FTSE 100 or FTSE 250: which is the best gauge of the UK's health?

The FTSE 100 recovered quickly after its post-Brexit falls, but the FTSE 250 continues to slide. Matthew Partridge explains which index is the most accurate gauge of the health of the British economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The result of the EU referendum led to dramatic falls in both the FTSE 100 and the FTSE 250. However, while the FTSE 100 quickly recovered, the FTSE 250 is still markedly down. So which index should we be looking to for the most accurate gauge of the health of the British economy?

The stocks in the FTSE 100 are the largest UK-listed firms. Many are global companies that have the majority of their operations and sales outside the UK. For example, HSBC, which accounts for 5% of the index, is a familiar presence on the high street, but the UK accounts for less than a quarter of its assets and revenues. Overall, less than a third of total profits for FTSE 100 stocks come from the UK. What's more, the index is skewed heavily toward certain sectors. BP, Royal Dutch Shell and British Gas account for 12.3% of the market, even though oil and gas is just 2% of the UK's GDP. Banks, insurance companies and other financial services (which account for 10% of value added and 4% of jobs in the UK economy) make up 20%.

The FTSE 250, which includes the 250 next-largest stocks, is much more focused on the domestic economy. The top ten constituents include firms such as online estate agents Rightmove and the property developer Bellway, both of which will be deeply affected by economic developments here. There are still international firms in the index: the largest constituent, Smiths Group, gets only 4% of revenue from the UK. And the skew towards certain sectors remains.Energy is a much more realistic 3%, but financials account for nearly 35% of the index. However, the FTSE 250 is a better overall barometer for the UK economy.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

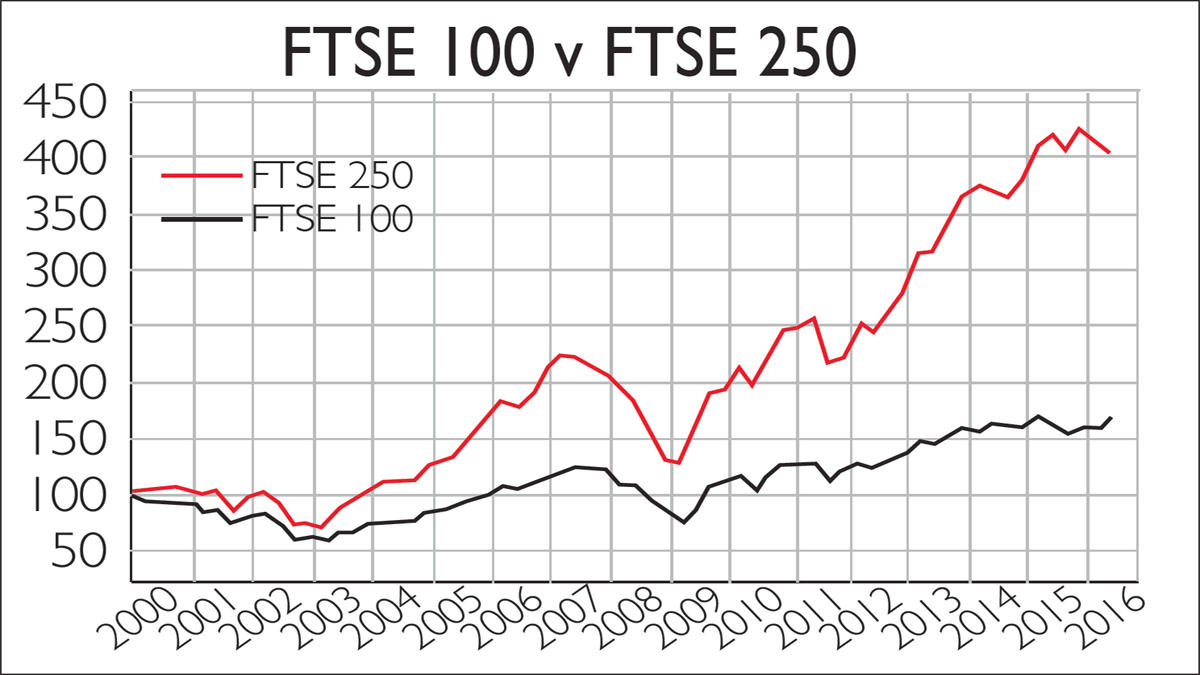

The FTSE 250 tends to be more volatile than the FTSE 100: not only has it suffered more in the aftermath of the referendum, but it was also hit harder by the 2008 crash. But over the long term, it has done much better. Investing £100 into the FTSE 250 three decades ago would have left you with £2,415 today, compared with £1,225 for the FTSE 100. This amounts to an annual return of 11.2%, compared with 8.7% for the FTSE 100. This is consistent with an extensive body of research that shows that smaller firms tend to deliver higher returns than their larger counterparts.

Lastly, what of the FTSE All-Share index? This includes the constituents from the FTSE 100 and the FTSE 250, as well as smaller companies, so it should be the broadest measure of the market. However, the size of the FTSE 100 companies means that they account for 80% of the overall market cap, so the performance of the FTSE All-Share (and also of the FTSE 350, which includes FTSE 100 and FTSE 250 stocks) is very similar to that of the FTSE 100.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

Dario Amodei: The AI boss in a showdown with Trump

Dario Amodei: The AI boss in a showdown with TrumpAnthropic’s CEO Dario Amodei was on an extraordinary upward trajectory when he found himself on the wrong side of the American president. He is about to be severely tested.

-

No peace dividend in Trump's Ukraine plan

No peace dividend in Trump's Ukraine planOpinion An end to fighting in Ukraine will hurt defence shares in the short term, but the boom is likely to continue given US isolationism, says Matthew Lynn

-

Europe’s new single stock market is no panacea

Europe’s new single stock market is no panaceaOpinion It is hard to see how a single European stock exchange will fix anything. Friedrich Merz is trying his hand at a failed strategy, says Matthew Lynn

-

FCA tells banks to speed up savings rate increases

FCA tells banks to speed up savings rate increasesRecord profits and low savings rates spurred the FCA to meet with some of the UK’s top banks.

-

Britain’s inflation problem

Britain’s inflation problemInflation in the UK appears to be remaining higher for longer when compared with similar rich countries. Why? And when can we expect a return to normal? Simon Wilson reports.

-

Why did SVB collapse and what does it mean for investors?

Why did SVB collapse and what does it mean for investors?News California-based Silicon Valley Bank collapsed seemingly overnight, casting doubts over the future of thousands of tech and science startups in the US and the UK.

-

Eurozone inflation hits 10.7% in October

Eurozone inflation hits 10.7% in OctoberNews Inflation across the eurozone hit 10.7% in October. What does it mean for your money?

-

A forgotten lesson on the dangers of energy price caps

A forgotten lesson on the dangers of energy price capsAnalysis Liz Truss’s proposed energy price cap is an ambitious gamble. But a similar programme in Spain ended up being a fiasco, say Max King and Tom Murley. Here, they explain why Truss’s plan could be doomed to failure.

-

Don't be scared by economic forecasting

Don't be scared by economic forecastingEditor's letter The Bank of England warned last week the UK will tip into recession this year. But predictions about stockmarkets, earnings or macroeconomic trends can be safely ignored, says Andrew Van Sickle.