Globalisation in retreat

World trade is stagnating and protectionist populism seems to be on the rise. Is this the end for globalisation? Alex Rankine reports.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

World trade is stagnating and protectionist populism seems to be on the rise. Is this the end for globalisation? Alex Rankine reports.

What's happening to global trade?

It is stagnating, both in absolute terms and relative to global GDP. Global Trade Alert reports that the volume of world trade failed to rise between January 2015 and March 2016, even though the world economy was growing as a whole. Meanwhile, the Peterson Institute for International Economics has found that world trade as a percentage of global output has been flat since 2008.

If the numbers are accurate then this would be the longest period of such stagnation since World War II. Cross-border investment also seems to be going backwards. The stock of cross-border assets (a measure of international investments) was worth 57% of global GDP before the 2007 financial crisis, says the FT. That number had fallen to just 36% by 2015. Foreign direct investment between countries is also well down from its 2007 levels.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

What about trade deals?

Little progress has been made. The Doha round of World Trade Organisation talks launched in 2001 and aimed to achieve a deal between developed and developing countries that included agriculture, manufacturing and services. But after 15 years, the parties have little to show for their efforts. With the failure of talks at a global level, countries and trade blocs have been looking to make more limited deals with each other, but even these are now in trouble. The EU-US TTIP agreement looks unlikely to pass and Hillary Clinton has vowed to kill off the Obama administration's new Trans-Pacific Partnership (TPP), a deal that she herself had helped to negotiate.

Is this a problem?

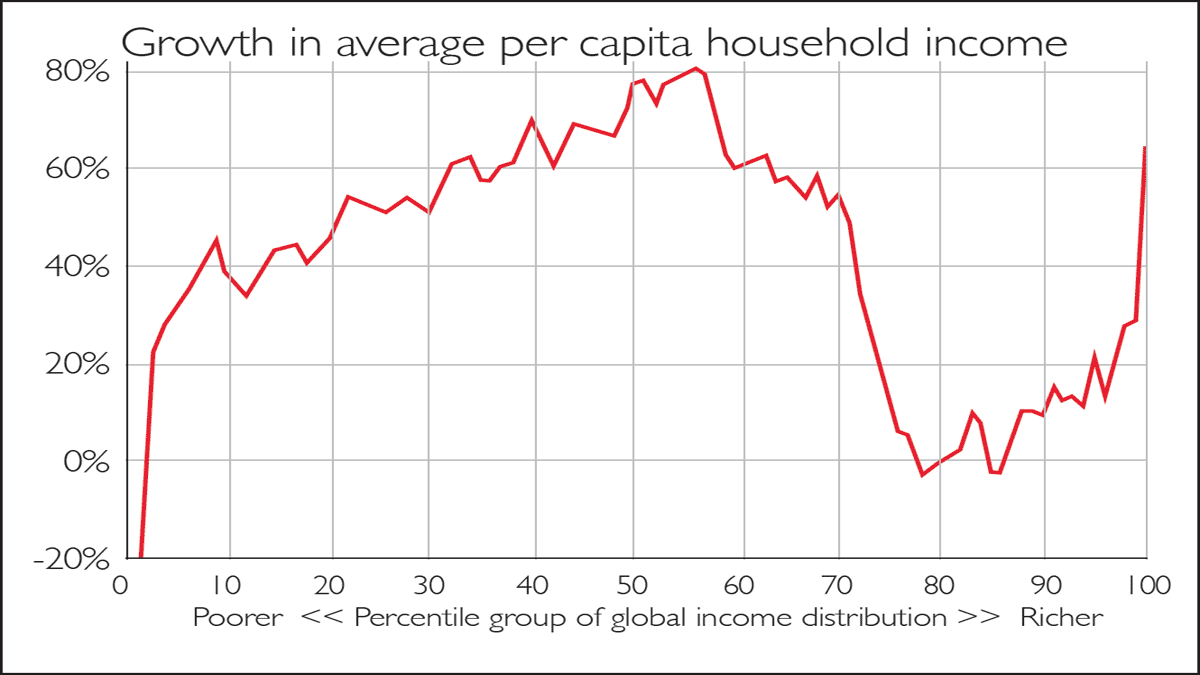

It depends who you ask. Opponents of globalisation say that although global trade has brought prosperity to some, the middle classes in developed countries have been hollowed out, as shown by the "elephant chart" (see box). Rising global competition has meant that old middle-class jobs in the West have been replaced by lower-paid and more precarious work. Indeed, in the US median household income is still lower than it was in 1999 in real terms, suggesting that the US middle class has not seen its living standards rise at all since the millennium.

Is there another side to the story?

Proponents of globalisation point out that income growth for middle earners is now picking up, with the average UK worker seeing pay rises above inflation and the US federal government last year recording the biggest increase in household incomes since 1965. Crucially, this rise was concentrated in lower- and middle-income groups, the demographic that globalisation was supposed to have left behind. Nevertheless, it is hard to deny that economic gains since 2000 have not been evenly shared, with middle earners particularly affected.

What else might be to blame?

The great recession and its aftermath dealt a severe and lasting blow to incomes across the developed world. The Institute for Fiscal Studies reported last year that average UK incomes were finally back to pre-crisis levels a full seven years after the crisis began. For working-age households the situation is even worse, with their real incomes still lower than they were in 2007. Younger households are particularly sensitive to Britain's high housing costs, and lower-income groups have been affected by changes in government welfare policies in recent years. This suggests that economic shocks and domestic policy choices are more to blame than globalisation for the middle-class malaise.

What about the politics?

There are signs that politicians and voters are turning against free markets in favour of renewed protectionism. The rise of Donald Trump and his vociferous anti-trade rhetoric in the US is a prominent example; the vote for Brexit is often cited as another. However, the new anti-trade stance goes much wider than English-speaking countries. The Global Trade Alert database recorded that 539 different protectionist measures were adopted by governments worldwide in the first ten months of 2015 alone.

Such measures are usually not as crude as old-school tariffs, but focus on bringing in regulations, controls and rules that make it harder for foreign companies to invest and sell across borders. With a rising China challenging the US for economic leadership, some think that the liberal global trading order could now be entering its twilight years. We could be at a turning point for globalisation.

A misleading elephant

Described as "the most powerful chart of the last decade", the elephant chart so called because it looks like an elephant with a trunk curving upwards purports to show how different income groups (poorer on the left, richer on the right) around the world have seen their incomes change in recent years.

The high elephant's back is the rising middle class in nations such as China, while the raised trunk shows that the global super-rich have also seen high income growth. However, the Western middle class who fall around the lower part of the trunk have seen much lower income growth. That said, not all agree with the findings: the economist Adam Corlett has sought to debunk the chart, arguing that if you strip out Japan and former soviet states then the chart shows that middle-class incomes have in fact grown steadily in recent years.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn