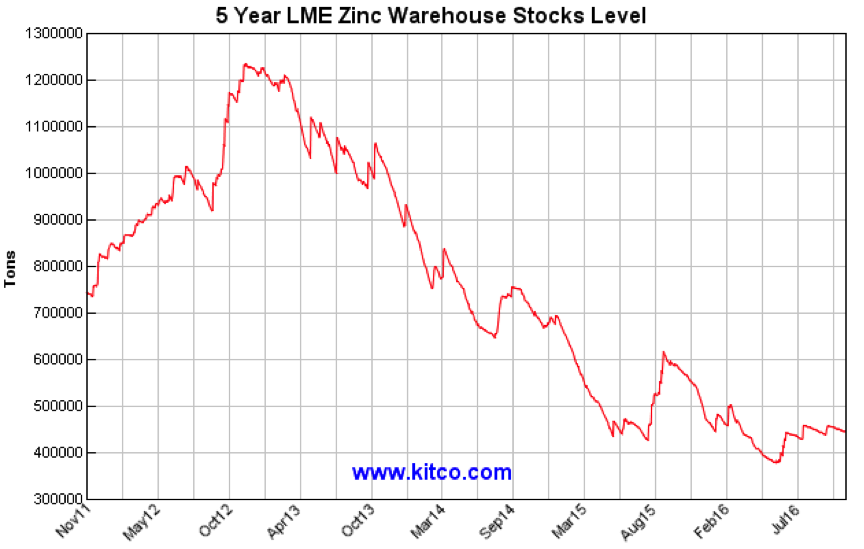

The amount warehoused at the London Metal Exchange (LME) has fallen steadily. This chart shows LME stocks over the last five years. You can see how supply is falling each year.

As the zinc supply has dwindled, so the price has risen and there's nothing like a rising price to bring in more buyers.

The next chart is for diehard zinc nerds only the rest of you can skip it. It comes from Nick Laird over at sharelynx.com and plots the zinc price in black over LME supplies in blue since 1971.

The relationship between LME stockpiles and price is not as pure and simple as you might think, but, as I say, this chart is for the interest of zinc buffs only. The rest of us can move on.

After iron, aluminium and copper, zinc is the fourth-most-used metal in the world. (Although be aware that in some years this title falls to titanium). Annual zinc demand stands at 13.4 m tonnes.

Per year, it is a $34bn market. To put that number in some kind of perspective, silver is about an $18bn market and platinum just $8bn. Copper meanwhile, is closer to $150bn.

What is zinc used for?

Galvanising

Batteries

Solder

Nickel-silver

Almost half of annual zinc demand comes from China, which is still building buildings and bridges, despite its economic slowdown. And if Donald Trump's proposed infrastructure splurge comes to fruition, you can expect US zinc demand to grow considerably in the coming years. Zinc is a beneficiary of government infrastructure spending.

How to buy zinc

ETF Securities

Alternatively, you can go down the individual company route. BHP Billiton (LSE: BLT) is the world's largest producer, although, of course, it produces many other commodities as well, so it is not a pure zinc play. I like BHP and, like zinc, it is in a strong uptrend. At 1,326p it has more than doubled from its lows of below 600p at the start of the year.

Other large, UK-listed zinc producers include Anglo-American (LSE: AAL), Vedanta (LSE: VED) and KAZ Minerals (LSE: KAZ). All of these companies are in strong uptrends, and the last in particular is on a bonanza run, so caveat emptor.

A purer play might be Griffin Mining (LSE: GFM), which owns just under 90% of an operating zinc-gold mine about 300 miles north west of Beijing. However, while I'm mentioning the company, that does not constitute a recommendation if you're keen on the theme, then it's one to do your own further research on. Otherwise I'd stick with one of the bigger players.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

These 2 stocks are set to soar

These 2 stocks are set to soarTips The returns from these two aluminium and tin stocks could be spectacular when the commodity cycle turns says David J Stevenson.

-

The best ways to buy strategic metals

The best ways to buy strategic metalsTips Weaker prices for strategic metals in the alternative-energy sector are an investment opportunity, says David Stevenson. Here, he picks some of the best ways to buy in.

-

A lesson for investors from a ill-fated silver mine

A lesson for investors from a ill-fated silver mineAnalysis Mining methods may have changed since the industry’s early days, but the business hasn’t – digging ore from the ground and selling it at a profit. The trouble is, says Dominic Frisby, the scams haven't changed either.

-

The natural resources industry is in a tight spot – which is bad news for the rest of us

The natural resources industry is in a tight spot – which is bad news for the rest of usOpinion The natural resources industry is in a bind. We need it to produce more energy and metals, but it has been starved of investment, plagued by supply chain issues, and hobbled by red tape. That’s bad news for everyone, says Dominic Frisby.

-

How to invest in the copper boom

How to invest in the copper boomTips The price of copper has slipped recently. But that’s temporary – the long-term outlook is very bullish, says Dominic Frisby. Here, he explains the best ways to invest in copper.

-

Why investors should consider adding Glencore to their portfolios

Why investors should consider adding Glencore to their portfoliosTips Commodities giant Glencore is well placed to capitalise on rising commodity prices and supply chain disruption, says Rupert Hargreaves. Here’s why you should consider buying Glencore shares.

-

How to invest in the multi-decade boom in industrial metals

How to invest in the multi-decade boom in industrial metalsTips The price of key industrial metals has already begun to rise. The renewable energy transition will take them higher, says David Stevenson. Here's how to profit.

-

Avoid China’s stockmarket – here’s what to invest in instead

Avoid China’s stockmarket – here’s what to invest in insteadOpinion China’s stockmarket is not a good place for investors to be. But you can't just ignore the world's second-largest economy, says Dominic Frisby. Here, he picks an alternative China play.