Central bankers are destroying capitalism

If central bankers push interest rates any lower, they risk undermining the social order upon which the capitalist system rests, says Ed Chancellor.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Central bankers justify ultra-low interest rates on the grounds they help to stave off deflation. One of the well-known consequences of deflation is that corporate profits become depressed. This happens because wages tend to fall more slowly than other prices.

By the same token, mild deflation boosts the purchasing power of incomes. As economist Alfred Marshall pointed out, a fall in the price level "tends almost imperceptibly to establish a higher standard of living among the working classes, and to diminish the inequalities of wealth".

Modern monetary policy, however, is working in the opposite direction. By arresting the tendency towards falling prices, low interest rates have boosted profits and depressed real incomes. In recent years, US corporate profits as a share of national income have climbed to a level last witnessed in 1929.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Wage growth in most developed economies has lagged productivity for many years. McKinsey Global Institute finds that over the past decade around two-thirds of households in advanced economies, comprising over 500 million people, have seen their real incomes flatline or shrink.

Quantitative easing and other unorthodox policies implemented since the financial crisis have exacerbated wealth inequality. US household wealth recently climbed to record levels relative to GDP. Naturally, the owners of financial assets and real estate have benefited disproportionately from this wealth explosion. The same effect is to be found in other countries.

In the UK, the top 10% of the population now own nearly two-thirds of financial assets, a sizeable increase since before the crisis, says S&P Capital IQ. Over the same period, the wealth share of the poorest sections of British society has shrunk.

After the crisis, central bankers hoped that higher levels of wealth would encourage spending and investment. As it turns out, low interest rates haven't spurred corporate investment as much as expected. Companies have held back on capital spending because they fear that the era of extraordinary monetary policy may have a nasty outcome. Why invest when the future is so uncertain?

Furthermore, very low interest rates have kept inefficient companies afloat, creating a business environment which is not conducive to corporate investment.

Had investment in the US and elsewhere been higher, then productivity growth and workers' incomes might have been expected to rise over time. Instead, firms have opted for share repurchases over investment. Profits have been boosted by cutting costs. Buybacks in the US have driven up share prices, enhancing stock-based compensation for senior executives and benefiting shareholders, but providing no tangible benefits for the majority who own few if any shares.

Over recent decades, easy money from the Federal Reserve has created one asset price bubble after another. Households have been misled by these successive inflations of paper wealth into thinking they needn't save for retirement. US household savings collapsed to a record low in 2005 and since the financial crisis have remained below their long-term average. The result, as Tyler Cowen of George Mason University points out in a recent column, is that the pot of pension savings owned by the US middle class is now too small to meet retirement needs.

Ultra-low interest rates may have been necessary to stave off a depression after the Lehman bust. But monetary policymakers clearly underestimated the distributional impact of their actions. The central bankers now find themselves caught between a rock and a hard place. They daren't raise interest rates for fear of triggering another mega-downturn. But if they continue pushing interestrates lower, they risk undermining the social order upon which the capitalist system rests.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

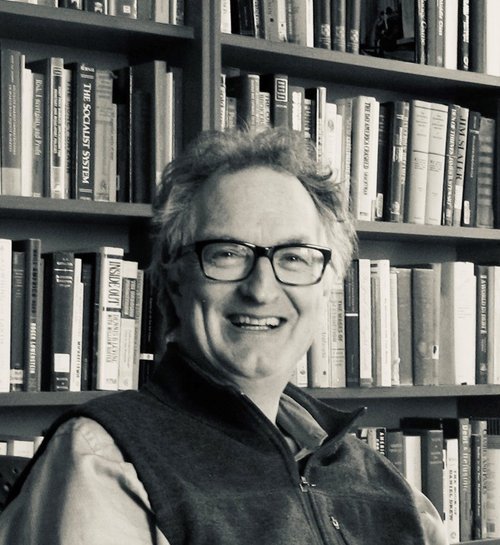

Edward specialises in business and finance and he regularly contributes to the MoneyWeek regarding the global economy during the pre, during and post-pandemic, plus he reports on the global stock market on occasion.

Edward has written for many reputable publications such as The New York Times, Financial Times, The Wall Street Journal, Yahoo, The Spectator and he is currently a columnist for Reuters Breakingviews. He is also a financial historian and investment strategist with a first-class honours degree from Trinity College, Cambridge.

Edward received a George Polk Award in 2008 for financial reporting for his article “Ponzi Nation” in Institutional Investor magazine. He is also a book writer, his latest book being The Price of Time, which was longlisted for the FT 2022 Business Book of the Year.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?