Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

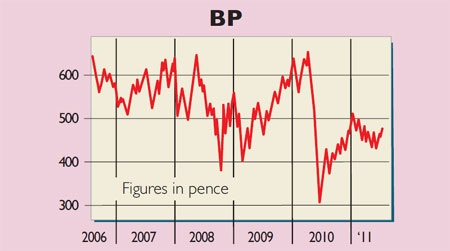

Oil giant BP announced second-quarter profits of $5.6bn on Tuesday, a considerable improvement on record losses of $17bn a year ago. But this turnaround failed to impress investors sufficiently: total production figures disappointed and the company's dividend remained low. The news sent BP shares sliding, ending the day 2.4% down.

What the commentators said

BP has made remarkable progress in recovering from last year's catastrophic Gulf of Mexico oil spill, and the company and its new chief executive Bob Dudley "are back from the brink", said Sylvia Pfeifer in the Financial Times. "However, the news was not good enough for some." Investors have not fully appreciated that this would be a self-confessed "year of consolidation" for BP and are demanding "more radical ways to unlock value". Many are calling for the company to follow the lead of US group ConocoPhillips by permanently splitting its refining and marketing division from the exploration and production business.

Yet all is not lost, argued Alison Smith in the Financial Times. The company's drop in output can be largely explained by its lack of drilling activity in the Gulf of Mexico. Future cash flow looks promising. Optimists can equally well say that BP looks set to continue moving from "strengthening to strength".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how